Eyes set on all-time highs post correction

The American Express Company (NYSE: AXP), a leading multinational financial service based in New York City, continues to reinforce its position as a well -known player in 30 parts of the Dow Jones Industrial Average. As experts on payment cards, the company continues to show significant performance in the market, further enhancing its reputation.

Meanwhile, analysts are holding mix -of -all opinions about the American Express (AXP). While the stock carries a rating of consensus “Hold,” reviews from 24 analysts show different views. Notably, 8 recommend the purchase, 15 suggest handling, and 1 sales advice. Moreover, the average target price currently stands at $ 295.05, with projections from a high $ 370.00 to low $ 235.00. For example, some analysts, such as Wells Fargo, have raised the target price to $ 370.00, reflecting an optimistic outlook on AXP's potential growth. However, on the other hand, some express concerns about short -term performance, which has resulted in sales ratings.

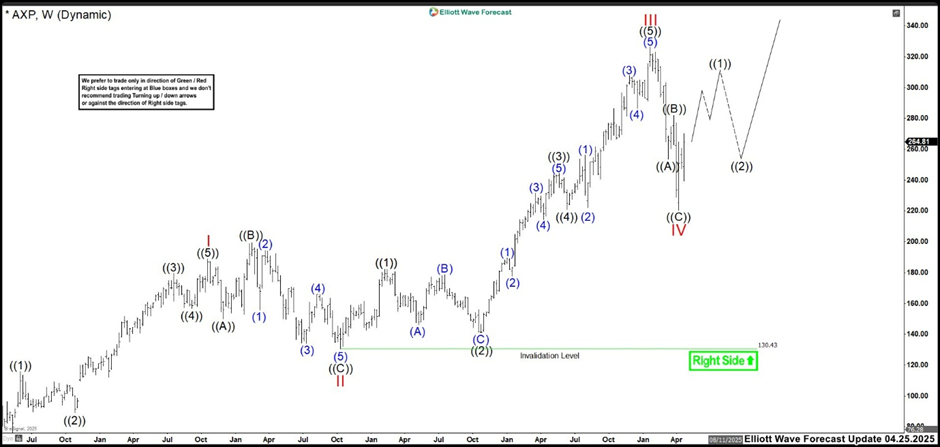

American Express (AXP) Elliott Wave View

Using the principle of the Elliott Wave, AXP movements show an ongoing bullish trajectory, with extensions that continue to attract strategic interest. Let's check out how the structure was developing in the last year.

April 2024:

In April 2024, the AXP had confidence with confidence as wave (V) of ((I)). Wave I reached its climax at 189.03 high before Wave II corrected 130.65 low. From there, the stock was launched in a strong rallies, scoring the wave ((3)) of III, and created the perfect purchase opportunities for entrepreneurs in line with the trend.

August 2024:

After 4 months, the AXP sinks to 256.24 high as waves ((3)), followed by a significant pullback as wave ((4)), which reresses the previous wave (4) low around 222.03. The market proceeded to the wave ((5)). Without further expansion, this wave ((5)) of III is expected to reach the 264.28–277.31 zone, which signed the potential start of a greater wave IV correction.

January 2025:

As opened in January 2025, the rally exceeded expectations, reaching the upper range of 264.28–277.31. The wave ((5)) of the III continued its expansion, with bullish momentum still dominant. The cycle is expected to end around 320.00, where AXP can start a pullback on Wave IV. The first target for this pullback is likely to be involved in a retest of previous wave (4) support, approximately 280.00–290.00 areas.

April 2025:

The AXP price action completed the wave ((5)) of III at a high 326.27 and then reversed sharply to the downside. The market tried to bounce near 290, close to the start of the wave (4), but the seller controlled and broke the support, starting the Wave IV pullback. The wave IV is formed by a corrective zigzag structure, re -evaluation in the previous wave zone ((4)). This correction ended at low 220.43. At this stage, we hope that the bullish movement will continue until the wave ((1)) is completed, followed by a wave correction ((2)). This correction should remain above the low IV wave to keep the bullish scenario properly. When the wave ((2)) retracement is completed, the market is likely to accelerate towards new highs, which potentially reach the target of 351.70 – 392.36 zone.