USD to INR Forecast for 2025, 2027, and 2030

- Summary:

- USDINR 2025 forecasts are bullish as a slowdown in India's economy, many reductions in the RBI rate and weight of the tariff war.

Indian Rupee (INR) showed strength in the first three quarter of 2024, but ran out of stream in the last quarter of the year, with the downward momentum flowing to 2025.

Usdinr had a strong start to 2025, rising at the peak of a full time 87.97 on February 10, 2025. However, but since refusing from that height, down 1.29% to the last last month. The pair is trading at 85.26 as of this writing. In addition, it is on the course to register the second consecutive monthly decline, which has previously been in a five-month winning streak. The dollar lost 2.34% against Rupee in March and dropped 0.19% with a week until the end of April.

Multiple interventions of the Reserve Bank of India have supported Rupee for a significant part of 2024, maintaining the rate below 84.30 for the first nine months. However, the safe status and weakness of the dollar in the Indian equities market finally destroyed Rupee's resistance to the fourth quarter.

2025 becomes another year, with a variety of major gaming factors. The main focal factors around the currency pair in 2025 will be global trade wars, crude oil prices, economic growth trajectory and Fed and RBI policy decisions.

In addition, geopolitical developments around India's relationship with Pakistan can be weighed in USDINR pair. An attack on the controversial region of Kashmir left 26 tourists who died in late April, and there was an underlying risk of an increase. The explosion of a military action between the two countries could interfere with their economies, but could provide tails to USDINR.

RBI interventions limit India's rupee losses against dollars

Usdinr has been in a strong revolt since December 2024, driven by a strong demand from imported and high rates of foreign institutional flows from the markets of equal India.

However, many interventions of the Reserve Bank of India (RBI) have helped keep Rupee stable at a time when the dollar usually gets against major currencies. Central Bank Net-Sold $ 36 billion in the second half of 2024, wrapping a strong invasion towards the dollar.

Strong economic data and a positive outlook on the Indian economy helped Rupee handle the dollar for the most part in 2024. Also, the demand for oil, underlined in China's economic struggles, put a cover on the USDinr pair. However, the last quarter of the year brought headwinds, with the weak revenue and release of foreign institutional investors from the markets of India equities weighing in Rupee.

However, the improving Indian economic output prompted Rupee to have a strong show in March, gaining 2.3% in the month. The weather saw the rise of institutional flows as the Nifty 50 index gained 6.3% and the Sensex rose 5.76%. However, the trade tariff war that was ignored by the United States in late March saw Rupee's lost traction, along with a USDINR pair that was assumed to be a choppy pattern in recent days.

Effects of interest rates and commodity tariffs

In December 2024, the Reserve Bank of India (RBI) changed the 2025 forecast for India's GDP growth from 7.2% to 6.6%. That can be the lowest growth rate for four years and indicates a likely continuation of the releasing soft economic data, which will support USDINR's gains.

Accordingly, the RBI has cut off interest rates by 25 basis points to 6.25% in February 2025, the first rate in five years. The Central Bank announced another 25 points basis cut off on April 9, which took the lending rate to the baseline by 6.0%. That adds propulsion to the USDINR and deeper cuts can be observed if India and the US are unable to reach a deal to solve the 26% tariff imposed eventually.

In addition, high rates of tariffs produce India exports to the US that are less competitive and may result in reduced dollars in the Indian economy. However, the effect of the RBI rate cut may be offset by likely reduction of the federal reserve.

The Fed was first expected to make only two deductions rates in 2025. However, recent back-to-back soft macroeconomic data, underlined by non payrolls (NFP) Miss Numbers and the unemployment rate spikes in February and March raised prospects of more deductions.

The dollar problems were combined with President Donald Trump's comment in early March that the US economy was in a “move,” interpreting some analysts as a potential retreat. In addition, the impact of US tariffs and counter-tariffs of affected trading partners such as China, Canada, Mexico and the European Union may limit greenback acquisitions.

Impact of oil prices on Rupee

India is the third largest imported crude oil, and product price oscillations have a significant impact on Rupee. The dollar crude oil denomination has experienced a slowdown in demand for the past year, as China's economic growth refused.

