Ethereum ETFs see inflows after 10-day drought as ETH reclaims $1,800

ETHEREUM ETHEREM is again in good place, with $ 38.74 million flowing on April 22. As a result, Ethereum interrupted a period of 10 days when ETH found the price of $ 1,800.

This reversal of fund flows is simultaneously at the 5% Ethereum rally in the last 24 hours. He also put pressure on short positions on the derivative market.

According to the latest data, the total cumulative net influx for ETHEREUMs now amounts to $ 2.26 billion, with total net assets reaching $ 5.66 billion.

ETF ETF market data shows mixed performance

A more in -depth inspection of the individual performance of the FNB ETF shows disparate results between the different transmitters. From data provided by SosovalueBlackrock's ETHA product on NASDAQ increased 0.31%, total net inputs worth $ 4.05 billion and net assets of $ 2.00 billion on April 22.

The Graycale ETH product exchanged on the NYSE and its value increased by 0.17%. However, he lost $ 4.27 billion in total after his transition to a trust format. The fund still has $ 1.96 billion in net assets.

Fidelity on CBOE feet increased by 0.28% with large daily entries of $ 32.65 million. Its total entrances are $ 1.39 billion and a total net asset at $ 849.67 million.

Some of the other popular artists are Bitwise of the ETHW on the NYSE (increase of 0.29%, daily influx of $ 6.09 million, $ 314.52 million in total entrance), ETHV of Vaneck on the Ezet of CBOE (0.29%, increase of 131.09 million dollars) and Total Afflux of Franklin). All ETF ETF products exchanged a combined value of $ 496.30 million on April 22.

Short positions Ethereum experience massive liquidations while the price bounces

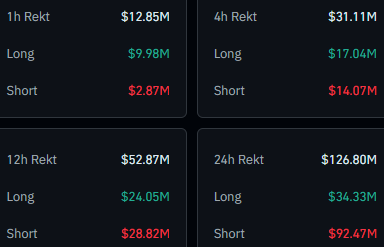

The Ethereum price has returned above $ 1,800, which caused money to be lost to certain short bettors. Data from Rinsing shows that short liquidations in the last 24 hours were $ 92.47 million. These were more than long liquidations of $ 34.33 million in the same time.

This difference in liquidation means that the majority of traders expected the price of Ethereum continues to decline but was surprised by a sudden increase. Total liquidations were worth 126.80 million dollars in 24 hours. During the last hour, $ 12.85 million long were liquidated.

These include $ 9.98 million long and $ 2.87 million in shorts. Statistics of the last 4 hours reveal $ 31.11 million in liquidations, of which $ 17.04 million is long and $ 14.07 million in shorts. In the past 12 hours, $ 52.87 million in liquidations took place, in which short films were $ 28.82 million and long was $ 24.05 million.

Market capitalization measures highlight Ethereum's position

Ethereum's rebound has pushed its presence on the market under the spotlight, and the $ 5.66 billion in net assets ETF now represent 2.77% of the market capitalization of the cryptocurrency. The dynamics between ETF flows and price action is now more important for market players.

The 10 -day drought period for entries before April 22 occurred with lower prices, while the return of positive fund flows occurred with prices again above $ 1,800. This correlation indicates that the feelings of large investors continue to influence the performance of the Ethereum market.

Total cumulative net entries of $ 2.26 billion in all ETF ETF products, because their launch represents a substantial amount of capital entering the ecosystem thanks to regulated investment vehicles. The total value of $ 496.30 million exchanged on April 22 shows healthy liquidity in these ETF products.

Cryptopolitan Academy: to come soon – a new way of winning a passive income with DEFI in 2025. Find out more