Key Fundamental Metrics for Memecoins in 2025

Hodlx Guest Post Submit your message

The memecoin segment has matured considerably since its inception.

Formerly caused by culture and speculation on the Internet, it now represents a complex commercial environment with an increasing institutional presence, data -based strategies and measurable risk factors.

In this market, individual traders are often faced with decreasing yields.

The stories move faster than most cannot react, and access to data in real time is now a minimum requirement.

In 2025, a successful participation in the same cycles required not only an infrastructure but also a clear framework to assess the assets before engaging with them.

The following measures represent a reference base to assess the viability in the same landscape of today.

Whale and smart money wallet monitoring The basis of signal -based trading

Large wallets commonly called whales Continue to serve the first indicators of feeling changes on the same market.

However, the simple fact of reproducing their professions without examining the trades of intelligent money was ineffective.

Instead, data must be used to identify behavior models.

- Portfolios with a history of verifiable profits in the last 30 days, ideally showing a capital return of 30 to 100%, tend to offer more reliable signals.

- A greater importance is generally attributed to those whose average business size exceeds $ 5,000, which suggests a higher level of conviction.

- Tools that provide real -time monitoring of portfolio activity can offer a precious context and alerts.

- Tokens that attract several large transactions Such portfolios in a short period of time are more likely to reflect emerging trends, while isolated transactions may not be significant.

This type of surveillance often provides a more precise image of the feeling of the market than the only technical indicators.

Social attention Without visibility, there is a limited traction

For the same time to gain ground, visibility remains a central requirement. An X -verified and active account has become a minimum reference for credibility.

Although the number of followers is less important than commitment measures, a basis for the benchmark for coherent activity and community response indicates a functional marketing effort n essential element of the same dynamics.

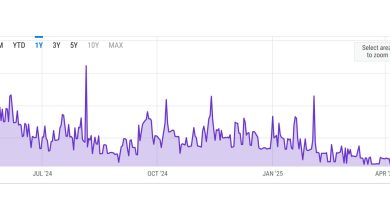

In addition, monitoring the volume and speed of social media mentions remains one of the most effective tools for early detection of signals.

Rather than focusing on absolute numbers, traders monitor acceleration The speed with which a token is gaining ground on platforms such as X, Telegram and Reddit.

A speed score emerges, measures the rate of increased mentions on short deadlines of approximately three hours.

The tokens showing strong trends upwards of social commitment often experience a price movement shortly after.

Liquidity The manipulation of ritic prices for attenuation

Liquidity acts as a stamp against volatility. Low liquidity parts can offer a clear increase during maximum dynamics, but have a significantly higher risk of decline.

In 2025, experienced traders tend to avoid tokens with total liquidity less than $ 150,000, unless they are associated with a short -term volume and a unusually high short -term whale activity.

As a rule

- The liquidity of $ 500,000 to $ 2 million represents a stable range for entering the capitalization medium cycles.

- Pools greater than $ 5 million are less likely to provide a strong price assessment, but ensure higher security against coordinated shift and manipulation.

Power supply and distribution of holders Ssessing structural risk

The tokens without the burning mechanisms of clear developers are increasingly considered to be unsustainable.

If the founding team retains an important part of the offer and no verifiable burning event occurred after the launch, long -term trust in long -term investors is unlikely.

Portfolio concentration is just as important. In practice, a TOP 10 portfolio group holding more than 20% of the total offer is considered a structural weakness.

A more distributed diet is generally correlated with reduced volatility and greater resilience with coordinated outings.

Trading volume Proxy for health and sustainability

The volume of coherent trading is essential for the attenuation of risks. In today's environment, the same merchants negotiating below $ 250,000 per day for more than 48 hours are generally considered inactive or abandoned.

Conversely, volumes above $ 2 million indicate active cycles and more reliable liquidity between exchanges.

And the rise in prices without a volume of correspondence tend to report a short -term exit activity rather than a real interest.

Understand the game Rading reflexivity, not the fundamentals

Unlike traditional assets, the same derives a large part of their value from reflexivity The cycle of belief and price movement.

That said, traders buy tokens not for their intrinsic value, but for the probability that others will buy after them.

The success in this market depends on the recognition of behavioral models, the identification of the moment when others will act and enter before the larger Momentum constructions.

Trying this solo is increasingly ineffective.

In 2025, the most competitive advantage came from the collaboration Small commercial groups with defined roles (chain analysis, social parameters, liquidity monitoring, etc.) regularly outline isolated participants.

In the end, trading even has become a highly specialized activity, demanding a structured analysis, real -time infrastructure and shared information.

For those who did not want or unable to approach it at this level, passive exposure can be the most rational path.

Rajath km is the CBO at Staders laboratoriesA platform for clearing and cabbage, a platform to follow the same indicators.

Follow us Twitter Facebook Telegram

Warning: Opinions expressed at Daily Hodl are not investment advice. Investors should make their reasonable diligence before making high-risk investments in bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk, and that any loser that you may incur is your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, and the Daily Hodl is an investment advisor. Please note that the Daily Hodl is participating in affiliation marketing.

Image generated: Midjourney