According to the International Energy Agency (IEA), the demand for the goods is expected to rise by 1.05 million barrels per day (BPD) to a total of 104 million BPDs in 2025. Growth is linked to China's economic recovery as stimulus measures are the result of fruits. A spike in demand for oil can increase the price and fuel acquisition of USDINR.

That said, Russian deputy Alexander Novak said the OPEC+ Oil cartel could reverse its decision to raise production in April if the demand continues to be weak. Crude oil prices dropped to six months lows in early March, which was pushed by concerns on the impact of the trade war on trade.

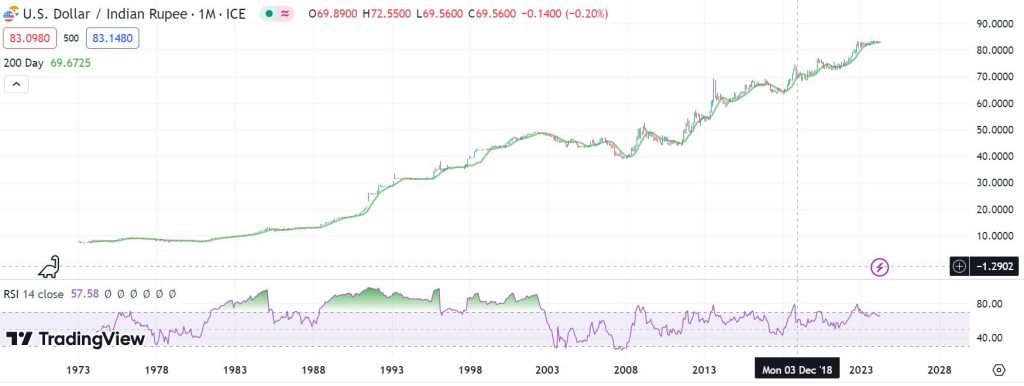

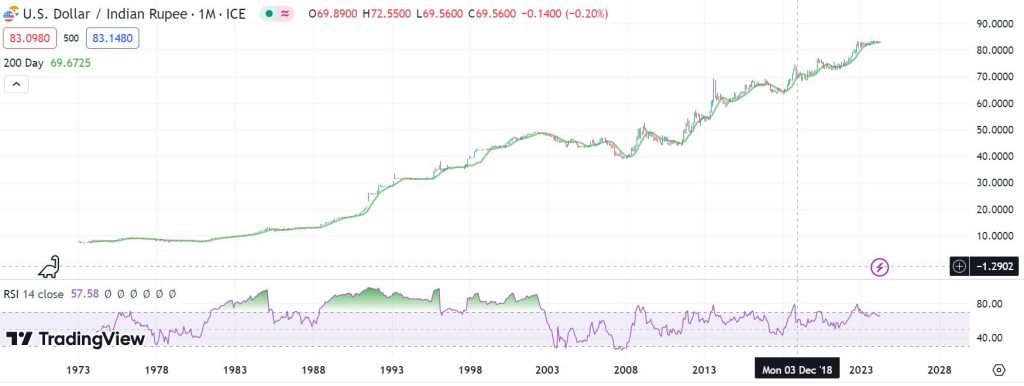

USD/INR history chart

USD trading dates at the INR in 1973 when the pair floated to the forex market at an opening price of $ 1 to 7.98 Rupees. In late 1983, the currency pair rose at the psychological level of 10 rupees in the US dollar. Between then and April 2002, it rallied 376.41% to 48.76 Rupees.

After releasing 39.9 Rupees in November 2007, the USD/INR has been in an uptrend since. The pair advanced to a full time of 83.47 on November 10, 2023. Before getting all the time high, USD/INR tasted a 76.45 price score in March 2020, as Coronavirus pandemic was sweeping the world.

As the US Federal Reserve rates began to hike, Indian Rupee began to slide against the US dollar. In October 2022, the pair advanced to a new full time of 83.28. This ATH was refreshing in 2023. However, the dollar rally in 2024 saw it hit a new ATH on March 22.

Strain on markets of equal Indian

There was a well -known sale in Indian stock markets by foreign institutional investors, leading to high dollar demand since the fourth quarter of 2024. The trend has been aggravated by the raised bond of the US Treasury bond, and it may take a while before we see it. Therefore, we are likely to see the USDINR stay on the rising term, with marginals acquired by Rupee.

