Five swing pattern points to further gain [Video]

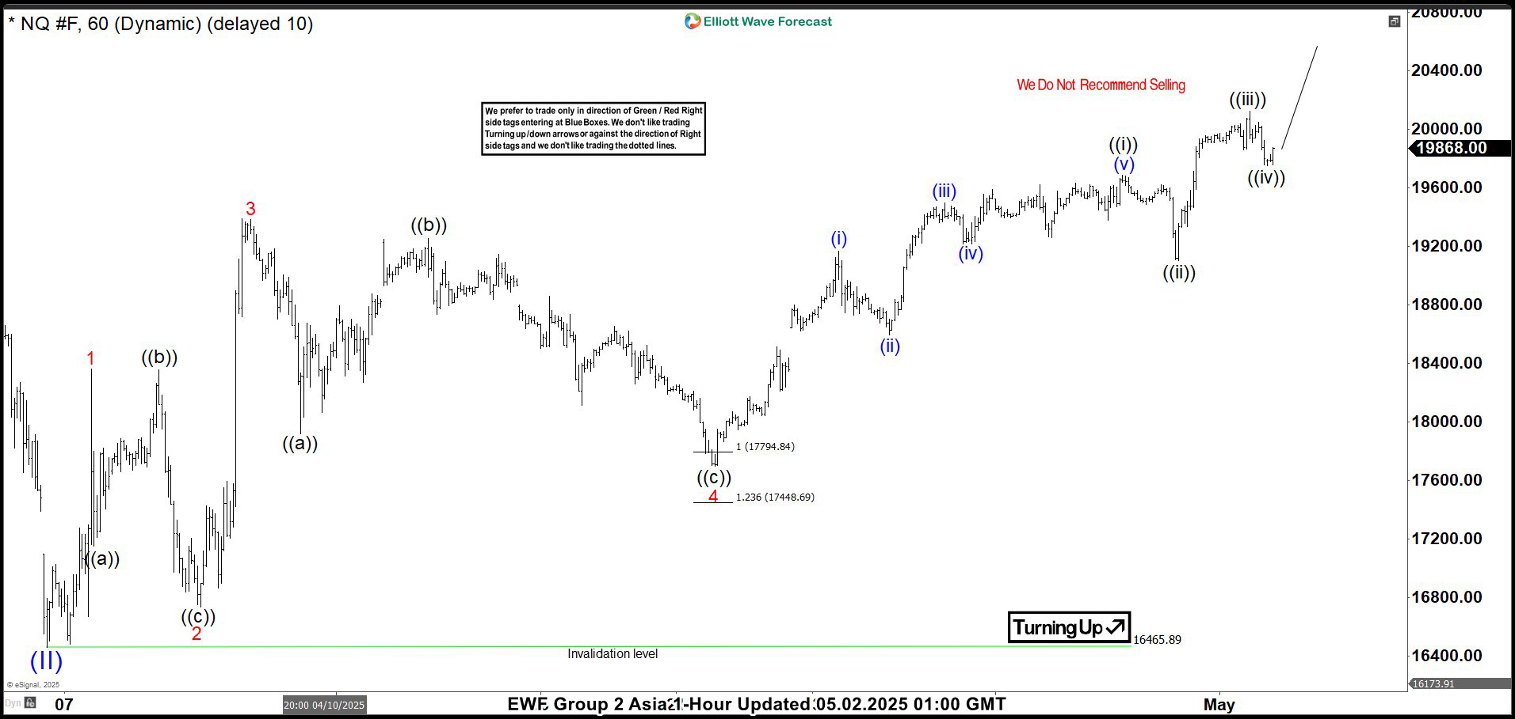

NASDAQ Futures (NQ) experienced a net sale following a pricing announcement by President Trump, with the decline from a peak on December 16, 2024, with 22,450. The sale ended at 16,465.89 on April 7, 2025, which we qualified as wave (II). In order for the index to confirm an upward trend and excludes a double potential correction, it must exceed on December 16, 2024, higher from 22,450. In the short term, the rally of April 7 of 16,465.89 takes place as a model of five swing. It is a sequence of motivations which suggests a potential for increase more.

From the lowest of April 7, the gathering develops in the form of a diagonal structure with five waves. Wave 1 culminated at 18,361.5, followed by a withdrawal from the wave 2 to 16,735. The index then jumped into the wave 3 to 19,386.75, with a drop in wave 4 ending at 17,700. Currently, the wave 5 is underway, with a subvague ((i)) despite 19,688.5 and sub-signed ((ii)) at 19.103.75. The Sub-and ((III)) reached 20,125.75, and a potential withdrawal of sub-sworn ((iv)) may have concluded at 19,749.5.

The index should repel once again in the undertake ((V)) to finish wave 5 of (1). After that, a withdrawal of the wave (2) must occur, probably in a model of 3, 7 or 11 swing, before the index resumed its upward trend. As long as the 16,465.89 lows, DIPs should attract buyers in models of 3, 7 or 11 swing, supporting other short -term gains