Hedera (HBAR) Forecast for May 2025 – Will it Breach $0.40?

Hedera (Hbar) enters a fragile but potentially explosive technical configuration in May, with cooling by term activity and price movements closely linked to Bitcoin momentum. The long -term volume of Hbar remains moderate, suggesting a drop in speculative interest compared to the beginning of this year.

Meanwhile, Hbar continues to follow Bitcoin's performance with amplified volatility. While BTC flirts with the level of $ 100,000 and the feeling changes its height, Hbar could either drill key resistance levels and rally at $ 0.40 – or face a deeper correction if the technical support fails.

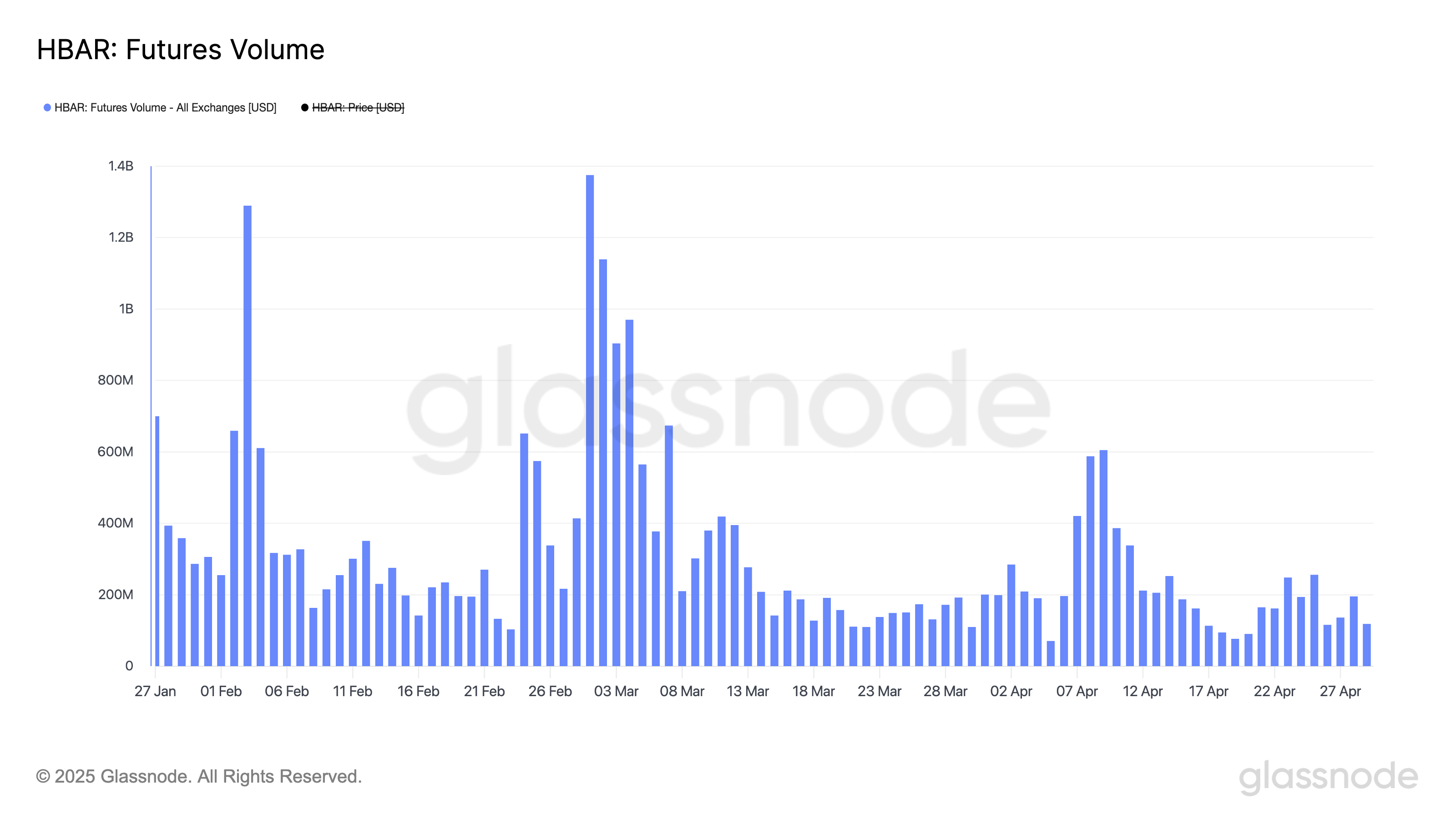

Low -long HBAR in -term volume points for cooling speculation

The long -term volume of Hbar is currently $ 118 million, against a recent minimum of $ 76 million on April 19, is the lowest point of the last three months.

This follows a constant drop in much higher levels observed earlier in the year.

In particular, Hbar Futures Open Interest had culminated at $ 1.3 billion on March 1, but has not exceeded $ 300 million since April 12, reporting a significant drop in speculative activity around the token.

The term contracts Hedera refer to derivative contracts which allow traders to speculate on the future price of Hbar, the native token of the Hedera network. Participants in the retail and institutional trade often use these contracts to cover risks or take leverage positions.

The term volumes and open interests are key indicators of market feeling and liquidity – higher volumes generally suggest stronger conviction or increased commercial activity. At the same time, the drop in figures can reflect a reduction in interest or confidence in short -term prices' action.

The current lower levels suggest that recent Hbar price movements may have been more influenced by punctual demand than leverage speculation.

