How Do Bitcoin & Solana Stack?

The data on the chain show that the XRP network has experienced a strong jump in “Hot Capital” recently. Here's how this growth is compared to Bitcoin and others.

XRP among cryptocurrencies observing the rise in hot capital

In a new job On X, the Glassnod chain analysis company explained how the hot capital of XRP has changed recently. The “hot capital” refers to this part of the cryptocurrency capital reserve which entered last week.

The capital reserve of any digital active ingredient is measured by its “ceiling carried out”, which is a capitalization model which calculates the total evaluation of a cryptocurrency by assimilating the value of each token in circulation at the cash price to which it was transformed on the network.

As the last transaction from scratch is likely to represent the last time it has changed hands, the price at this time could be considered its current cost base. Thus, the ceiling carried out essentially sums up the basis of the cost of all active investors.

When the value of this indicator changes, the capital could be supposed to enter or out of the cryptocurrency, according to the direction of change. In the context of the current subject, the ceiling made of the whole network is not interesting, but only part of it: hot supply.

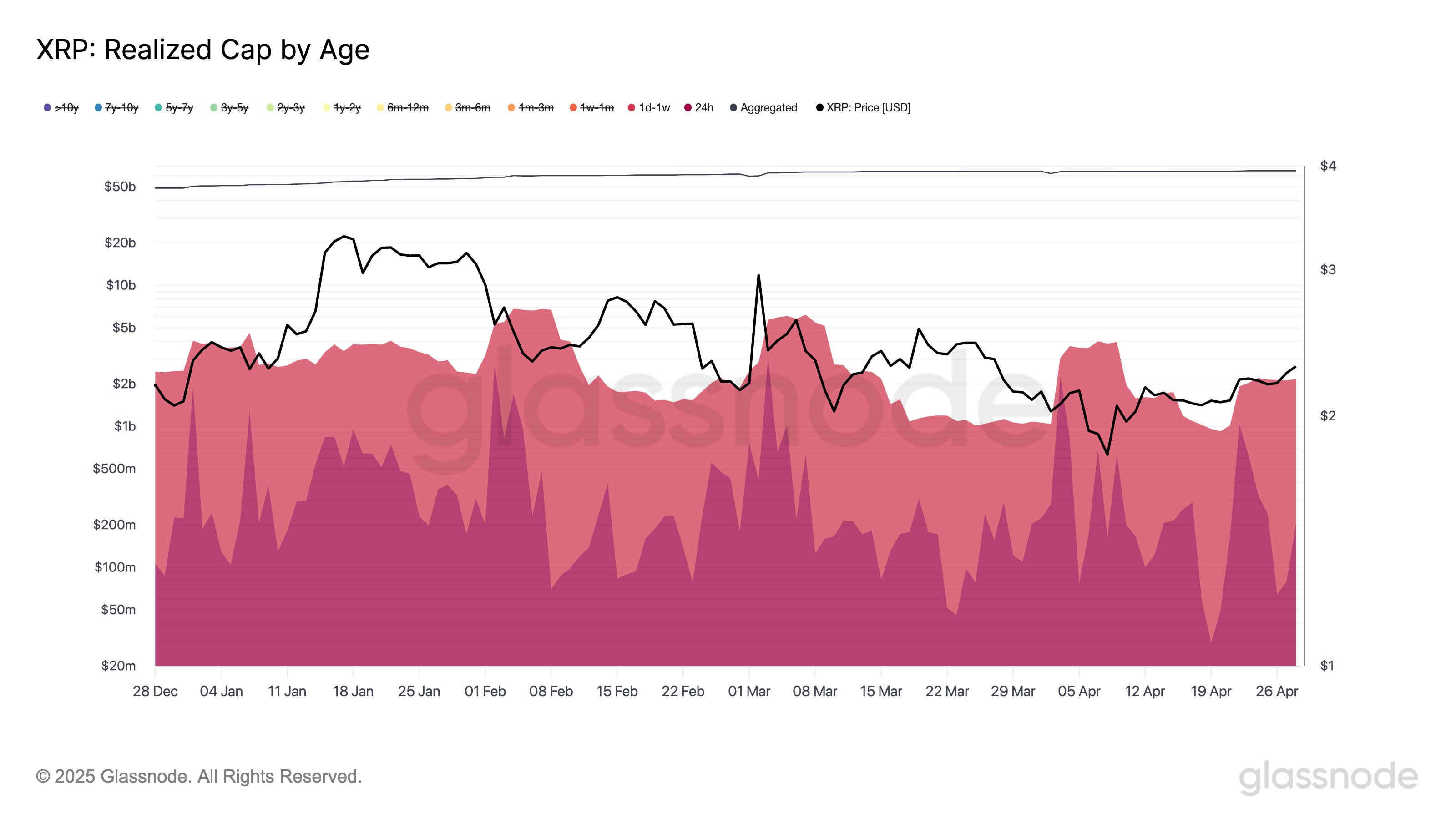

You will find below the graph shared by the analysis company which shows how the capital stored in the form of these young pieces has changed for XRP in recent months:

The value of the metric seems to have jumped in recent days | Source: Glassnode on X

As is visible in the graph above, the ceiling carried out associated with the parts that came in the last week recently recorded an increase in XRP, a potential signal that speculative capital enters the cryptocurrency.