USD/INR Forecast 2025

Like this writing, the USDINR is in a powerful uprising, with sixteen weekly obtained from seventeen. The KaMag -child -child index in the day -to -day chart is at 78, proving strong bullish handling. However, at that level, the Rupee is oversold, and the USDINR may be close to a return.

Based on the current market foundations, the USD/INR looks likely to continue to rise. Therefore, you may want to observe the 87.86 mark, which corresponds to the middle bollinger band. The action above 87.30 will indicate an upward momentum. The USDINR pair is likely to range between 86.58-87.30 in the medium term. A long stay at the upper level will strengthen consumers and potentially clear the path to test 88.00.

On the downside, the action below 86.58 will favor sellers to control. The medium-term support is likely to come at 85.86, which is aligned with the lower bollinger band. Destruction below that path can clear the path for a stronger descending momentum with the next support that is likely to be at 85.00.

The US interest rate policy will play an important role in determining the USDINR exchange rate. If the first interest rate cutting will come after June, we will likely see fewer cuts by 2025, translating into a stronger US dollar ..

What will be USD at the INR rate in 2027?

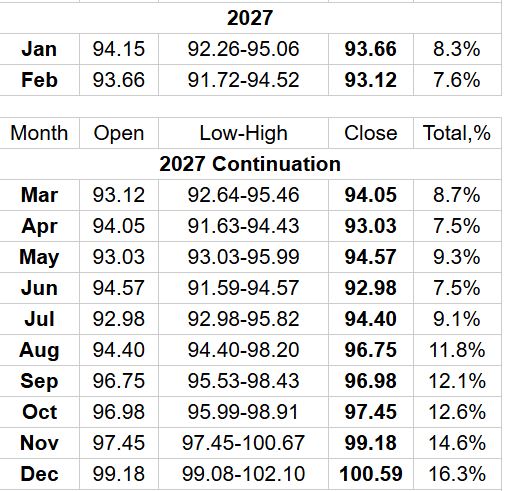

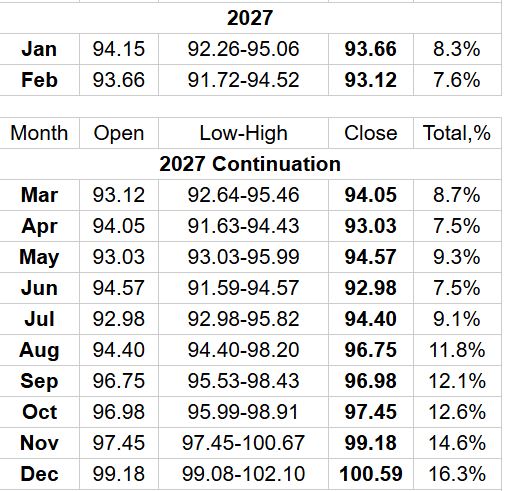

Long Forecast's USD to Inr Forecast 2027 suggests the start of the year around 94.15 Rupees. It expects money pair to average 92.98 in the middle of the year before ralling to 100.59 by the end of the year. Prices may be higher if the global economy enters a prolonged retreat after ongoing deflection measures.

It is important to note that the targets for September 2025 have been achieved, while the price pattern in the sun -day chart indicates that there is a high potential for the target price of October 2025 83.95 to meet in the second half of 2024. Like this, it makes USD in INR forecast 2025 above to live, even with some minor -age differences. It is important to do your own individual research.

USD TO INR Forecast 2030

A feasible USD in the INR forecasting for 2030 was informed of Indian economic health and the US financial policy, Fed and RBI, and the demand for the US dollar as a safe shelter. Therefore, a strong dollar is likely to push the USD to INR to a new record high, depending on the main drivers.

However, as an emerging market, India's money has the potential to strengthen in the coming years. From that perspective, the USD to INR forecast 2030 is for pair to stay for a range of years.

How to exchange usdinr

To exchange USDINR, one has to open an account with a respectable -respect Forex broker. When researching the best broker, it is advisable to consider their spread, commissions, and other fees. It is also possible to exchange money derivatives in the form of USDINR futures.