How Anish Kumar Jain Transformed Credit Card Application Fraud Detection at a Leading Bank

At a time when financial institutions are faced with unprecedented challenges of sophisticated fraud programs, the successful modernization of the detection system of detecting credit card application of a banking organization of a large organization is a historic success in the innovation of banking security. As part of the strategic leadership of the veteran of Anish Kumar Jain technology, this complete modernization project has not only established new fraud detection standards, but has fundamentally transformed the way in which one of the largest American banks approaches risk management in the digital age.

The landscape of modern financial security has a constantly evolving challenge, fraud of credit card demand representing one of the most important threats to banking institutions. While fraudsters use increasingly sophisticated techniques and technological tools, the need for robust and real -time fraud detection systems has become essential. The Fraud Detection Detection System of the Bank's credit card applications, dealing with an extraordinary volume of 65,000 to 70,000 requests per day, serves as a crucial defense mechanism against various forms of applications, preventing $ 175 million in combined and third -party fraud losses.

The modernized system, under the leadership of Anish Kumar Jain, represents a wonderful technical orchestration, managing multiple fraud prevention intentions thanks to a sophisticated microservice network. The complete approach to the system deals with the prevention of fraud by third parties, successfully preventing around $ 75 million in fraud losses per year by focusing on external threat actors who try to exploit the process of demand. Simultaneously, its advanced analytical capacities tackle fraud from the first part, preventing approximately $ 100 million in annual losses from candidates who have distorted their intentions or references. The integration of alerts from the credit office and the activation of instant expenditure further strengthens the capacity of the system to make secure decisions in real time concerning the emission of digital cards and immediate expenditure capacities.

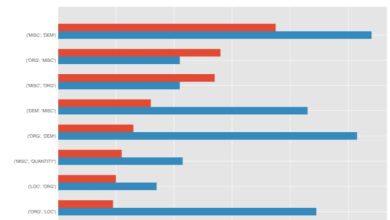

The technological architecture of the modernized system highlights the tip of financial technological innovation. Basically, the platform orchestrates a complex network of API both internal and external models and automatic learning, treating around 500 distinct characteristics via eight sophisticated analytical models. These models transparently incorporate various data sources, including information on the credit office, real -time application data, advanced digital fingerprints of the IP and the device, validation of small businesses and the verification of social security information. The system's ability to process and analyze this wide range of real -time data points while retaining high performance and reliability standards represent a significant realization in engineering of financial technology.

The approach of Anish Kumar Jain in this effort of multi -year modernization reflected his deep understanding of technical architecture and commercial objectives. The transition to server -free technologies was executed thanks to a carefully planned strategy which emphasized the reliability and safety of the system during the transition phase. This complete approach included advanced monitoring capacities, recovery protocols after robust disaster and sophisticated test frames to ensure the integrity of the system.

The modernization initiative provided an exceptional commercial value on several dimensions. Thanks to strategic planning and innovative implementation, the project carried out a remarkable reduction of 50% of the operational support capacity, resulting in annual savings of approximately $ 1 million. Migration to server -free architecture has resulted in a 30% reduction in “running the engine” costs by sprint, supplemented by monthly infrastructure savings of $ 2,500. The successful downgrading of inherited systems has eliminated redundant infrastructure costs and improving system maintainability.

The modernized system has introduced sophisticated risk assessment capacities that have revolutionized the applicant's experience. Thanks to real-time analysis and decision-making, the platform assesses the eligibility for instant credit with improved precision, allows an instantaneous emission of secure digital card and adjusts the dynamically based risk thresholds based on emerging threat models. This balance between security and user experience demonstrates the system's ability to achieve operational and customer -focused objectives.

For Anish Kumar Jain, this project represented more than technical achievement; This has shown its ability to stimulate transformational change in financial technology. With almost two decades of experience in major financial institutions in Europe and the United States, its leadership in this modernization effort presented the perfect mixture of technical expertise and strategic vision. The implementation of advanced technologies such as Golang, server -free architecture and sophisticated automatic learning models positioned the bank at the cutting edge of financial security innovation.

The modernized credit card application detection system represents more than just technological upgrade; It establishes a basis for future innovations in the prevention of fraud. While financial fraud continues to evolve in sophistication, flexible architecture and advanced capacities of the system position the organization to adapt quickly to emerging fraud models, integrate new safety technologies transparently and increase effective operations to effectively respond to increasing requests.

A distinguished technological leader in financial services, Anish Kumar Jain has established himself as a pre -eminent expert in financial innovation and security. His global experience extends over several major financial institutions across Europe and the United States, where he has always demonstrated excellence in the technical expertise commission with strategic commercial objectives. With multiple technical certifications and a strong emphasis on innovation, security and quality, Anish has won numerous prizes and recognition throughout his career.

While the financial services industry continues to evolve, Anish Kumar Jain's work testifies to the power of strategic technical leadership in the conduct of a significant transformation. Its success in the modernization of the bank's fraud detection capacities while achieving significant operational efficiency establishes a new standard for technological leadership in the banking sector. Thanks to projects such as the modernization of detecting fraud of the credit card card, it continues to shape the future of digital banking and financial technology solutions, ensuring that financial institutions can meet the challenges of an increasingly digital world while retaining the highest security and reliability standards.

About Anish Kumar Jain

A distinguished technological leader in financial services, Anish Kumar Jain has established himself as an expert in financial innovation and security. His global experience extends over several major financial institutions across Europe and the United States, where he has always demonstrated excellence in the technical expertise commission with strategic commercial objectives. With multiple technical certifications and a strong emphasis on innovation, security and quality, Anish has won numerous prizes and recognition throughout his career. His commitment to continuous learning and excellence in delivery made him a respected figure in the financial technology sector, where he continues to shape the future of digital and financial technology solutions.

This story was distributed as a press release by Echoshipire Media as part of the Hackernoon commercial blog program. Learn more about the program