Saison Capital, Bri Ventures and Coinvestis are triggered by Tokenize Indonesia – RWA Startup Gas

Bagkok, Thailand, April 25, 2025/Chainwire/-

Tokenize Indonesia lasts from August to August 2025 and selected start -ups organize evidence of concepts (POCS) evidence with leading Corporations of Indonesia, including financial institutions such as Bank Rakyat Indonesia (BrI) and telecommunications services such as Telkom Indonesia. The program will culminate in August, with the largest cryptocurrency crypto infestival in Asia on August 21 – 22 in Bali.

The announcement of Indonesia tokenize's launch was made at the address

“We believe that chip circuit technology and its widespread advantages are the foundations for the future of inclusive finance, changing existing financial systems and creating greater equity for everyone. Despite the current market volatility, active investors are still active when starting a block chain. Based on better support services to find better support services.

“One of the leading financial groups in Indonesia is Bri Ventures, who is dedicated to continuous research and investment in transformative technologies that shape the future of finance in Indonesia. Our goal is to promote meaningful collaboration between established financial institutions and innovative, fast technology partners and innovative financial stations and innovative financial plants. Indonesia, said Markus Liman, investment manager at Bri Ventures.

“With over 20 million crypto users, Indonesia Now Ranks Third Globally in Web3 Adoption -Clear Eviction of a Thriving Ecosystem. We Are Witnessing Rapid Growth in Developer Talent, Institute of Institute Engagement, Long-Term Progress.

The ecosystem of Indonesia and tokenization is rapidly evolved, supported by technically expert demography, expanding middle class, growing Fintech sector and increasing digital payment infrastructure. These factors contribute to the environmental environment and the scope of the environment.

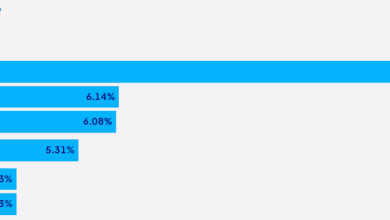

Project Wira, Bri Ventures, Saison Capital, D3 Labs and Tiger Research, developed report emphasizes blockchain potential to change the Indonesian financial ecosystem. 7% of the Indonesian population have its own digital assets that exceed 6.4 million stock investors in the Indonesian Stock Exchange (IDX), which have greater potential for increased potential. Updates have already increased in digital money, goods, bonds, carbon credits and real estate. The report estimates that demand for toxen the assets in Indonesia can reach $ 88 billion by 2030.

For RWA start -up companies interested in capturing an enormous opportunity in Indonesia, users can apply for Indonesia:

About the capital of Saison

From the Asian Pacific Ocean, but the introduction of capital on a global scale, Saison Capital Saison uses extensive financial services operating background and resources in key markets, including Singapore, Indonesia, Indonesia, India, Vietnam, Thailand, Philippine, Cambodian, Japan, Brazilian, Brazilian, Brazilian. Sison Capital is a subsidiary of Credit Saison.

Bri Ventures on

About Coinvestas

Contact:

LOOI QIN EN

The capital of Saison

Contact

Andrew cheong

Saison international

This story was distributed under Hackenoon's business blogging program Chainwire. For more information about the program