Is ‘Twenty One’ MicroStrategy’s Downfall?

The most significant shift in Bitcoin’s corporate landscape wasn’t announced on cable TV or hyped by influencers. It emerged through a carefully orchestrated alliance that will reshape how capital markets interact with cryptocurrency forever.

The New Bitcoin Paradigm

While the market was distracted by price fluctuations, Twenty One Capital quietly assembled what might be the most important Bitcoin structure ever created.

“Announcing Twenty One: a #Bitcoin-native company and the ultimate vehicle for capital markets to access #Bitcoin,” their announcement read. “We intend to leverage capital markets to maximize #Bitcoin ownership per share (BPS) & pioneer #Bitcoin-native financial tools.”

The statement seems straightforward until you recognize its revolutionary implications: Twenty One isn’t just another company buying Bitcoin—it’s a purpose-built entity designed from scratch to transform how Bitcoin interfaces with global finance.

Launching with 42,000 Bitcoin (approximately $4 billion), Twenty One represents the third-largest corporate Bitcoin treasury in existence. But the size of its holdings isn’t what makes it revolutionary—it’s how the entire entity has been engineered around Bitcoin-native principles.

The Bitcoin-Native Innovation

“Twenty One Capital will be using bitcoin as a medium of exchange. They will be the first publicly-traded company to use Bitcoin as money,” reveals an internal document shared with potential investors.

This single sentence signals a fundamental shift in corporate Bitcoin strategy. While other companies treat Bitcoin primarily as a reserve asset, Twenty One embraces its complete monetary function: store of value, medium of exchange, and unit of account.

The counterintuitive insight that drives Twenty One’s approach: Bitcoin’s true power emerges only when it functions as money, not merely as a financial asset.

“We’re not here to beat the market, we’re here to build a new one,” Jack Mallers declared. The statement isn’t metaphorical—it’s their literal business plan.

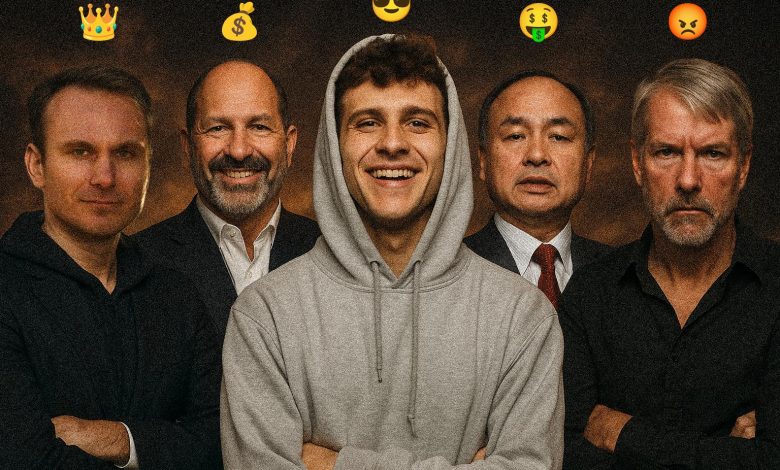

The Strategic Coalition

Twenty One wasn’t conceived by a single visionary but emerged from an unprecedented coalition of Bitcoin’s most powerful players—each bringing unique capabilities:

Jack Mallers: As CEO of both Strike and Twenty One, Mallers brings operational experience running profitable Bitcoin businesses. Strike’s metrics speak volumes: “8-9 figures in net profit in 2025 with just ~75 employees” while operating on a Bitcoin standard, with “$6B+” in 2024 volume and “600%” year-over-year growth.

Paolo Ardoino: The CEO of Tether and Bitfinex has been a pivotal infrastructure builder in the cryptocurrency ecosystem. “At Tether and Bitfinex, we have always believed in supporting initiatives that strengthen Bitcoin’s dominance and real-world utility,” Ardoino explained, positioning Twenty One as the natural extension of their vision.

Masayoshi Son: SoftBank’s founder brings a level of financial firepower and global connections that transforms Twenty One’s potential impact. “When Masa commits to a vision, capital follows in tsunamis, not waves,” explained a SoftBank executive.

Cantor Fitzgerald: This global financial services firm provides institutional credibility and market access through its SPAC, Cantor Equity Partners (CEP).

This coalition wasn’t assembled randomly. Each participant provides specific capabilities that, together, create a Bitcoin vehicle of unprecedented sophistication.

