Why is Platinum So Expensive? • What Affects Platinum’s Price? • Benzinga

Platinum is one of the rarest and most precious precious metals in the world. Its high price is motivated by its rarity, its process of complex extraction and its various industrial applications, in particular in the automotive and jewelry industries. Unlike gold, the value of Platinum is strongly influenced by industrial demand, which makes its market price more volatile but also more sensitive to technological progress and economic cycles.

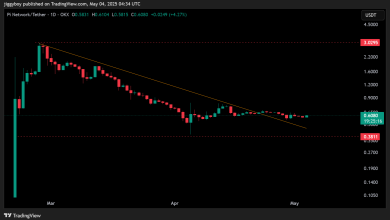

Platinum price history

Platinum has not always been so expensive, but its price is almost always volatile because of its rarity and its difficulty in exploiting. The history of Platinum prices has been a roller coaster in the past two decades. At the beginning of 2000, Platinum was negotiated at around $ 450 per ounce. The price remained relatively stable until the end of 2001, when it started to increase, reaching a peak of around $ 2,270 per ounce in May 2008.

Some major factors have led the price, in particular a weakened US dollar and a drop in the platinum supply of problems in South African mines. However, this peak did not last long.

The global financial crisis occurred for months later, causing the fall in the price of the platinum, falling to a hollow of $ 763 per ounce in November 2008. From there, the price of the plate started to climb, reaching almost $ 1,900 per ounce in 2011.

Since the Platinum peak in 2011, its price has regularly dropped. The decline was hidden after the Volkswagen emission scandal, which led to a decrease in the production of diesel engines and therefore also diesel catalytic converters (who use a lot of platinum). In September 2019, Platinum was negotiated at around $ 786 per ounce, marking a hollow of 14 years.

However, the COVVI-19 pandemic caused a strong increase in the demand for precious metals, including platinum, as investors have looked for shelters. The price of the platinum climbed $ 1,200 per ounce in August 2020 and has continued to increase since then.

In July 2024, Platinum was traded at just under $ 950 per ounce, a significant increase compared to its hollow of 2019. Despite its ups and downs, Platinum remains one of the most sought -after precious metals in the world, with applications in various industries such as jewelry, automobile and electronics.

What is the platinum for?

Despite its rarity, the platinum would not be as expensive if it was not in high demand and a vital component of a myriad of consumer and business goods. Here are the main uses of platinum:

- Jewelry: The shiny white appearance of Platinum makes it an ideal material for high -end jewelry. It is commonly used to make engagement rings, alliances, earrings and other luxury items.

- Automobile: Platinum is a key component of catalytic converters, which reduce the harmful emissions of vehicles. It is also used in the ignition candles and other components of the engine.

- Electronic: Platinum is used in the manufacture of liquid crystal display screens (LCD) (used in most modern televisions, PC monitors and laptops), hard drives and other electronic components due to its excellent conductivity and corrosion resistance.

- Chemical: Platinum is a vital catalyst in the production of a massive range of chemicals, including fertilizers, pharmaceutical products and other chemicals.

- Oil: Platinum is used in the refining of crude oil in petrol, diesel and other petroleum products.

- Medical devices: Platinum is used in medical devices such as heart stimulators, dental implants and other surgical instruments due to its biocompatibility and corrosion resistance.

- Investment vehicle: Platinum is a popular investment option, many investors with physical platinum bruises or buying (ETF) negotiated platinum stock markets as a coverage against inflation and market volatility. You can also buy platinum in an IRA. Continue to read to find out how.

The versatility of Platinum, associated with its rarity, has resulted in its price, which makes it one of the most expensive metals in the world.

Platinum vs Gold: What is rarer?

Platinum and gold are well known for their relative rarity, but the platinum seems to be slightly rarer in the earth's crust (the only accessible part of the earth to mine, so far). However, metal is much rarer in practice because it is difficult to exploit and the margins are small.

In 2022, the world platinum mine production (Without counting the recycled platinum from catalytic converters or other sources) was around 190 metric tonnes, compared to around 3,000 tonnes of gold produced in the same year. Platinum is rarer than gold, but it is in fact not the rarest precious metal. Other metals of the platinum group such as iridium, osmium and rhodium are a rarer order of magnitude.

Where to buy platinum (direct delivery or IRA))

For those looking to buy platinum, it is important to understand the different ways to buy it. Platinum can be purchased for home delivery with cash, credit card or bank account, or via an IRA.

Some of the best precious metal dealers who offer direct delivery and IRA are there.

Is Platinum a good investment right now?

Platinum could be an excellent investment in the right situation. He followed closely with gold for a large part of his history, he could therefore be a decent investment on shelters. However, Platinum has behaved much worse in recent years.

The price of the platinum also depends strongly on supply and demand. If you use factors that determine the supply and demand for building a solid investment thesis, a well -positioned trade may well work with enough luck. However, this can always be unpredictable.

Frequently asked questions

A

A

Yes, platinum is much more than gold because there are only 2,700 tonnes of platinum above the ground against around 187,000 tonnes of gold.

A