How this trader racked up $46.5 million profits from leveraged crypto bets on Hyperliquid

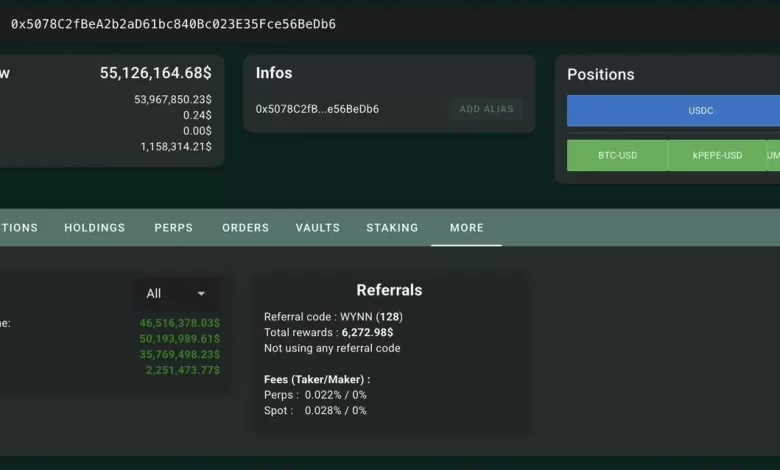

An entrepreneur is drawing attention from the crypto community for a massive return to the decentralized exchange of hyperliquid. In an X post, the lookonchain revealed that the businessman known as James Wynn made up to $ 46.5 million in income trading on the platform.

According to PostWynn has formed these revenues from just two months of trading by taking a massive long position in Bitcoin and some memecoins.

Currently, he has a 40x long position in Bitcoin, which he enters when the flagship trades around $ 94,000. With the BTC now trading above $ 100,000, the businessman has unnecessary $ 5.4 million income.

His other positions are mostly memecoins with 10x leverage long in Pepe and Trump and 5x long in Fartcoin. The Pepe trade, which he entered at $ 0.00766, became his greatest profit, with the unlucky ones earning $ 23.8 million.

The massive return is further influenced by the amount of trade funding, with the entrepreneur making more than $ 56.15 million worth of PEPE in position while also putting more than $ 57 million in the bitcoin trade.

His smallest position was on the hype, with only $ 6.2 million, generating over $ 31,000 income. With over $ 5 million each of Trump and Fartcoin's acquisitions, the businessman currently has $ 39.92 million in the unlucky income.

However, the post has developed mixed reactions from many in the crypto community. As some praised his acumen in trading, many criticized the post as a shill and accused The Wynn of being a scammer who launched and broke a project in 2024.

A user said:

“@Jameswynnreal has scammed people last tag -day. Launched a rug pull then disappeared for several months. Be careful of following this year.”

Others have added that the X account tagged in the post is the Shilling Low-Cap token and is currently promoting another project, leading to suggestions that he may be a crypto influencer that promotes projects.

Short traders continue to struggle as the crypto market maintains gains

Despite the criticism, Wynn's massive acquisitions, such as highlighting the post, reflect the recent advancement of the value of crypto assets. Toro entrepreneurs with a long position benefited from the gains, while the bears suffered a massive fluid.

The market recorded $ 879 million in destroying on May 9, when the BTC crossed $ 100,000 for the first time since February, and ETH saw a 20% increase in value. Most fluids are short positions in BTC and ETH, with $ 329 million and $ 305 million, respectively.

While the rally is cooled, short traders continue to account for most exterminations. According to Coinglass The data, $ 285.36 million worth of positions has been –liquidate for more than 125,000 merchants in the last 24 hours.

Shorts cost $ 167 million, while Longs has $ 118.34 million. Noteworthy, Ethereum has the highest extermination with $ 104.87 million, and short positions cost $ 66.63 million.

Despite the losses of short traders, there are still many bearish. A whale recently deposited 17 million USDCs in Hyperliiqu to short bitcoin, Ether, and Solana with 3x leverage. According to LookonchainThey have been sitting more than $ 1.2 million in losses.

Hype soars in value as hyperliiver generate more activity

Meanwhile, one of the beneficiaries of recent price volatility is Hyperliquid. The decentralized ongoing trading platform continues to dominate the amount of trade and attract new users.

According to DefillamaHyperliquid is the leading protocol for decentralized perpers trading, which costs 60% of the trading volume in the last 24 hours with $ 9.259 billion. It also saw $ 40.94 billion in volume in the last seven days and $ 1.416 trillion throughout its life.

With hyperliquid that detects massive volume, its hype token is also performing well. It gained 20% last week and climbed 81.11% in the last 30 days. However, its price around $ 25 means it still drops by 5% this year.

Cryptopolitan Academy: Tired of market swings? Learn how the Defi can help you develop a steady passive income. Register now