Jeff Bezos to dump $4.75bn in Amazon stock

Today, regulatory deposits have shown that the founder of Amazon, Jeff Bezos, wants to sell up to $ 4.75 billion in electronic trade in the next 12 months.

Bezos, who left the CEO post of the technological company based in Seattle in the middle of 2021, will sell up to 25 million actions. It will follow a scheduled sale which will last until the end of May 2026. According to the latest quarterly report from Amazon, the commercial plan was drawn up in early March.

Bezos directs his funds to other projects

Bezos tried to reduce his expenses. The first thing he did was to move from Washington to Florida. According to research carried out by Forbes, Florida is a better place for billionaires like Bezos to sell their assets than its old original state, which only comes from 7% of long -term capital gains of more than $ 250,000.

Indeed, Florida has neither State income tax nor tax on capital gains. If Bezos had always lived in Washington when he sold his shares, he should have paid $ 954 million in the state capital gains last year. With other deductions and credits, it can still have around $ 3.2 billion in the federal government.

After moving, Bezos sold more than $ 13.4 billion in Amazon shares. The same year, the business value of the company increased to more than 2 dollars. This was largely due to the excitement of investors about AI.

The richest second in the world slowly attracted his attention from the online store he started in 1994 and put it back on his space company, Blue Origin, and the American newspaper, the Washington Post.

Bezos is the only partner of Blue Origin and sold Amazon shares to help pay it. To compete with Elon Musk SpaceX, Jeff Bezos' space exploration activity, Blue Origin, wishes to adopt the emphasis on the results focused on results.

The CEO of Blue Origin, Dave Limp and the financial director Allen Parker, are two people that Bezos hired Amazon. Blue Origin has sent only one orbit rocket so far, while SpaceX has sent more than 400 orbit ships.

Bezos has also sold both large amounts of Amazon stock and smaller amounts to collect funds for charities. For example, he launched the fund for the first day, a non -profit organization inspired by Montessori.

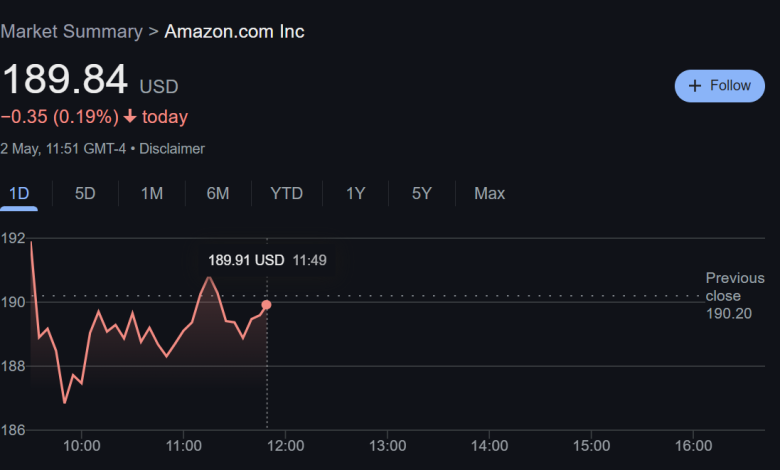

Amazon's stock takes a hit.

The news only intervened a few hours after Amazon announced Thursday evening that it expected that net sales and operating income is lower than what Wall Street expected. This is mainly due to President Trump's trade war with other countries.

To reduce the effects of prices, Amazon has negotiated large discounts with suppliers. About a quarter of the things he sells comes from China.

Before the Amazon's results report, Goldman Sachs analysts said the prices could reduce business operations by $ 5 billion to $ 10 billion this year, depending on how the trade war has proven. It would take a bite of 6 to 12% on the operating gains of $ 79.2 billion that Wall Street is waiting for the new exercise.

On Thursday, the company based in Seattle thought it would earn between $ 13 billion and $ 17.5 billion in operating income this quarter. It was less than the $ 17.7 billion that Wall Street was waiting for, but it was more than $ 14.7 billion than last year.

Amazon also said that its net sales for the current quarter are between $ 159 billion and $ 164 billion, which is less than $ 161.4 billion that experts were waiting for. In the meantime, Amazon actions are down 0.19%, negotiating at 189.84.

Cryptopolitan Academy: Do you want to develop your money in 2025? Learn to do it with DEFI in our next webclass. Record your place