“XRP hot capital went from $ 0.92 billion on Apr 20 to $ 2.17 billion on the Apr 28 – a overvoltage of $ 1.25 billion (+ 134.9%),” notes Glassnode. “Despite this rebound, the metric remains ~ 72% below its December 2024 peak of $ 7.66 billion.”

XRP is not the only digital asset to observe an increase in the activity of short -term holders. As the analytical company stressed it in other X, Bitcoin, Ethereum and Solana positions were all witness to a considerable increase in hot capital during the same period.

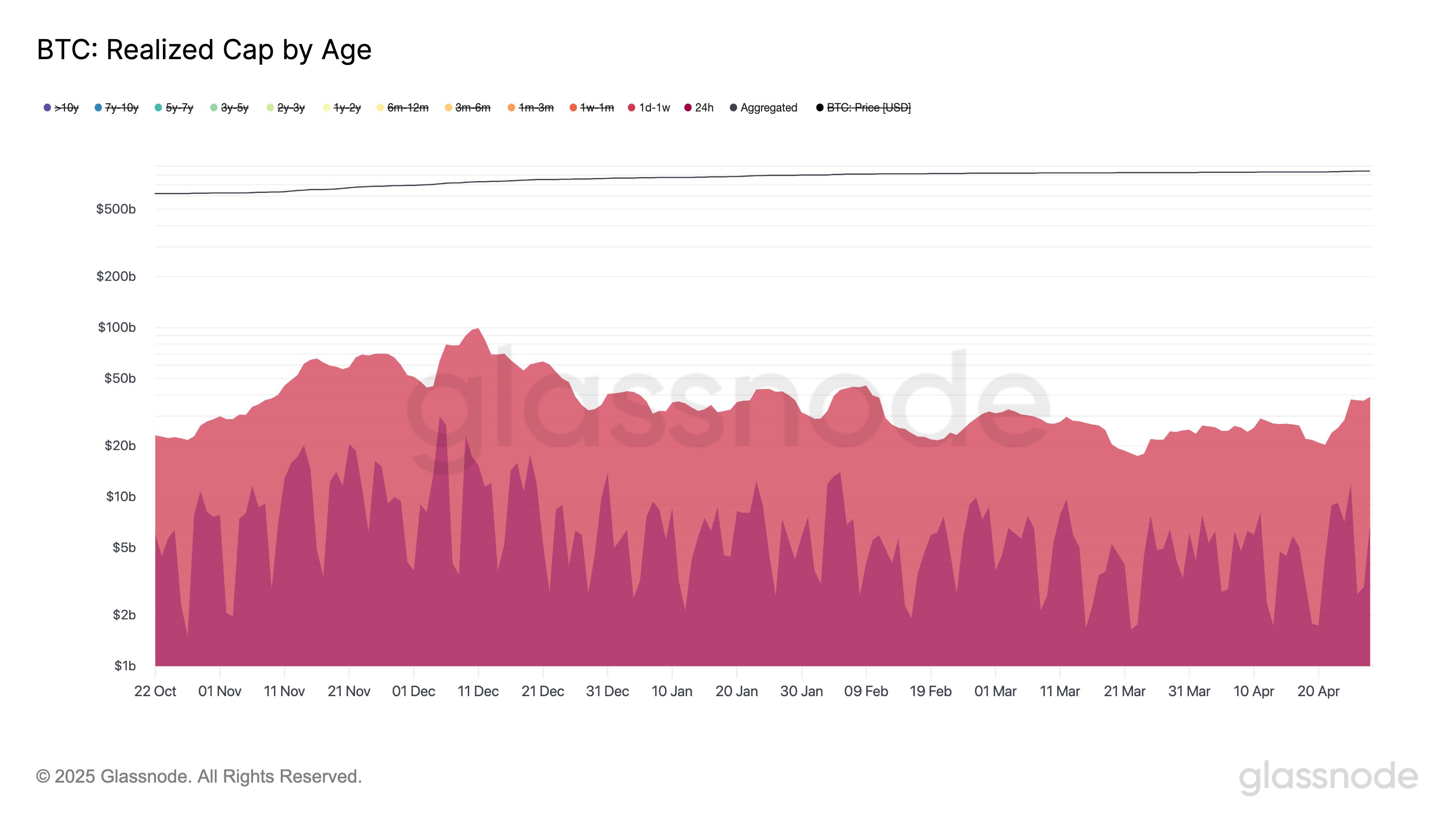

First of all, here is the Bitcoin painting, displaying how metrics went through a overvoltage of 92% to 39.1 billion dollars:

The trend in the shot-term Realized Cap of Bitcoin | Source: Glassnode on X

According to Glassnode, this reversal in the hot capital is one of the fastest increases that the indicator has seen for Bitcoin in recent months. Although the percentage increase observed by the metric is still lower than that of XRP.

