For the next 5 years, $ 1,000 Ripple (XRP), Mutuum Finance (Mutm) or Ethereum (ETH)? Here you will find out what GROK-3 AI chose

Cryptoers are closely discussing crypto investments between Ripple (XRP), Mutuum finance (mutm)And Ethereum (ETH) starting over the next five years of $ 1,000. The fourth phase of Mutuum Finance (mutm) has reached $ 7.3 million for sale, while the prices of its symbols rose from 425 million units to $ 425 million to $ 0.025. Increased demand comes from about 9,200 owners who show enthusiastic support.

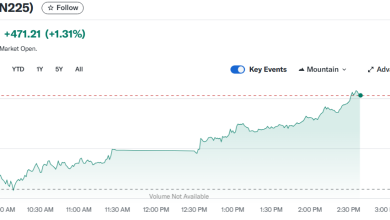

Ripple (XRP) retains its position with a $ 125.76 billion market capitalization, while Ethereum (ETH) is facing more than 50% of the decline compared to its peak value. Based on the analysis, the GROK-3 AI predicts the property, which will provide the highest revenue due to complete and strong benefits. Different strength factors direct the road of cryptocums, while one particular asset turns out to be the market leader.

Ripple (XRP) is a growth

Ripple XRP shows strong market potential, despite falling 6.58%, reaching the current price level to $ 2.16. The eager institutions are planning to invest billions of Ripple ecosystem through the expected launch of the US XRP ETF in 2025. Technical indicators containing upward trendy 50-day moving average with RS indication 51.99 show strong potential for further growth.

The purpose of the XRP is by the end of 2025 prices ranging from $ 5 to $ 10, as investors have to be fixed as assets. Institutional adoption is the only stabilizing aspect for XRP, despite its fluctuating short -term market performance. If the XRP maintains stability with a $ 1,000 investment, it will remain with the same intense price potential with newer projects.

Ethereum (ETH) fights for importance

ETH price was restored from the lowest at $ 1,383 to reach $ 1,787, forming bullish flag patterns. Its $ 107 billion at Defi TVL and $ 124 billion in the Stablecoin market ceiling emphasize its dominance. ETH is behind Bitcoin and Solana because Charles Hoskinson is leveled against it because of the criticism of the layer-2 network.

Critical 2 150 -dollar resistance levels are the main obstacle of the Ethereum price (ETH), whose potential to $ 3,000 depends on how the market works, while failure to pass this barrier can cause ETH to fall to $ 1600. The potential recovery of ETH is exciting near $ 1,000, but is still uncertain.

Mutuum finance (mutm) lights up

Mutm's current Stage 4 Stage at Mutuum Finance Exchange generates its interest rate of $ 0.025 in investors. Mutuum Finance has accumulated $ 7.3 million and has stated 9,200 investors with 425 million chips.

Step 5 activates an increase of 20%, raising the price to $ 0.03, earning 20% profits to existing investors. Tokenomics suggests that mutm chips start at $ 0.06 after public launch, leading to an impressive 140% ROI. Grok -3 AI assumes that the mole reaches $ 2.50 after the market is launched, which marks the growth of 9900%.

The Mutuum Finance team conducts a Sertik audit when this audit updates appear on social media platforms. According to the mutual financing (mutm), the shopping and distribution system is a constant demand to buy returns that are later scattered to participants. Its platform offers stand -out for decentralized loan solutions and passive income generation mechanisms.

The early phases of the pre -sale experienced the urgency as Stages 4 have ended. Currently, investing $ 1,000's finance is accompanied by the acquisition of $ 40,000, which can be $ 100,000 if they cost $ 2.50.

Sealing a five -year contribution

GROK-3 AI recommends investing Mutuum Finance (Mutm), as its impressive investment potential yield combines a strong pre-sale jump. Ripple (XRP) and Ethereum (ETH) and Mutm stand out as the latter gives a start of 140% and can achieve $ 2.50 after starting. Those who want to invest $ 1,000 in a five -year period must immediately complete their transactions as Stages 4 shows a rapid decline.

Visit the links below for more information on Mutuum Finance (Mutm):

Website: https://www.mutuum.finance/

LINKERE: