Mexican peso is firm as the markets are awaiting clarity and watching trade calls

- Mexican peso has profits because the risk of appetite is improved by proclaiming talks between the US and China.

- The focus is on the decision of the interest rate of the Federal Reserve and the possibility of future cuts to the chairman of Jerome Powell's words.

- The USD/MXN loosens, short-term resistance remains firmly intact.

Mexican peso (MXN) expands the profits of the US dollar (USD) on Wednesday, benefiting from updated hopes for escalating global trade tensions after positive developments between the United States and China. The optimism surrounding the upcoming trade dialog of US higher and Chinese officials, which takes place over the weekend in Luzern, Switzerland, has overturned the wider relevant market (EM) lessons. For Mexico, a decrease in global friction is supported by external demand, reduces risky and relieves the pressure of the capital flow, contributing to the recent peso stability.

Because USD/MXN trades near 19,639, which is 0.17%at the time of writing, the currency pair is closely consistent with the shift of risk moods and monetary policy expectations. As global trade speeches and tariff uncertainty continue to affect the positioning of the investor, the focus on the Federal Reserve (FED) interest rate on Wednesday.

Mexican Peso is looking for Powell instructions to get the next political tip

The Federal Open Market Committee (FOMC) statement, followed by Fed Chairman Jerome Powell's press conference, is key to developing a short -term prospect of the US Dollar and Mexican Peso.

Although the CME Fedwatch tool currently shows a 95.6% probability that Fed rates of interest rates between 4.25% -4.50%, Powell's comments on inflation, growth and credit conditions are precisely partized. These remarks carry the potential of the market to the market, especially if they change expectations in July around the expected rate.

The US Treasury's yields and the dollar trajectory are likely to spread to EM currency such as the peso, which is sensitive to the differences in global liquidity and interest rates.

Mexican peso monitors US-Mexico diplomatic strain

Meanwhile, tensions between Mexico and the United States are still a critical background risk. On Saturday, Mexican President Claudia Sheinbaum publicly rejected US President Donald Trump's proposal to send American troops to Mexico to fight drug cartels. “We respect bilateral cooperation, but we do not accept the troops on our surface,” said Sheinbaum Texcocos during a call. Later, Trump confirmed an offer to journalists on board Air Force on Sunday, saying: “We have made an offer. Cartels are a danger to both countries. If they want help, we will give it.”

On Tuesday, the Mexican Foreign Ministry responded with an official statement that strengthened the Mexican sovereign position: “Mexico responds to international contracts, but sovereignty is undeniable.” These developments, together with existing tariffs in Mexico, continue to consider bilateral confidence and increase uncertainty about regional trade and investment.

Given that about 80% of Mexican exports are related to the United States, any deterioration in US-Mexico relations, whether through increased tariffs, political divisions or diplomatic conflicts, poses a clear threat to Peso. At the same time, positive signals may help to help compensate for this pressure when the sentiment improves.

Mexican Peso Daily Digest: Waiting for Powell's words

- US President Donald Trump has publicly criticized the high interest rates of Fed Chairman Jerome Powell, claiming that the central bank is “damaging American competitiveness”. Although Fed retains its independence, political rhetoric adds pressure on the sensitive political phase.

- Security and Trade Agreements between the US and Mexico have been received after the recent comments of both governments after pressure. Disagreements on the introduction of sovereignty and troops can be more severe bilateral coordination, including migration and trade.

- On Monday, the Mexican government announced a fiscal support package aimed at small businesses and the development of infrastructure in response to slowing down growth. The purpose of the initiative is to support domestic demand without damaging fiscal stability.

- It is expected that the Mexican Bank will reduce its benchmark on 15 May by 50 base points as inflation will continue to cool. Internal production (GDP) increased by 0.2%in the quarter, avoiding technical recession, but weak investments and external demand continue to consider economic momentum.