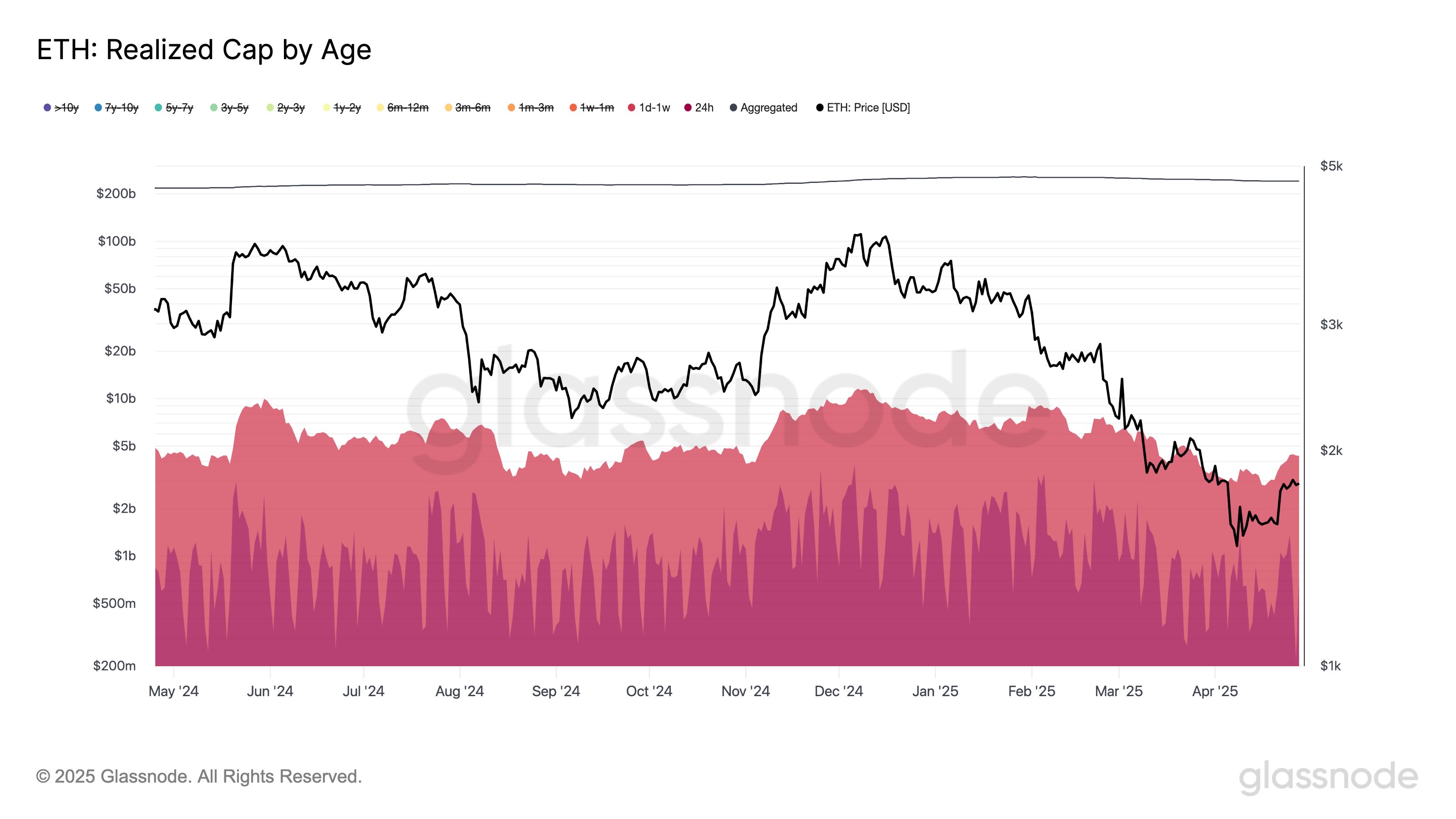

Ethereum and Solana are also similar in this area, with ETH in particular lagging behind with an increase of 54% since April 17.

