How Special Relays Let Some Ethereum Transactions Skip the Public Queue

Link

Abstract/zusammenfassung

Newspapers

Recognition

Chapter 1: Introduction

-

Introduction

1.1 General -Idesa of thesis contributions

1.2 Thesis Outline

Chapter 2: Background

2.1 Blockchain and Smart Contracts

2.2 Transaction Prioritization Standards

2.3 Transaction Prioritization and Contention Transparency

2.4 Decentralized Management

2.5 Blockchain Scalability with Layer 2.0 solutions

Chapter 3. Transaction prioritization standards

-

Transaction prioritization standards

3.1 methods

3.2 Study of compliance with the standard

3.3 Investigation of violations of the standard

3.4 Dark transactions

3.5 ending reminders

Chapter 4. Transaction Prioritization and Contention Transparency

-

Transaction prioritization and dispute transparency

4.1 Procedure

4.2 In the transparency of dispute

4.3 In Prioritization Transparency

4.4 Finishing reminders

Chapter 5. Decentralized Management

-

Decentralized management

5.1 methods

5.2 Attitude Attitude

5.3 Compound management

5.4 Finishing comments

Chapter 6. Related Tasks

6.1 Transaction Prioritization Standards

6.2 Transaction Prioritization and Contention Transparency

6.3 Decentralized Management

Chapter 7. Discussion, limitations and future labor

7.1 ordering transaction

7.2 Transaction Transaction

7.3 Distribution of Voting Power to Change Intelligent Contracts

Conclusion

Appendices

Appendix A: Further Analysis of Prioritization Standards of Transactions

Appendix B: Further Analysis of Prioritization and Contention Transparency Transactions

Appendix C: Further Analysis of Voting Power Distribution

Bibliography

4.2 In the transparency of dispute

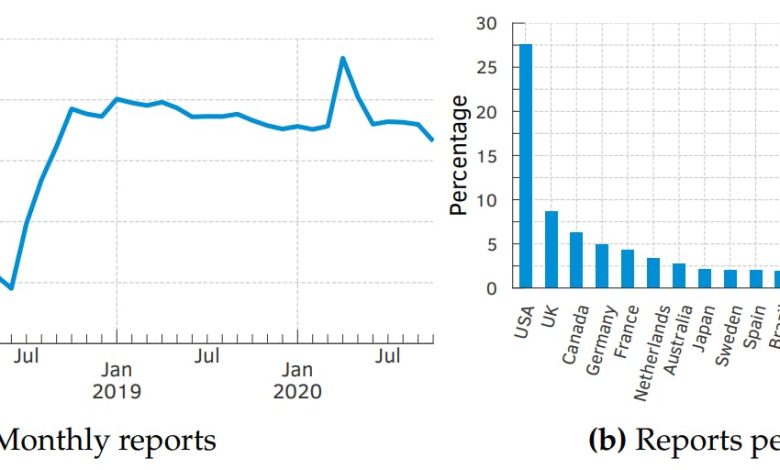

In this section, we show that the transparency of the dispute does not hold the practice as transaction relay networks become popular with Ethereum. It allows miners to include transactions privately and therefore not all miners or even transactions have a full view of all available transactions pending for integration.

4.2.1 The rise of private relay networks

In the useful market of Decentralized Finance (DEFI) in Ethereum, today, bots are engaged in predatory behaviors running such as sandwich attacks and transactionreplay attacks (Daian et al., 2020; Kiffer et al., 2017; Qin et al., 2022, 2021; Torres et al., 2021; 2021). Relay networks help users to oppose such attacks: they provide users of a private channel for talking to miners, who need to prove their identity to participate in the relay. Relay networks help users to completely avoid the P2P network: users send their relay network transactions, which will return them to its participating miners. The relay network and its participants claim (a) not to run these transactions; and (b) to keep them private until they are included in a block (flashbots, 2022a). These transactions, therefore, by construction, are experiencing issues running in front. Relay networks are centralized; If miners make a mistake, they may lose their membership in the network and lose their future income. Multiple relay networks (e.g.