The strong correlation of Hedera with BTC could lead the next rally

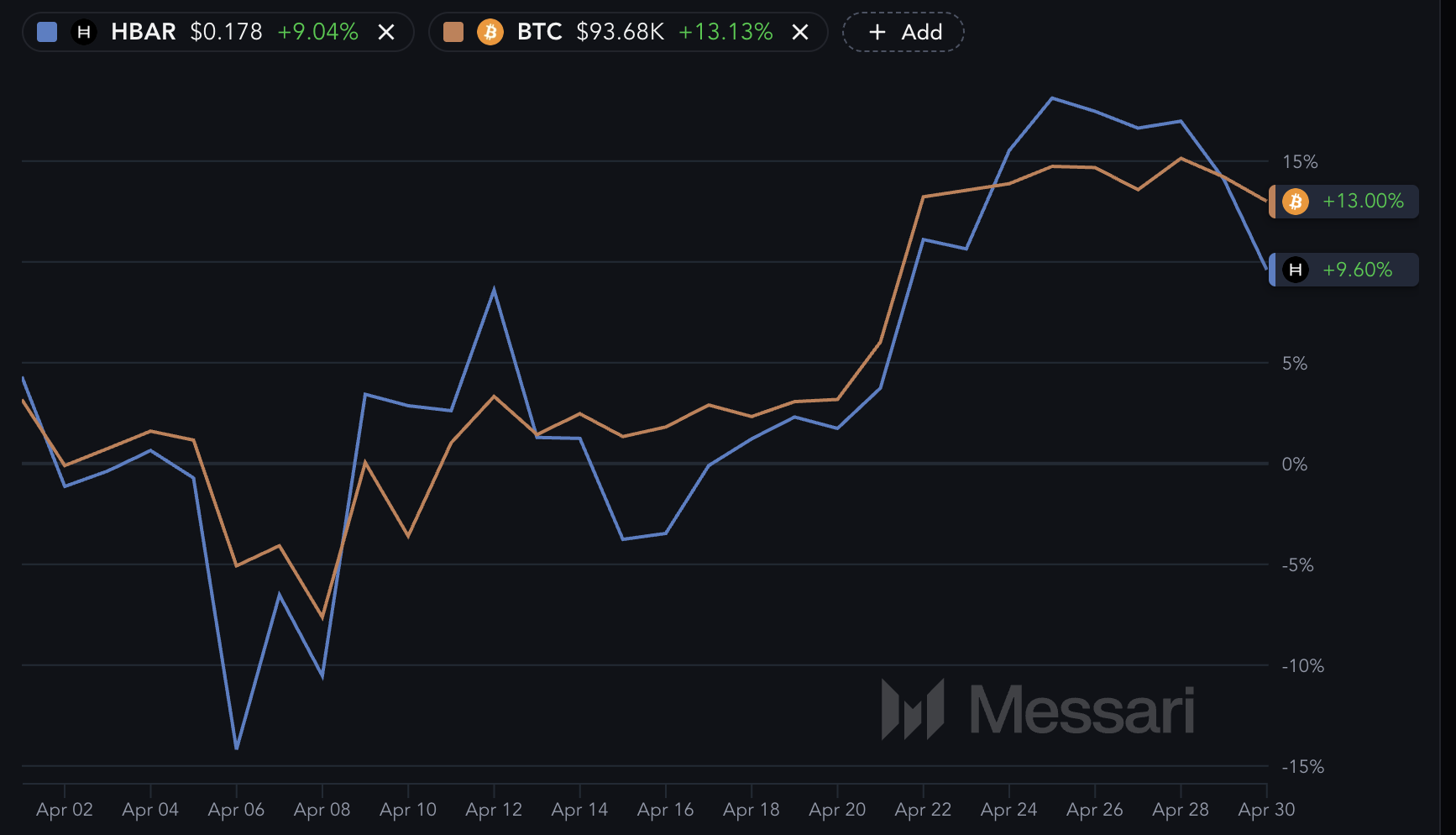

Hbar has recently shown strong correlation with Bitcoin (BTC), often amplifying the wider leading market leaders in the cryptography market.

When the BTC gathers, Hbar tends to increase even more strongly; Conversely, Hbar often experiences deeper withdrawals during corrections. This model reflects Hedera's sensitivity to the feeling of the market and positioning as a higher asset in cryptographic space.

Consequently, changes in the Bitcoin trajectory, in particular during periods of strong dynamics, can considerably influence the action of Hbar prices.

With Bitcoin up 13% in the last 30 days and now sitting at only 6.3% below the $ 100,000 mark, the next leg could have a strong overflow effect on Hbar.

The data on the chain show a resumption of the apparent demand from the BTC, while the institutional feeling is gradually improving, the entries of FNB showing the first signs of a rebound. If Bitcoin exceeds $ 100,000, Hbar could benefit from capital renewals and the increase in market enthusiasm.

Given Hbar's trend to surpass the BTC in bullish phases, a decisive break from Bitcoin could be a powerful catalyst for a wider movement in Hedera.

Key levels to look at Hbar faces an optimistic escape or the death cross

Hbar Price faces a critical technical configuration in May, with the potential of a net movement in both directions. On the bullish side, if Hbar can attract high purchase pressure and establish a sustained increase trend, it could increase up to 123% to reach $ 0.40.

To do this, the token must first pierce a series of key resistance levels at $ 0.20, $ 0.258, $ 0.32 and $ 0.37, each of which acted as a rejection point during past rallies.

A successful escape through these levels could point out a renewed impulse and a broader confidence in the market in Hedera.

However, the downward risks remain firmly at stake. The EMA lines of Hbar show signs of an imminent death cross – a low -term scheme in which the short -term average moves below the long term average, indicating that a deeper correction can be in advance.

If this training is confirmed, Hbar could first test the support at $ 0.16. Not maintaining this level can lead to new losses around $ 0.124, and in a more aggressive decline, prices could decrease to $ 0.0053.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.