The Structural Breakthrough

Twenty One’s transaction structure reveals levels of financial engineering that fundamentally reimagine how Bitcoin entities can be designed:

- Tether and Bitfinex contribute 31,500 BTC upfront

- Tether secures an additional ~$462M worth of Bitcoin

- PIPE investors contribute $200M

- Convert investors add $340M

- SoftBank purchases shares equivalent to 10,500 BTC

“This transaction structure wasn’t just about raising capital efficiently—it was engineered specifically to maximize Bitcoin-per-share metrics from day one,” explained a financial architect involved in the design.

The result? Twenty One launches with 42,000 Bitcoin (~$4 billion), no debt, and the most efficient capital structure possible for Bitcoin accumulation and deployment.

“Twenty One’s balance sheet simplicity provides additional flexibility for strategic capital raises,” notes their investor documentation—understating the tremendous advantage this clean structure provides for capital market access.

The Legacy Approach Limitations

To understand Twenty One’s breakthrough, we must briefly acknowledge the limitations of existing corporate Bitcoin strategies, most notably MicroStrategy (now Strategy₿).

Michael Saylor pioneered corporate Bitcoin accumulation with a debt-fueled approach that worked brilliantly during the bull market. Strategy₿ now holds 499,096 Bitcoin, making it the largest corporate holder worldwide.

However, this approach created significant structural issues:

- $8.2 billion in convertible debt requiring eventual refinancing

- A retrofitted software company rather than a purpose-built Bitcoin entity

- Diminishing returns on new Bitcoin purchases due to size

- A philosophical limitation: treating Bitcoin primarily as digital gold rather than money

“With ~500,000 Bitcoin, MSTR must purchase larger quantities to increase BPS, reducing the per dollar impact of future capital deployments,” explains an internal Twenty One document.

This mathematical reality created a perfect opening for innovation—one that Twenty One’s architects recognized and exploited.

The Metrics Revolution

When compared directly, Twenty One’s structural advantages become immediately apparent:

Strategy₿ (MicroStrategy)

-

“Pure Play” Bitcoin Exposure: Medium

-

Bitcoin-Native Operations: Low

-

Existing Debt Balance: High

-

Debt Collateralization: High

-

Insider Ownership: Medium

-

Purpose-Built KPIs: Medium

TWENTY ONE

- “Pure Play” Bitcoin Exposure: High

- Bitcoin-Native Operations: High

- Existing Debt Balance: Zero

- Debt Collateralization: None

- Insider Ownership: Low

- Purpose-Built KPIs: High

“Twenty One is a potentially superior vehicle for investors seeking capital-efficient Bitcoin exposure,” concludes their comparison analysis.

For every dollar deployed, Twenty One can move its Bitcoin-per-share metrics approximately 12 times more efficiently than older approaches due to its optimized structure and absence of legacy constraints.

The Financial Infrastructure Vision

Twenty One’s most revolutionary aspect isn’t its Bitcoin holdings but its ambition to build an entirely new financial ecosystem:

“Twenty One intends to develop a corporate architecture capable of supporting financial products built with and on Bitcoin. This includes native lending models, capital market instruments, and future innovations that will replace legacy financial tools with Bitcoin-aligned alternatives.”

This single paragraph reveals Twenty One’s true endgame: not just to hold Bitcoin efficiently, but to build a comprehensive financial infrastructure with Bitcoin at its core.

“While accumulation strategies focus on Bitcoin as an asset, we’re focused on Bitcoin as a system.” “The opportunity isn’t just to own Bitcoin—it’s to reinvent finance using Bitcoin’s capabilities.”

The Capital Efficiency Game-Changer

Twenty One’s approach to capital deployment represents a fundamental shift in how Bitcoin entities can operate:

“At closing, Twenty One will be majority-owned by Tether, the world’s largest stablecoin issuer, and Bitfinex, with significant minority ownership by SoftBank, one of the world’s leading technology investment companies.”

This ownership structure provides Twenty One with unprecedented capital access. Tether’s position as issuer of the world’s largest stablecoin creates unique capital formation capabilities, while SoftBank’s involvement brings the potential for massive capital infusions if needed.

“Investors would get an opportunity to purchase equity at a ~1.0x multiple to Bitcoin Net Asset Value (“NAV”), where other companies pursuing a bitcoin treasury strategy regularly trade at a premium to NAV,” notes the investor documentation.

This pricing approach reflects Twenty One’s focus on sustainable growth rather than speculative premiums—a fundamental shift in how Bitcoin vehicles position themselves.

The Operational Reality

Jack Mallers brings something crucial to Twenty One that previous Bitcoin corporate strategies lacked: proven operational experience running Bitcoin-native businesses.