Flashbots private relay network

As previously discussed, at the time of our review, flashbots were the most popular private relay network in Ethereum. Flashbots users bind one or more transactions to some specific confession (flashbots, 2022b). The whole bundle is expected to be (maintaining the order of transactions inside the bundle) and place it on top of their blocks. Miners receive fee (paid by a direct transfer to their wallets) for the integration of the bundle in addition to the (traditional) fee associated with transactions in that bundle. If there are two competing bundles – taking the same financial opportunity, for example, liquids – the bearers will choose one with the highest reward (i.e., to maximize financial incentives). The other bundle was thrown away (as the financial opportunity no longer exists after the accompanying bundle was obtained), even though its transactions did not spend any gas. Therefore, with the exception of a network base fee introduced to EIP-1559,[11] Arbitrageurs and liquidators can participate without having any balance in their purse: if they successfully get a financial opportunity, they pay the miner from income that is secure and pocket left (flashbots, 2022C). Flashbots are a free to use the relay network, and they allow anyone to ask if a transaction has used their relay network and private fees paid to the miner (after which it focuses on a block). We use the available public data for review of transactions issued (private) in flashbots. Flashbots, however, do not listed discarded bundles (or its transactions): we have access, therefore, only to those who have made transactions.

4.2.2 Characterized private relay networks

Flashbots are labeling its bundles (and constitutional transactions) in one of three categories: (i) Flashbotsrepresenting those sent by their private relay; (ii) RogueDetermined those delivered to a (flashbots) miner, but through another relay network; and (III) Miner payoutindicating a bundle containing payouts to users of a mining pool (WeinTraub et al., 2022). We found 58.82%, 27.93%, and 13.25%of transactions belonging to flashbots, miner payouts, and rogue categories, respectively. We also noticed that 70,260 (1.01%) of all flashbots transactions failed to perform after integration with a block. A small portion of the transactions is, therefore, not successfully executed despite the use of private relays.

Flashbots also say that there are ≈ 85% of the total Ethereum hash rate (flashbots, 2022C). Each of our tests, however, most of the mining pools (47 to 48 – obstruction Etpool) uses flashbots, providing 99.99% of the total Ethereum hash rate, a recent task also confirms our findings (WeinTraub et al., 2022).

Some of the strongest mining pools like spark pool[12] (collaborating with the Taichi Network (Sparkpool, 2021)), Ethermine (Ethermine, 2022), and F2Pool (part of the Eden Network (Eden Network, 2022)) offered their own relay networks. While these networks allow transactions to send transactions exclusively to a specific miner, we indicate that miners (or prioritize) these transactions to those sent through the P2P public network. Crucially, payments from these private transactions are guaranteed, while those from the public that release transactions are not – they are available to any miner who wants to make them. Miners, therefore, are likely to offer treatment preferences for private transactions.

4.2.3 In preference to treat private transactions

We proved our treatment hypothesis for private transactions through an active experiment conducted on September 8, 2021. We released 8 transactions, of which 4 were sent privately through the Taichi Network, powered by the spark pool, and 4 by the Public Ethereum Network (Refer Table B.1 in §b.1). We spent 100 euros for running this experiment.

During the experiment, we reviewed whether the popular Ethereum blockchain explorers (i.e., Eterscan (Eterscan, 2023b), Blockchain.com (Blockchain.com, 2021), and Blockchair (Blockchair, 2023)) have observed either of our private transactions; If they did, it would indicate that the Taichi network leaked public transactions. While public transactions have appeared on explorers of this blockchain, after we have sent them through the P2P public network, private transactions are not noticed either of them until the transactions are included in a block. More importantly, our private transactions are no longer Ethercan (which relies on flashbots API (flashbots, 2022A) and more recently in Eigenphi (Eigenphi, 2022)) as private, even after integration with a block. The measurement of the proliferation of private transactions is, therefore, challenging; It is likely that our estimates of the volume of private transactions based on such tools represent, therefore, a lower bond.

Our results show that the Babel Pool includes 2 of our 4 private transactions. The spark pool supports this mining pool, indicating that they are “cooperating” in the manufacture of private transactions sent to the Taichi Network (Babel Finance, 2021). Our transactions are included, however, in the appropriate block position based on their fees. We evaluate the prioritization of transactions in the next section.

We also describe the proliferation of private transactions to Ethereum and indicate that mining pools may each have a unique set of private transactions in their mempool. Users, as a result, can no longer rely on public mempool only to estimate their transaction fee. Due to the absence of other data, they are likely to end with a false estimate of “appropriate” transaction fees for their transactions.

May -set:

(1) Johnnatan Messias Peixoto Afonso

[11] The EIP-1559 became live with London upgrading Ethereum in London on August 5, 2021, with block number 12,965,000. [12] The spark pool suspended their mining services on September 30th, 2021, due to regulatory requirements introduced by Chinese authorities (Helen Partz, 2021).