JPMorgan Chase, Bank of America CEOs lead to only four months of $ 268,628,928 for their business shares

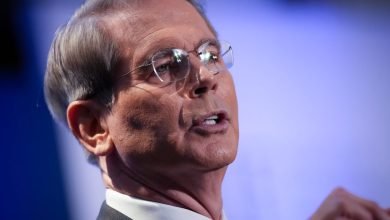

JPMorgan Chase CEO Jamie Dimon and Bank of America CEO Brian Moynihan are unloading a huge amount of personal equity in their companies.

According to the Financial Data Miner Secuform4.com, the last transactions happened this month when Dimon and Moynihan sold shares worth $ 32.18 million in two banks, which they drive.

Starting with JPMorgan Chase CEO Dimon sold 133 639 The share of the largest bank in the US according to the total assets on April 14, a total of about $ 31,50 million.

In February, Dimon sold 866 361 shares of JPMorgan Chase, worth about $ 233.78 million when the share traded at high levels of all time.

Meanwhile Moynihan sold $ 679,717 in Bank of America shares on April 17.

In March, the Bank of America Boss also sold the shares of the second largest lender in the United States in March, worth $ 731,563, the value of the shares in February 971,274 and in January $ 974,169 worth of $ 169.

Combined, Dimon and Moynihan have sold shares in two megabanes worth about $ 268.63 million since the beginning of the year.

As the Bank of America Boss regularly disposes of the trillion dollar lenders, Dimon JPMorgan Chase initiated the first sales of his shares in Chase in February 2024. During the last 14 months, Dimon has eliminated JPMorgan Chase shares worth $ 448.26 million. Dimon became CEO of JPMorgan Chase in December 2005.

On the other hand, Moynihan has sold Bank of America shares since July 2022. He became CEO of Bank of America in January 2010.

Follow us on XTo do, Facebook and Telegram

Do not skip a stroke – order to receive e -mail notifications directly to your inbox

Check the price of the prices

Surf a blend of everyday hodl

& Nbsp

Opinion: Opinions published in the Daily Hodl are not investment advice. Investors should make their diligence before investing in Bitcoin, cryptocurrency or digital assets. Note that your transfers and transactions are your own responsibility and all the damage that may occur is your responsibility. Daily Hodl does not recommend buying or selling cryptocurrencies or digital assets or Daily Hodl investment advisor. Note that the Daily Hodl is involved in the marketing company marketing.

Created image: Midjourney