Federal Reserve calls shares and real estate “risky investments” on the day after crypto alleviation

On Friday, the Federal Reserve named shares and risky investments in real estate, abandoning the warning just one day after the end of the crypto rules.

The financial stability report, published by the Federal Reserve, said that the prices of assets were still “significant”, although some markets were hit at the beginning of this month.

According to In the report: “Even after the recent drop in stock prices, prices were high for analysts' profit forecasts, adapting to slower than market prices.” The report also made it clear that the yield of the treasury remained at all deadlines at the highest level that someone has seen since 2008.

The Federal Reserve also pointed to the market a major problem and said that the risks of funding were still serious. The report, which included market conditions until April 11, was said that the financing markets remained strong through the rough patches in early April, but that did not mean that everything was in order.

The central bank certainly mentioned that the fair loss of fixed -rate assets was still high for some banks and that these losses were very sensitive to interest rates.

The Federal Reserve highlights the prices, debt and leverage problems of assets

The financial stability report collapsed when bad things saw through four large areas. Starting with the assessment of assets, the Federal Reserve shares said expensive compared to the profit even after April sales.

The yield of the Treasury remained stubbornly high and spreads moderate between the company's bonds and regime. Liquidity problems built until the end of March and in April worsened, but trading still worked.

On the real estate side, home prices remained high and the ratio of house prices to rents included a record peaks. Inflation -corrected commercial real estate indices showed some signs of leveling, but Fed warned that refinancing needs could soon cause problems.

The debt didn't seem much better. A business and household debt as a part Skp fell to the lowest point of twenty years. However, the business amplifier remained high and private credit transactions were constantly increasing.

The household's debt seemed to be tamed compared to recent history. Most mortgage loans are fixed at interest rate and low interest rate, and the overall relationship between debt services is slightly better than before the pandemic. However, Fed noted that the increase in crime of credit card and car loans has increased, especially for people who do not have Prime credit results and lower income.

According to the Federal Reserve, the banks still looked reasonable, the capital levels are higher than the regulatory minimums. However, the losses of assets with fixed interest rate hit some banks. Some banks, insurance companies and securitization shops also piled up commercial real estate.

Fed said that lending to non -bank financial companies to the bank continued to climb, partly due to better tracking methods. The leverage of hedge funds sat at the highest level of the last decade and was mostly packed in larger funds. Some amplified investors began to litter the positions to cover the margins, with the risk funds of relative value transactions that are some of the hardest.

Federal reserve flags fund risks and continued market fragility

According to the Federal Reserve, the risks of funding slipped to a moderate level over the past year, but did not disappear. Running money -like obligations remained near the historical medians, still posing a long -term threat. Banks will reduce their dependence on uninsured deposits from 2022 and 2023.

The main money market funds looked better, but other money vehicles with the same risks increased steadily. Bonds and loan funds, holding assets that can change under pressure quickly, saw the usual outflows during the market stress at the beginning of April.

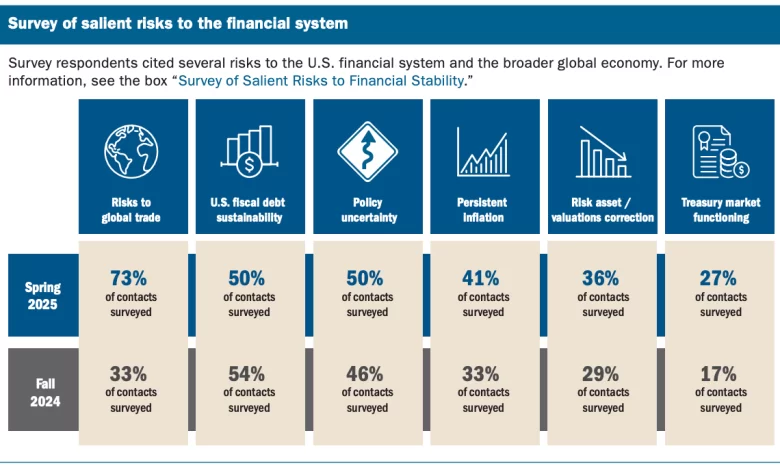

The financial stability report also said global trade risks, debt problems and inflation worsened. He added: “Many respondents also mentioned permanent inflation and corrections to the assets markets” and most of the feedback was collected before April 2.

Only the day before the blast of the shares and real estate back Years of cryptic restrictions. This gave up earlier rules that ordered Banks to do something before crypto. In the Thursday announcement, the Federal Reserve said: “These operations ensure that the expectations of the board are in line with the developing risks and further support the innovation in the banking system.”

Cryptopolitan Academy: Do you want to raise your money in 2025? Here's how to do this in our upcoming web class. Save your place