All parties express concern about the negative effects of trade friction

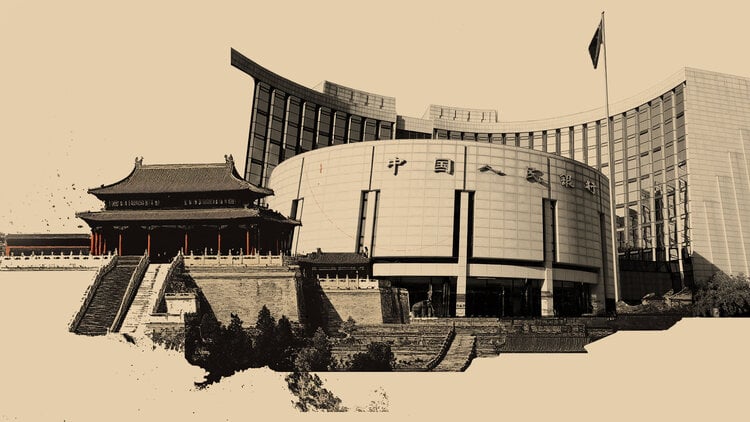

Pan Gongsheng, governor of the Chinese People's Bank (PBOC), said on Friday that all parties expressed concern about the negative effects of trade friction. Pan added that economic fragmentation and trade voltages continue to disturb the industrial supply chain and weaken the momentum of global growth.

Basic equipment

All parties called for dialogue strengthening and political coordination.

All parties are supported by the construction of a more stable, more efficient and durable international financial engineering.

Economic fragmentation and trade tensions continue to disturb the industrial supply chain and weaken the momentum of global growth.

Larger economies should strengthen the participation in political coordination.

Currently, the Chinese economy is in a good start, it continues to recover with a good trend and financial markets are smooth.

Applies moderate and loose monetary policy to promote the development of the Chinese economy.

Market reaction

During the press, AUD/USD fell 0.03%in a few days to trade 0.6407.

PBOC FAQ

The main monetary policy objectives of the Chinese People's Bank (PBOC) are the defense of the stability of the price, including the exchange rate stability and the promotion of economic growth. The aim of the Chinese Central Bank is also financial reforms, such as opening and development of the financial market.

PBOC belongs to the state of the People's Republic of China (HRV), so it is not considered an autonomous institution. The Secretary of the Chinese Communist Party (CCP), named by the National Council, has the impact of the key on PBOC leadership and direction, not on the governor. However, Mr Pan Gongsheng has both posts.

Unlike the Western economy, PBOC uses a wider set of monetary policy tools to achieve its goals. The primary tools include the opposite seven -day repotenor (RRR), medium -term loan facilities (MLF), currency exchange interventions and the reserve ratio (RRR). However, the Prime Minister of the Loan (LPR) is the interest rate of China's benchmark. The LPR changes directly affect the rates paid in the loans and mortgages in the market and the interest paid in savings. By changing the LPR, the Chinese central bank can also influence the exchange rate of the Chinese Renminb.

Yes, there are 19 private banks in China – a small part of the financial system. The biggest private banks are digital lenders Webank and Mybank, supported by the Tech Giants Tencent and Ant Group, in the Strait time. In 2014, Chinese domestic lenders, who have been fully exploited by private funds, promised to operate the country's dominant financial sector.