Metaplanet launches new $25M bond to resume BTC buying

Metaplanet issued another short -term obligation, worth 3.6 billion JPY, or nearly 25 million dollars. The company intends to continue BTC purchases both as an indigenous entity and through its global subsidiaries.

Metaplanet has announced another short -term obligation for JPY 3.6B, or nearly 25 million dollars. The company intends to regain its BTC purchases, with the intention of adding up to 5K BTC by the end of the year.

Metaplanet issued an ordinary short -term obligation with a nominal value of 100 JPY, which will be exchanged on October 31.

* Metaplanet issues 3.6 billion JPY in ordinary 0% bonds to buy $ BTC* pic.twitter.com/e3uiep7csr

– Metaplanet Inc. (@metaplanet_jp) May 2, 2025

The obligation does not bear any return, and there is still no data for the market price to which it will open. The obligation is the 12th series of ordinary debt instruments for the company. Bond redemption will be funded by Metaplanet's shares acquisition rights. If the company obtains a sufficient product from its rights to acquire shares, it may proceed to the immediate redemption of the bonds in circulation.

The new Metaplanet bond plan came one day after the company Announced plans To launch an American subsidiary, recorded in Florida. The new entity will have up to 250 m of capital to buy more BTC.

Metaplanet increases BTC's confidence

Previously, Metaplanet covered the debt in circulation before its due date, and the new obligation had the same option. The company aims to build a healthy assessment with a lower debt, while reflecting its BTC profits.

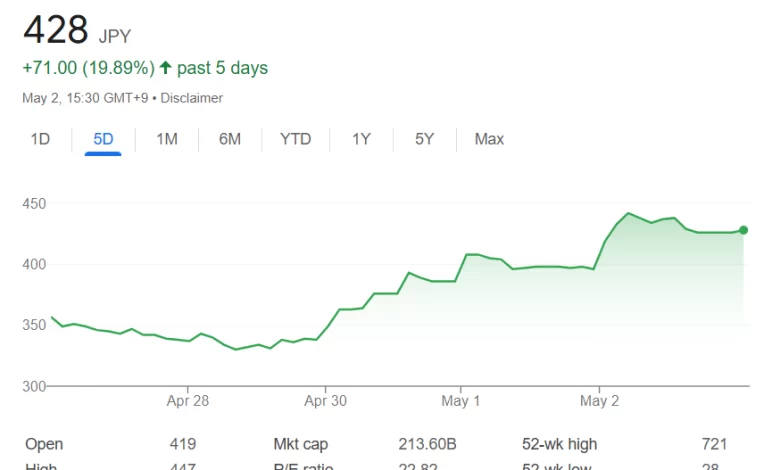

After the news, Metaplanet's actions continued their expansion, to negotiate at 428 JPY. The shares have increased by almost 20% during the last week of work, corresponding to the presence of the company's social media and the overall tremor for corporate BTC buyers.

The CEO of the company, Simon Gerovich, noted that the Metaplanet trading volumes were upwards, reflecting the recent Rally of the BTC.

Yesterday scored our 4th consecutive day of the volume of records. A warm welcome to all our new shareholders 🇺🇸 pic.twitter.com/cfa7penq9n

– Simon Gerovich (@gerovich) May 2, 2025

The small -scale acquisitions of Metaplanet have led more companies to build treasury bills from zero. In recent weeks, the number of business entities has reached a total of 101 holders, against a recent count of 92 companies. The total number of BTC stored in treasury bills is 3.26 million parts.

Metaplanet is a relatively small holder, ranked 11th based on corporate treasure vouchers. High -level and visible marketing of the company, however, earned it the reputation of the Japanese strategy (MSTR).

Metaplanet continued its BTC purchases alongside the strategy, but on a smaller scale. Others, such as Mara Holdings, slowed down their acquisition calendar. Despite the active BTC accumulation, so far, the market price has not responded with a massive rally. However, treasury bills have increased considerably, making holders more reluctant to sell or even transfer the BTC.

The recent announcement arrived while the BTC oscillated around $ 97,000, indicating a higher acquisition price for Metaplanet. The company already has an average acquisition price of more than $ 85,000 per BTC, with market operations open in recent weeks.

Bitcoin bitcoin buyers will also receive an additional orientation of the Bitcoin conference for companies, organized by strategy. The meeting in Orglando, Florida, will welcome the most eminent buyers of the BTC in the past year.

Cryptopolitan Academy: to come soon – a new way of winning a passive income with DEFI in 2025. Find out more