China to suspend its 125% tariffs on US as central bank injects cash into the economy

China is preparing to roll back 125% tariffs on some US imports, including medical equipment, ethane, and aircraft, according to a report from Bloomberg, citing anonymous resources.

The decision was discussed within Beijing while both economic pressure and trade friction intensified. Officials involved are also suspected Analysis A full removal for tariffs on airplane leasing, as part of a broader communication around avoiding restrictions.

This development followed the comments made on Thursday by President Donald Trump, who confirmed that members of his administration held meetings with Chinese officials on trade.

Trump made the statement during a joint Press event with Norwegian prime minister Jonas Gahr Støre. When asked which officers were involved in the discussions, Trump replied:

“It doesn't matter who 'they'. We can reveal it later, but they have meetings this morning, and we're meeting in China.”

PBOC RAMPS UP Liquidity with the largest cash injection from 2023

As Trump's White House pushed trade talks, the People's Bank of China responded to mounting economic stress by injection of 600 billion yuan-about $ 82.3 billion-in the financial system on Friday using a medium-term lending facility.

The move came as a direct counter on the impact of increasing US tariffs, which is as high as 145%. After expirying loans, this means a net increase of 500 billion yuan for April, the highest monthly boost of liquidity since December 2023.

In a written statement, the Central Bank said the operation was intended to maintain “lots of liquidity” in the system. Wang Qing, Chief Macro Analyst in Golden Credit Rating, Says The decision indicates a financial policy aimed at staying supported under growing trade pressure.

“It is also to ensure that liquidity conditions remain sufficient when the government funding through special releases of government debt accumulates the pace,” Wang said.

The PBOC has already faced growing calls for policy -ledgenenening. Investors demand stronger support steps as China's economy faces both external trade barriers and internal funding needs.

Fresh liquidity can help banks handle surging demand for cash in the early holidays and restore the launch of special bonds that started this week.

Last month, the central bank suits how the MLF rate is set. It now allows banks to submit bids to various price points instead of relying on a fixed rate.

At the same time, the PBOC has stopped announcing the cost of some people loans altogether. These changes are part of a move towards economic management through shorter interest rates while maintaining what officials call “moderate loose” bearing.

Returning a large MLF injection injection is not expected. In recent months, the PBOC has tried to reduce the tool dependence, which often replaces it with three to six-month reverse repurities. But this April, the 1.7 trillion yuan worth of reverse repos is set to grow old, the largest monthly total since the tool was introduced in October.

An update on how PBOC plans to handle the reverse repo operation of this month is expected at the end of April. Ming Ming, chief economist in Citic Securities, said the MLF transfer could help reduce pressure from repo matches and delay any need for cuts in the ratio of the banks required.

“While the importance of MLF policy is reduced,” Ming said, “remains a useful PBOC tool to inject longer liquidity.”

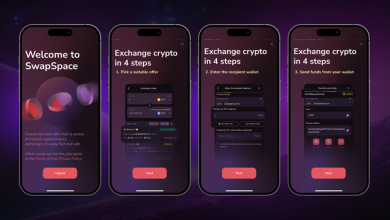

Cryptopolitan Academy: closely – a new way to earn passive income with the defi in 2025. Learn more