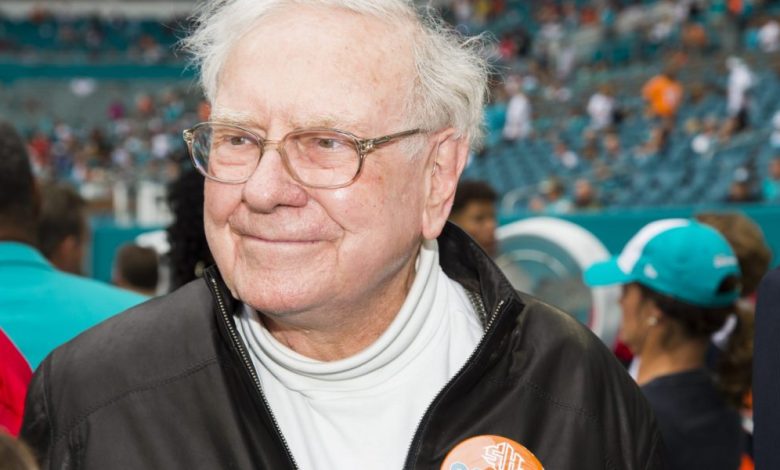

Jamie Dimon says Buffett 'represents everything that is good for American capitalism when Tim Cook praises him and descendant Abel

- Warren Buffett pulled numerous tribute After Saturday's surprise announcement that he was going to be the CEO of Berkshire Hathaway by the end of the year. Jamie Dimon, CEO of JPMorgan, said she “represents everything that is good for American capitalism”. Apple CEO Tim Cook praised Buffett and his successor Greg Abel.

Top CEO praised Warren Buffett after the legendary investor said on Saturday that he plans to resign as a Berkshire Hathaway leader by the end of the year.

Buffett said Greg Abel, CEO of Berkshire Hathaway Energy, should take over the annual conference of the annual conference as a leader of the stunning shareholders.

“Omaha oracle” pulled numerous tribute, including JPMorgan Chase CEO Jamie Dimon.

“Warren Buffett represents everything that is good for American capitalism and America itself – investing in the integrity of our people and its companies with the integrity, optimism and common sense,” he said, he said, he said. According to ReutersTo. “I have learned so much from him to this day and I have the honor of calling him a friend.”

Apple CEO Tim Cook also responded to a surprise announcement. Berkshire started buying Apple shares in 2016 and continuously added more shares.

When Berkshire sold more than half of its holdings last year Apple Stock, the iPhone manufacturer is still the highest position in its portfolio.

“There has never been nobody like Warren, and countless people, including myself, is inspired by his wisdom,” Cook posted after XTo. “It has been one of the great privileges of my life to know him. And there is no doubt that Warren leaves Berkshire in his big hands.”

At the Saturday shareholders' meeting, Buffett praised Cook, saying he “made much more than I did Berkshire,” adding that “no one besides Steve (jobs) would have created Apple, but nobody could have developed it.”

Not only did the Buffett surprise the shareholders knew, neither Abel nor the board members that he announced. Buffett said that only his children who work as directors had prior knowledge.

“It surprised me, but it impresses me,” said Board member Ron Olsen CnbcTo. “Warren has lived a life full of surprises, very few of his decisions have been nothing more than sensational.”

CFRA analyst Cathy Seifert said Associated press This buffet's decision was probably very harsh, but it is better that he is leaving his conditions.

“I think Berkshire will make efforts as a regular environment like a regular environment,” he added. “It still has to be identified.”

In the meantime, J Stern & Co's investment manager Christopher Rossbach, whose company is Berkshire's shareholder, fought back with tears in response to the news.

“It's absolutely monumental,” he said Financial timesTo. “Berkshire Hathaway is an incredible business and an incredible achievement. It stands for everything that is best for American capitalism and entrepreneurship.”

This story was originally reflected on Fortune.com