Looks like the ETH Hot Capital is significantly under the earlier top | Source: Glassnode on X

While Hot Capital has increased through these cryptocurrencies, its value remains well below the top observed earlier in the cycle, an indication that speculative activity has not yet made a complete return. More specifically, the indicator is seated 60% for Bitcoin and Ethereum, and 72% for XRP.

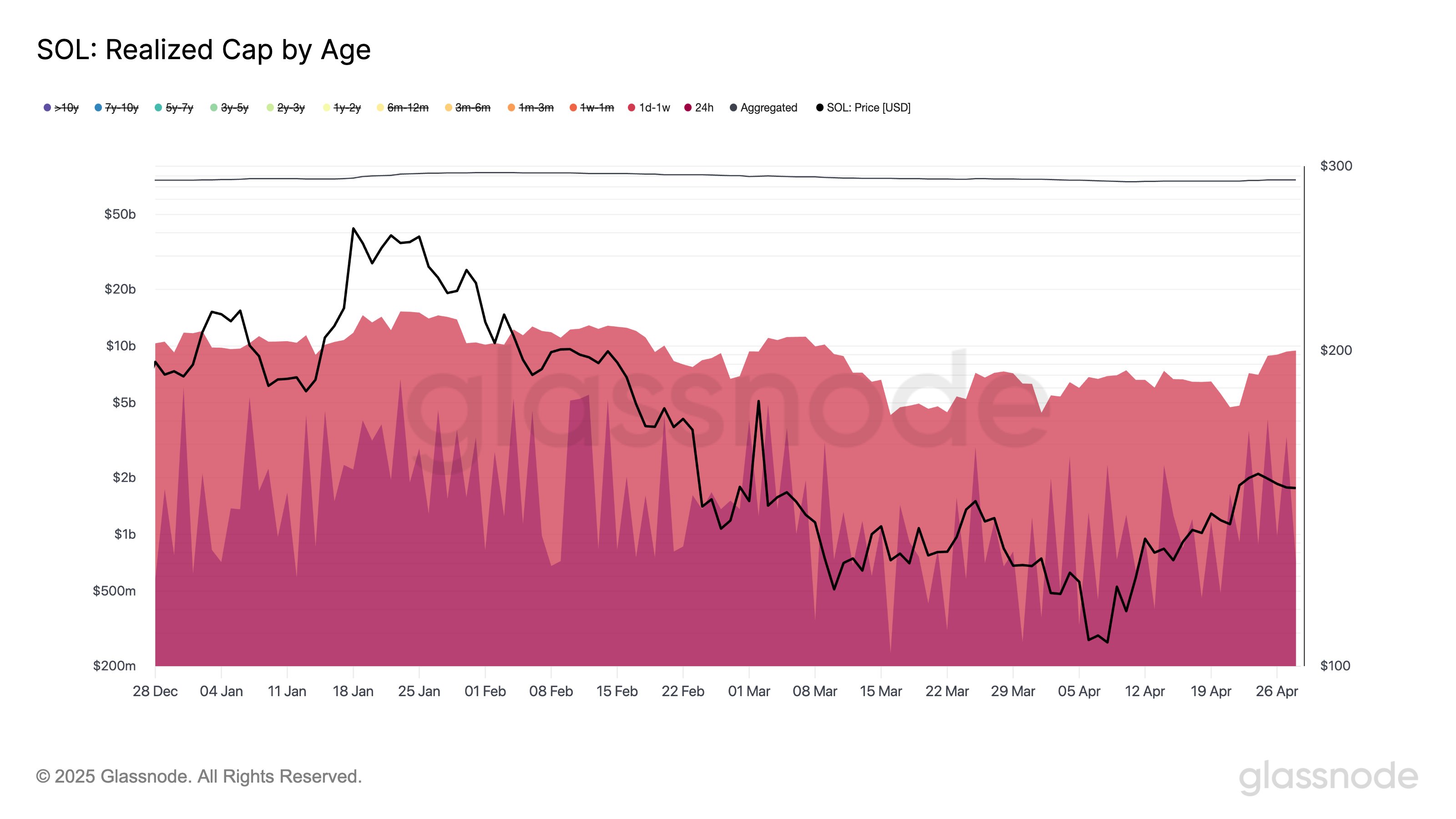

The asset which is currently the closest to the realization of a return is Solana, the metric being about 38% after a 100% skidding.

The increase in the metric that SOL has seen | Source: Glassnode on X

XRP price

XRP has crossed the mark of $ 2.30 earlier in the week, but it seems that the asset has seen a decline since then because its price has returned to $ 2.17.

The coin appears to have plunged during the past day | Source: XRPUSDT on TradingView

Dall-E star image, Glassnode.com, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.