Grayscale introduces the Grayscale Bitcoin Adopters ETF (BCOR)

Grayscale, the largest global manager focused on the crypto, announced the launch of his new product negotiated on the stock market, Grayscale Bitcoin Eartage, ETF (BCOR). The firm said that the FNB will offer investors' exposure to companies that have adopted the BTC as an active in reserve of the Treasury.

Business said BCOR focuses on long -term growth in the adoption of Bitcoin companies as a coverage against inflation of the files. Grayscale has also said that the FNB will be used as a tool for the diversification of business treasury and risk management.

Grayscale launches the FNB of Bitcoin adopters in gray levels

Presentation of the ETF of Bitcoin adopters in Gray (Ticker: $ BCOR)) $ BCOR Provides exposure to companies that have added #Bitcoin as a Treasury reserve asset. These companies are in several sectors and industries and are all united by a common thread – the adoption of Bitcoin.

See… pic.twitter.com/o0fx2or50q

– Grayscale (@Graycale) April 30, 2025

The asset manager of the Grayscale digital currency has spear A new product negotiated in exchange, the ETF of Bitcoin adopters in gray levels. The company said that the FNB will offer an exposure to investors to companies that have adopted digital assets as a cash reserve.

The Crypto Asset Manager has also noted that BCOR will focus on businesses with a minimum of 100 BTC. Graycale has acknowledged that the Stock Exchange Fund deploys a weighting system which considers the size of the company and prioritizes companies outside the ecosystem of Bitcoin.

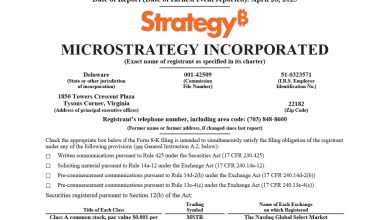

The company said that the fund will invest specifically in companies that include the Indxx Bitcoin Edopters index, a owner index designed to assess the performance of companies that have adopted BTC as an asset for business treasure management.

Grayscale has recognized that BCOR offers a diversified exhibition on global actions to companies in seven sectors and 15 sectors, all united by an adoption of Bitcoin. The company argued that although digital assets question the traditional standards of assets with their volatility, companies also consider them as potential coverage against inflation and a Treasury diversification tool.

“We could not be happier to launch an ETF of Bitcoin adopters on a gray scale, which offers investors a new way of drawing from the upward trend in the adoption of the Bitcoin de corporate Treasury without having to hold Bitcoin directly.”

-David Lavalle, world chief of ETF in Grayscale.

Lavalle also stressed that BCOR will provide a prospective strategy to take the dynamics of companies integrating virtual assets via traditional stock markets. He considers the new ETF as an exciting opportunity for those who believe in the long -term potential of Bitcoin.

The net value of Bitcoin Entf assets in Bitcoin ETF gray levels is $ 25.31 on April 30. The firm has also said that the Stock Exchange Fund will have a semi-annual distribution frequency. The ETF will also be negotiated on the New York Stock Exchange under the Ibadin index ticker.

According to the Digital Asset Manager, the ETF had about $ 1,012,425 in assets under management at the time of publication. The stock market negotiated on the stock market also has 40,001 shares in circulation.

Grayscale is always at the top of us all the btc in income

The Bitcoin Trust ETF de Graycale (GBTC) generates more income than all other funds negotiated in exchange for combined bitcoins despite the load costs up to seven times higher than its rivals. Sunday, president of Etf Store, Nate Geraci said that GBTC is always “Do more than $$$ than all other ETFs combined …”

Linen data watch The GBTC generates approximately $ 268.5 million in annual income, with expenditure costs of 1.5% applied to $ 17.9 billion in management. Compared to GBTC, the IBIT of Blackrock has three times more assets, at $ 56 million, but it only generates $ 137 million in revenues with its costs of 0.25%.

Geraci revealed that all other US-Bitcoin FNB generates an implicit annual turnover of around $ 211.8 million, compared to a total of $ 89 billion in management assets.

Grayscale established its mini Trust Bitcoin in March mainly to offer an alternative at a lower cost at GBTC costs while diversifying its range of products in the middle of increased competition.

The company's GBTC launched regulated BTC investments in 2013 as a private trust before offering an ETF in January of last year, as well as other ETF transmitters. The company then won a historic case against the dry led by the genius then to convert its confidence to an ETF.

Dry note Expenditure ratios for ETFs were “Historically less than those of the corresponding investment funds” Because their distribution and transaction costs are different and often lower. Financial regulators have also recognized that the negotiated funds “Can be more effective in tax” Because ETF actions are generally redeemable “In kind.”

The CEO of Grayscale, Micheal Sonnensnes, mentioned in April of last year that the fees “Go down” As the ETF market matures.

Cryptopolitan Academy: tired of market swings? Find out how Defi can help you create a stable passive income. Register