Mexican peso technical outlook: Consolidation phase signals indecision

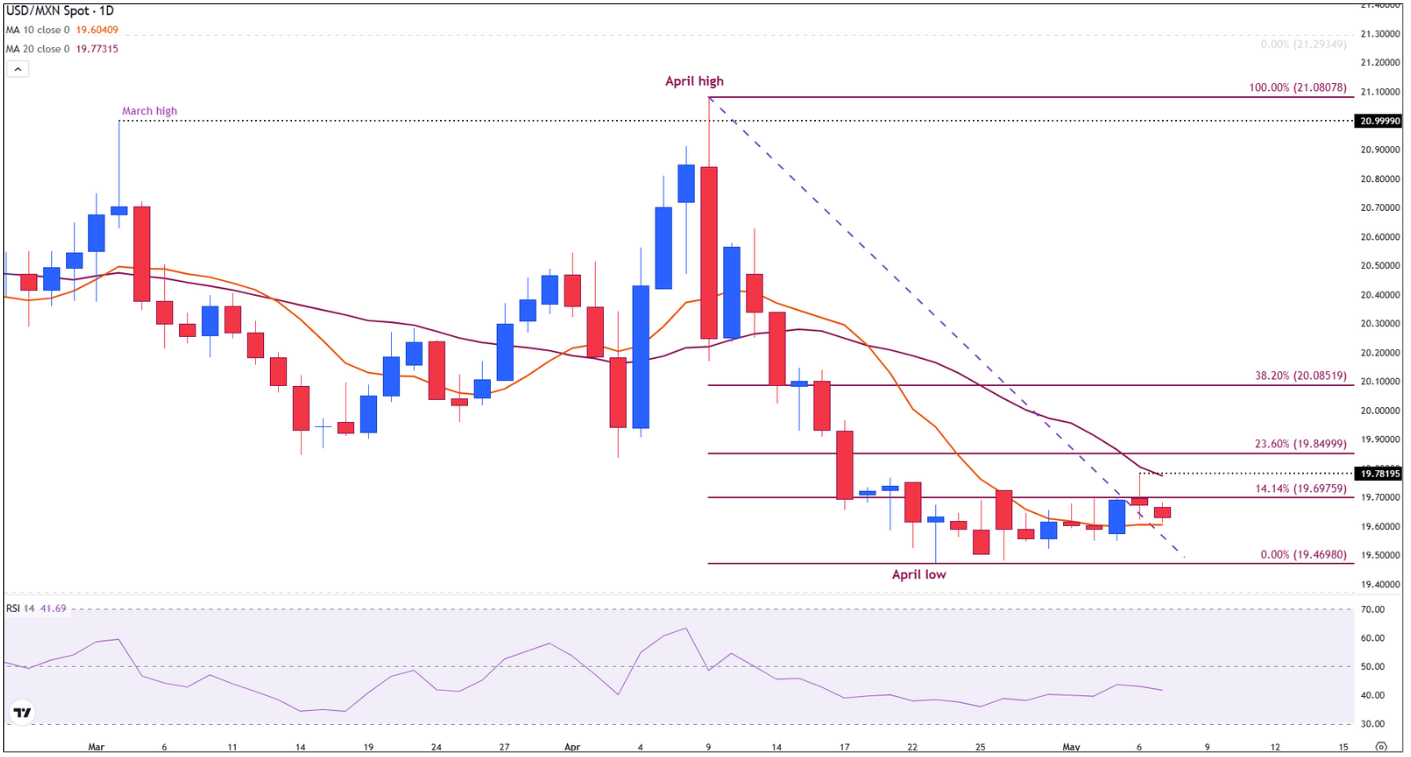

The USD/MXN trades near 19.64, which is slightly lower on Wednesday, extending the range of consolidation between 19,46 and 1976 from April 18th.

The initial support can be found at a 10-day simple moving average (SMA) 19.60. Below this level would reveal at the lowest level of April 19.46.

USD/MXN daily chart

The momentum will remain back. The relative strength index (RSI) smoothes 42.44 near the 50-neutral lines, which refers to the lack of a strong trend. The overall structure continues to reflect indecision.

On the fourth, every bullish attachment should exceed psychological resistance at 19.80. The pause above this area may open the door for the 23.6% retraction of Fibonacci, compiled on April 9, 21.08 from the highest of April 23, 19,46, 7pm and 20.07th (38.2% to Fibonacci's retreat). However, this result would probably require a surprise or tone of Jerome Powell during today's press conference.

Economic indicator

Fed interest rate decision

Its Federal Reserve (FED) consider monetary policy and make a decision on interest rates with eight pre -plan meetings per year. It has two mandates: to keep inflation 2%and maintain full employment. Its main tool to achieve this is the setting of interest rates – both banks and banks are borrowed to each other. When it decides on hiking prices, the US dollar (USD) tends to strengthen as it attracts more foreign capital inflow. If it reduces prices, it tends to weaken the USD as capital flows into countries that offer higher revenue. If the tariffs are left unchanged, the Federal Open Market Committee (FOMC) will pay attention to the tone of the statement and whether it is Hawkishis (in the expectation of higher future interest rates) or Dovind (in the expectation of lower future rates).

Read more.

The following edition:

Wednesday 7th May 2025 18:00

Frequency:

Irregular

Consensus:

4.5%

Previous:

4.5%

Source:

Federal Reserve