Is It Too Late to Buy UNI? Uniswap Price Prediction

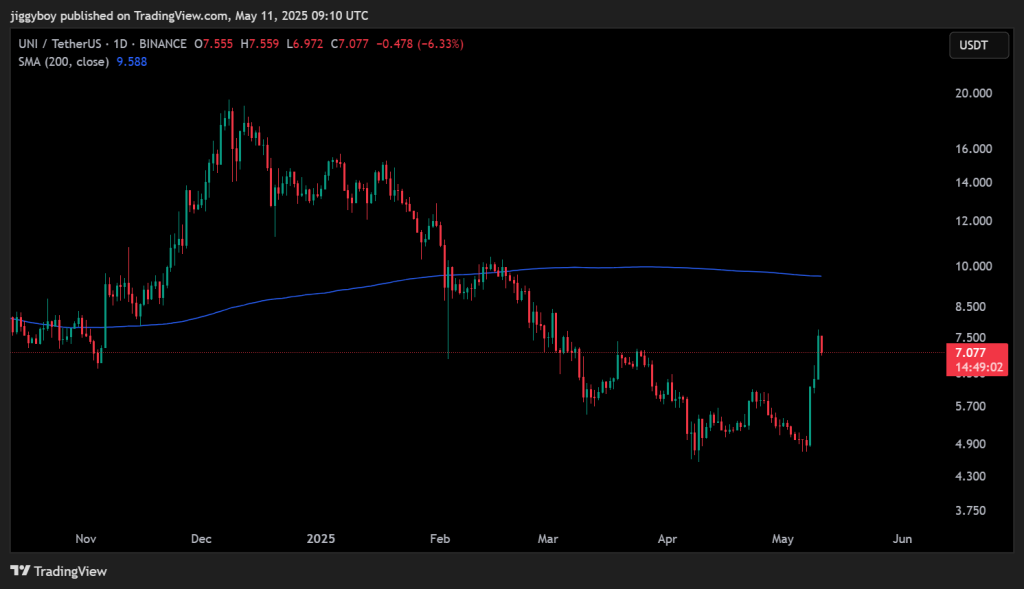

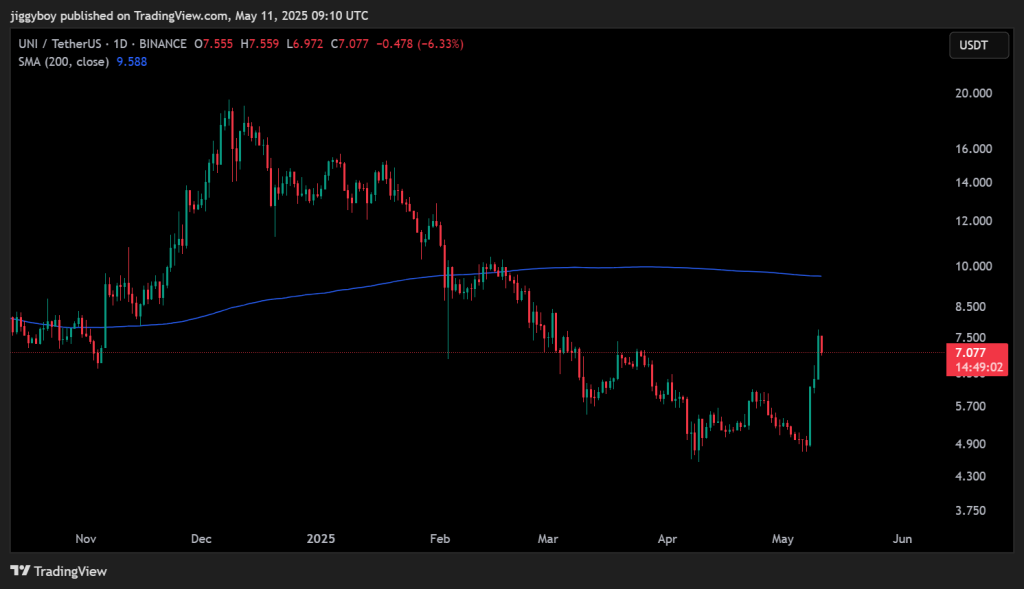

Uniswap is back on traders’ radar after a strong bounce from its recent lows. The token was stuck below $5 for most of April, but then it suddenly shot up to $7.55 before pulling back a bit.

Now, UNI price is trading around $7.07 after dropping about 6% in a day. Many are wondering if that was the start of a bigger move, or did they miss the boat?

What the Uniswap Chart and Indicators Are Saying

The price chart shows a clear breakout from the long downtrend that stretched from January through early May. UNI price lost more than 65% of its value during that decline, dropping from over $16 to under $5. But the recent move changed the structure, with a strong leg up that formed a higher high.

Price is now pulling back and testing the $6.50–$7.00 zone, which previously acted as resistance and may now flip into support. If this area holds, bulls could target the 200-day simple moving average (SMA), currently at $9.59. That level could act as the next key resistance, followed by the psychological barrier at $10.

Read Also: Here’s Why Arbitrum Price Is Pumping and What ARB Chart Is Telling Us

On the downside, a break below $6.50 might expose Uniswap to a retest of the $6.00 or even $5.70 region. The token’s base remains intact between $4.30 and $4.90, where buyers previously stepped in.

Uniswap price is trading at $7.0892 at writing. It has recorded an 8.26% gain over the past day, with trading volume climbing by 35%, signaling growing interest and activity.

A look at the daily technical indicators suggests strong short-term momentum, though there are also signs that UNI may need to cool off.

| Indicator | Value | Interpretation |

| MACD | 0.234 | Bullish crossover |

| CCI | 210.15 | Overbought territory |

| Ultimate Oscillator | 67.31 | Positive momentum across timeframes |

| Rate of Change (ROC) | 27.54 | Strong upward price movement |

| Bull/Bear Power | 2.605 | Buyers still dominant |

The MACD remains above the signal line, indicating bullish pressure is still present. The Rate of Change confirms a strong uptrend, while the Bull/Bear Power reflects buying interest. However, the CCI above 200 suggests UNI price may be temporarily overextended, and some short-term consolidation or pullback wouldn’t be surprising.

Read Also: Cardano Whales Just Bought 40M ADA – What Comes Next?

Uniswap Price Forecast

If UNI holds above the $6.70 level and regains strength above $7.50, the next logical target is the $9.00–$9.50 range, aligning with the 200-day moving average. A sustained move above that could open the door to $10 and beyond.

On the flip side, a break below $6.50 could shift momentum back in favor of the bears. In that case, traders may look toward the $6.00 zone or the mid-$5 range for the next possible rebound.

So, is it too late to buy UNI?

Not necessarily, but it’s not an early entry either. The strongest gains from the $5.00 breakout have already occurred. Right now, the UNI price appears to be in a consolidation phase. Whether it leads to another breakout or a deeper pullback will likely depend on broader market conditions and the token’s ability to hold current support. For now, it’s a moment of waiting, not chasing.

Read Also: Ethereum Price to Hit $10,000? ETH Whales Accumulate ‘Like Never Before’

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Read our recent crypto market updates, news, and technical analysis here.

We recommend eToro

Active user community and social features like news feeds, chats for specific coins available for trading.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.