Metaplanet Grows Bitcoin Treasury to 5555 BTC With $53 Million Buy

- Metaplanet acquired 555 bitcoin for $ 53.4 million at an average price of $ 96,134.

- 25 million dollars in zero coupon bonds issued to finance the last purchase of the BTC.

The investment company listed in Tokyo Metaplanet has acquired 555 other bitcoins for $ 53.4 million. The company revealed the purchase on May 7, confirming an average price of $ 96,134 per room. This last decision pushes Metaplanet's total BTC assets to 5,555, worth around 481.5 million dollars at the cost of acquisition.

To finance the purchase, Metaplanet issued $ 25 million in zero coupon bonds to Evo Fund. This marks the 13th issue of the company's bonds, following a similar increase of $ 25 million last week. In total, the company has raised more than $ 244 million thanks to funding for bonds and stocks since the beginning of 2024.

CEO of Metaplanet Simon Gerovich celebrated the milestone on X. The company aims to have 10,000 BTC by the end of 2025 and finally 21,000 BTC. With this last acquisition, he exceeded the halfway of his 2025 goal.

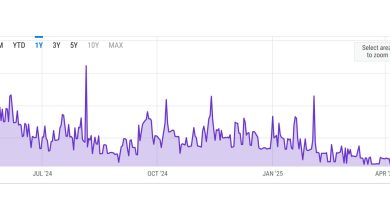

The company's internal performance metric, “BTC renders”, jumped 309.8% to T4 2024. It increased by 95.6% to T1 2025 and amounted to 21% for T2. While BTC is negotiated nearly $ 97,000, Metaplanet is already in profit on the last purchase.

American expansion and increase in institutional demand

In addition to Bitcoin's purchases, Metaplanet develops in the United States last week, he unveiled Metaplanet Treasury Corp., a subsidiary based in Florida. This new entity aims to collect up to $ 250 million to support the company's Bitcoin strategy and US operations.

Metaplanet is now the largest public Bitcoin holder in Asia. On a global scale, it ranks 11th, according to BitCointaresurries.net. The strategy (formerly Microstrategy) remains the shortfall with 555,450 BTC.

Institutional interest in bitcoin continues to increase. In the first quarter, public companies increased their assets by 16.1%. Recently, the strategy has doubled its capital recovery plan at $ 84 billion. He also extended his debt emission target to $ 42 billion, with $ 14.6 billion still available.

Meanwhile, the American government shows little intention to develop its BTC assets. The co-founder of Bitmex, Arthur Hayes, cited a strong national debt and cultural resistance as the main barriers.

Highlighted the news of the crypto today

Will Farcoin have reached new stockings after a difficult drop of 8%?