GBP/USD attracts some buyers to near 1.3290 on Monday

GBP/USD Forecasting Price: The bullish tone remains playing near 1.3300

The GBP/USD pair gets traction around 1.3290 during the early European session on Monday. The US Dollar (USD) softens against Pound Sterling (GBP) amid increased economic uncertainty at the end of the false trade policies of President Donald Trump.

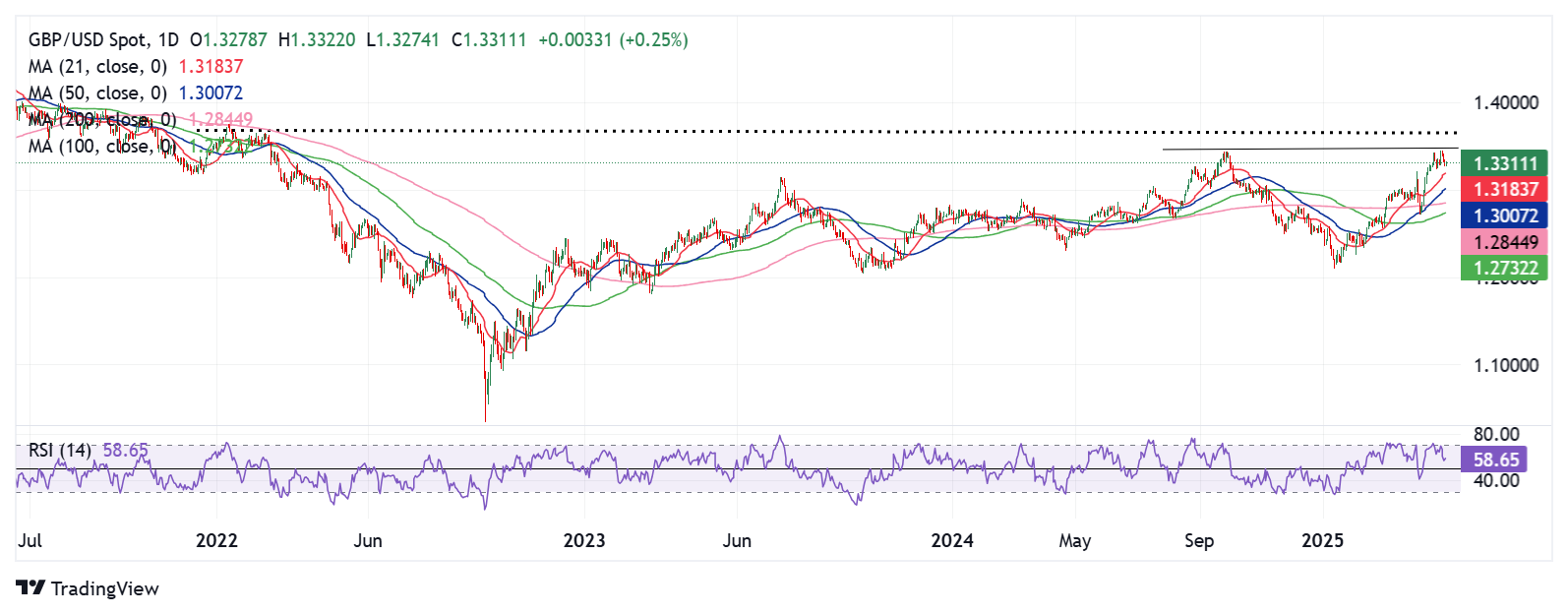

According to the daily chart, the GBP/USD's bullish perspective remains intact, characterized by price holding more than the 100-day exponential transfer of average (EMA). The upward momentum is supported by the 14-day relative (RSI) index, standing above the midline near 55.60, suggesting the path of at least resistance is upside down. Read more …

GBP/USD Weekly Perspective: Pound Sterling Awaits Fed-Boe Policy Decisions for Fresh Impetus

Pound Sterling (GBP) witnessed a collapse of correction against the US dollar (USD) after GBP/USD's refusal to refuse to reject 1.3450 barriers. The King Dollar recovered its throne, booking a third weekly benefit, due to the backward fears of tariff war and hope emerging from potential trade dealings between the United States (US) and the major Asian trading partners.

United States President Donald Trump and some of his colleagues were stuck in their rhetoric that trade negotiations continued in China despite Beijing's removal of such conversations. Trump said for a week that he had a “potential” trade deal with India, South Korea and Japan and there was a very good chance of reaching an agreement with China. Read more …

GBP/USD combines above the mid -1.3200 while traders move to the edges early in Boe this week

The GBP/USD pair begins in the new week on a constituent note and is oscilled in a narrow trade band around 1.3260-1.3265 area, near a weekly low-touching Asian session.

The US Dollar (USD) remains in defense under a multi-week top amid increased economic uncertainty behind President Donald Trump's tariff plans and turns out to be a major factor acting as a tail for the GBP/USD pair. Adding to this, the expectation of a more aggressive federal reserve (FED) emerging policy seems to ruin the greenback. Read more …