How Will FOMC Day Affect Bitcoin And Altcoins

The Federal Open Market Committee (FOMC) meeting is underway, the American federal reserve providing for its next monetary policy decision at 2 p.m. on Wednesday.

According to data from CME FedwatchMerchants expect the central bank retaining its target rate of federal funds unchanged between 425 and 450 base points.

However, the Fed President's press conference Jerome Powell could trigger significant volatility on the markets, potentially have a major impact on cryptographic investments.

Given the low GDP report of the American first quarter, it is very likely that Powell will adopt a more dominant position, offering potential relief for the cryptography market.

Investors of smart money are already buying down, pushing the price of bitcoin to $ 97,000. Application investors may have one last opportunity to accumulate on the best cryptos to buy before the start of an explosive rally.

Wednesday FOMC could trigger significant volatility in cryptography prices

There is an increasing consensus on the fact that the post-FOMC discourse of the president of the Fed, Jerome Powell, could be optimistic for the financial markets.

THE US Q1 GDP Contracted by 0.3%, clearly worse than market expectations of growth of 0.3%. Reading has triggered significant recession problems, taking into account two consecutive quarters of negative GDP meets the criteria of a technical recession.

The chances of a recession in the American economy in 2025 increased by more than 70% on the prediction market like Kalshi and Polymarket.

Meanwhile, the economy received good news on the inflation front, with the preferred indicator of the Fed, Core Pceat 2.6% in accordance with market expectations.

Consequently, it will not be surprising that Powell adopts a dominant position to give a very necessary respite to nervous investors, potentially indicating aggressive rate drops this year or alluding to the start of the Fed's Quantitative breath.

As such, CME Fedwatch indicates the possibility of three cups this year. In addition, the Central Bank continues to provide liquidity to the markets through several non -QE measures. Yesterday, the Fed bought for $ 20 billion in 3 -year bonds, the largest purchase of a day in 2021.

It is not without any reason that the price of Bitcoin successfully defended the level of support of $ 93,500 before the FOMC, bouncing now at $ 97,000 at the time of the press with climbing open interest.

Best cryptos to buy now

Investors sidelined should quickly increase their exposure to Bitcoin. There is an increasing consensus on the growth of the price of Bitcoin at $ 150,000 in the second quarter itself. Several eminent analysts are now also referring to the possibility of $ 210,000 this year.

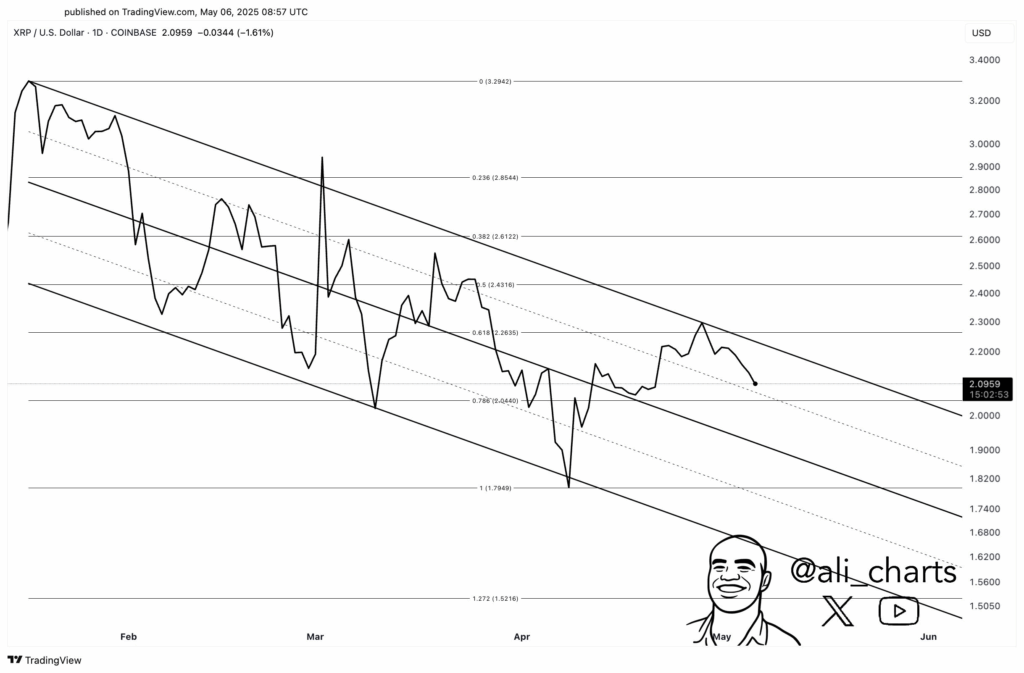

Investors should also buy XRP, since it is one of the strongest altcoins on the market. In particular, a decisive closure above the $ 2.26Who could happen quickly after the FOMC on Wednesday, could trigger a $ 3 short -term rally.

Among the coins, Popcat has become an attractive investment, recording the highest investments in intelligent monetary wallets in the past 24 hours, data from Candle revealed.

Investors should also keep an eye on Fartcoin, due to its relative strength. In particular, a daily fence greater than $ 1.20 would open the way to a rally at $ 2.

Investors in smart money also are looking for low capitalization jewels, especially in the AI sector. For example, Mind of Pepe (Spirit) Attracted the attention of whales before the launch of its AI agent on May 10.

Last week, a whale exchanged 70 ETH for the mind, adding to the list of its six -digit investments.

The spirit of Pepe's presale has already collected more than $ 8.8 million in a short time, which indicates strong community support. However, it is also a piece of small capitalization AI, always in its presale, which makes it an attractive investment.

Analysts and influencers of eminent crypto call it the next Crypto 100x, while others consider it one of the best cryptos to buy now.

Visit the spirit of the presale of Pepe

This article was provided by one of our business partners and does not reflect the opinion of Cryptonomist. Please note that our business partners can use affiliation programs to generate income via the links in this article.