Strike’s metrics demonstrate this operational reality:

- 2024 Volume: $6B+

- YoY Growth: 600%

- Gross Profit Margin: 85%

- Customer Acquisition Cost: $0

- Largest Customer Cohort: $50K-$500K/month

“Strike is lean, profitable, and growing. Strike operates on a #Bitcoin standard. We hold almost all of our balance sheet in #bitcoin and sweep all of our cash flow into our #bitcoin treasury,” Mallers explained.

This operational expertise allows Twenty One to approach Bitcoin not just as an investment thesis but as a functional economic system—bridging the gap between theory and practice.

The Visionary Leadership Team

Twenty One’s leadership combines visionaries from different segments of the Bitcoin ecosystem:

Jack Mallers as CEO brings lightning network and payment expertise through his success with Strike, demonstrating how Bitcoin can function as a medium of exchange at scale.

Paolo Ardoino contributes infrastructure expertise through his leadership at Tether and Bitfinex, where he’s been instrumental in building the liquidity foundations that power cryptocurrency markets.

“Jack Mallers taking the helm of this new venture as CEO is truly epic. Pure perfection,” Ardoino stated, highlighting the complementary nature of their expertise.

This leadership combination creates a potent mix of payment innovation, infrastructure development, and financial engineering—precisely what’s needed to build Bitcoin-native financial systems.

The Unlimited Firepower Reality

Perhaps Twenty One’s most significant advantage comes from the financial resources behind it:

Tether controls the world’s largest stablecoin with a market cap exceeding $140 billion, providing unprecedented ability to create dollar-denominated assets for potential Bitcoin acquisition.

SoftBank, under Masayoshi Son’s leadership, has deployed hundreds of billions into transformative technology bets through its Vision Fund, with Son famous for his willingness to make audacious investments.

“Imagine another big Saylor in the market… If Saylor got us from ~70k – 108k and is never going to sell, then 21 Capital can double that,” notes an analysis of Twenty One’s potential market impact.

This financial firepower transforms Twenty One from merely another Bitcoin accumulator into a potential market-moving force with the resources to significantly influence Bitcoin’s adoption curve.

The Infrastructure Endgame

Twenty One’s vision extends far beyond Bitcoin holdings to the creation of an entirely new financial architecture:

“Twenty One will take a Bitcoin-first approach that aligns with our vision—prioritizing accumulation over speculation and building long-term value for those who understand what Bitcoin represents.”

This statement hints at Twenty One’s ultimate goal: to build financial infrastructure that treats Bitcoin as a complete monetary system rather than just a speculative asset.

“This isn’t just another Bitcoin treasury. They’re building an alternative financial system with Bitcoin at its core.”

The Hidden Capital Migration

Smart money doesn’t announce its moves—it positions quietly before narratives change.

“We’re seeing significant institutional interest in Twenty One—not because of Bitcoin itself, but because of capital structure efficiency and vision,” revealed a wealth manager who allocates for several multi-billion dollar family offices.

The mathematics is compelling:

- Twenty One: 42,000 Bitcoin, clean structure, maximum capital efficiency

- Older approaches: Larger holdings but diminishing returns on new capital

For institutional investors seeking optimized Bitcoin exposure through equities, Twenty One’s purpose-built structure offers compelling advantages.

The Paradigm Shift Timeline

Here’s what happens next—the timeline that will reshape Bitcoin’s institutional landscape:

- Within 6 months, Twenty One announces strategic partnerships with tier-one financial institutions

- By Q4 2025, they launch the first truly Bitcoin-native financial products

- Bitcoin-efficient vehicles like Twenty One attract increasing institutional capital

- The ecosystem of Bitcoin-native financial tools expands, accelerating institutional adoption

“The market rewards those who see the pivot points before they’re evident to all,” noted a Twenty One advisor. “By the time the narrative shifts publicly, the structural advantages will have already been cemented.”

The Evolution Complete

Twenty One represents the natural evolution of Bitcoin’s corporate adoption—moving from simple accumulation strategies to sophisticated, purpose-built entities designed to maximize Bitcoin’s complete monetary potential.

“Twenty One is built to accumulate Bitcoin and grow ownership per share,” notes an analysis of their approach. But this understates their true significance: Twenty One isn’t just accumulating more efficiently—it’s building the infrastructure for Bitcoin to function as money in the fullest sense.

The market will increasingly recognize that Bitcoin adoption isn’t just about corporate treasury holdings—it’s about building financial infrastructure that treats Bitcoin as the foundation of a new economic system.

Twenty One isn’t just participating in the Bitcoin revolution. It’s engineering it.

Disclosure: This article presents an analysis based on available information and should not be considered financial advice. Twenty One Capital represents a significant development in corporate Bitcoin strategy that deserves critical examination.