Has the Bitcoin Bear Market Ended or Is It Just a Fake-Out?

The crypto market went green in the first week of May, but the doubt remains strong. Some believe that current signals show the signs of a larger upcoming bullish twist, especially as Bitcoin destroys a basic psychological threshold.

However, others warn that temporary factors may list the indicators. This article uses on-chain data and history patterns to explore both sides of the argument.

Is it about to see the crypto market a bull run?

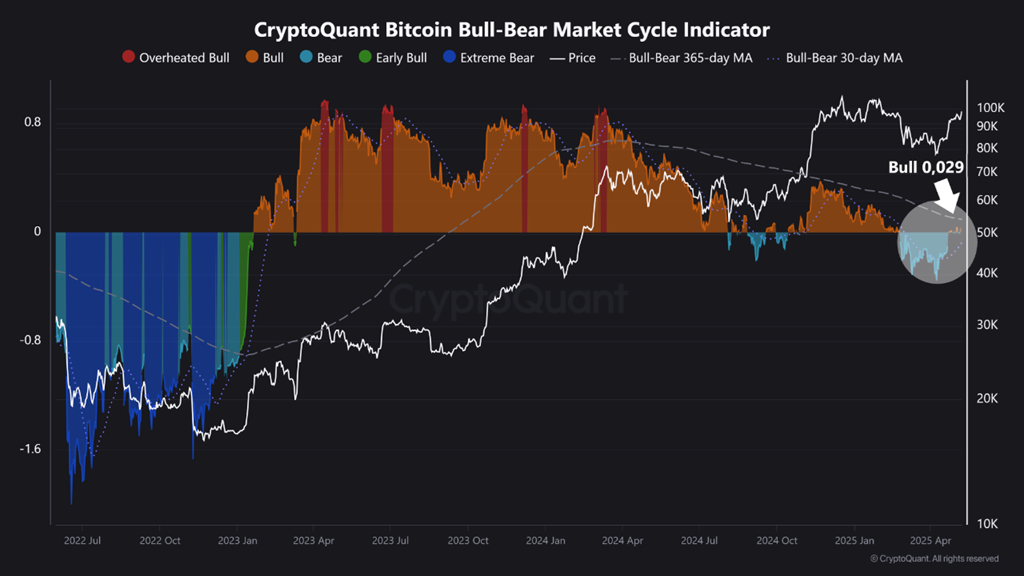

The indicator of the cycle cycle of the Cryptoquant Bull-Bala, designed to identify bullish and bearish phases in the crypto market, has recently shown positive signs.

Since February 24, 2024, the indicator has continued to sign a bearish market. However, in recent days, it began to show signs of a potential return.

However, the signal remains weak and unclear. By mid -2024, this same indicator caused false predictions. The market has moved to the sideways for a long time without constitting a clear trend.

Analyst Burakkesmeci added observations using 30-day and 365-day transitions of averages (30dma and 365dma) to clarify bullish potential.

“More importantly, the bull-bear 30dma-a short-term average move-will go up. predicted.

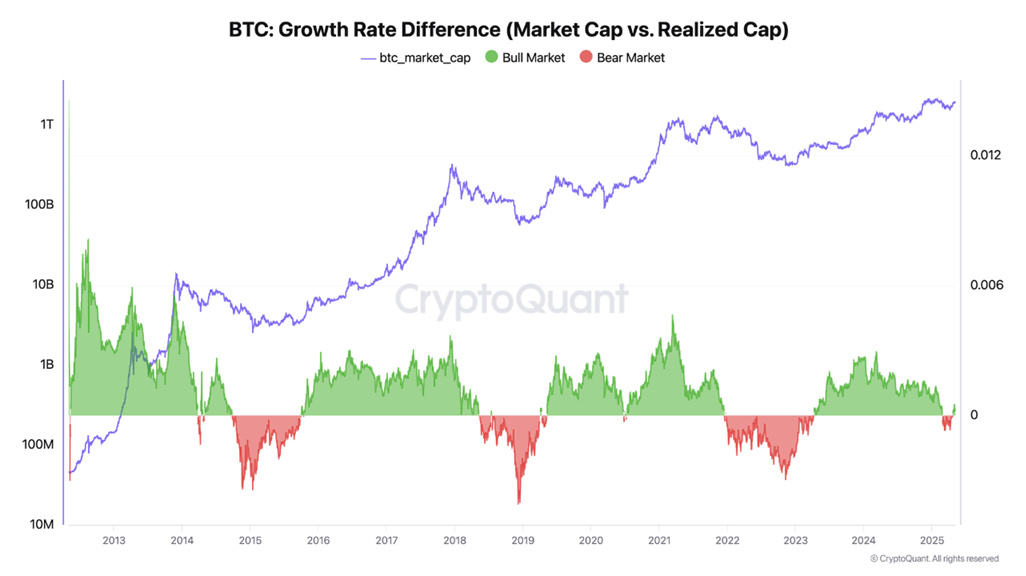

However, the analyst darkfost offered A more careful perspective when examining the growth rate indicator. This indicator examines the state of the Bitcoin – Bull or Bear market – by comparing the market cap and realizes the Bitcoin cap.

He noted that the indicator returned to bullish territory, which in conjunction with Bitcoin ($ BTC) recovered the precious $ 100,000 mark.

Instead of guessing the end of the bear market and the start of a bull run, the darkfost warned that it could be a false recovery that is being triggered by special conditions.

These special conditions include Donald Trump who signed a trade agreement with the UK, which helped remember the tariff shocks. Meanwhile, the Federal Reserve maintains a careful bearing and keeps interest rates unchanged.

“It is possible that traditional market dynamics will continue to be interrupted within a few hours, making it difficult to read the current environment,” Darkfost Says.

Another remarkable data point is the Crypto Fear & Greed Index. It rose to 73, entering the “greed” zone – its highest level in two months. This indicates that the investor's sentiment is moving from caution to chaos.

However, high levels of “greed” or even “extreme greed” often serve as warning signs. Historically, these levels are preceded by major price corrections.

Refusal

In compliance with the guidelines of the trust project, the beincrypto focuses on unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult a professional before making any decisions based on this content. Please note that our terms and conditions, privacy policy, and disclaimers are updated.