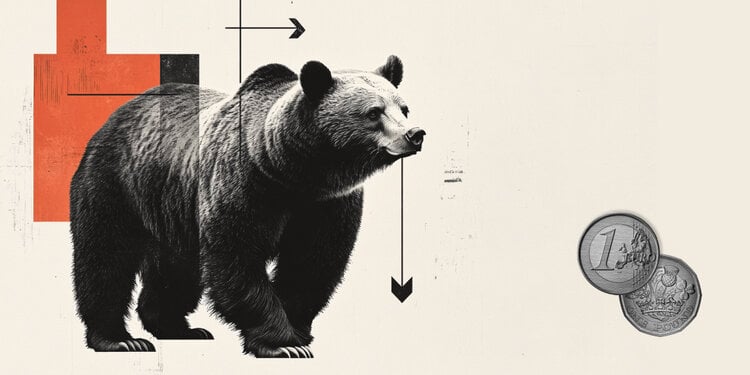

Euro holds bullish tone while drifting near 0.8500

- EUR / GBP is negotiated near the 0.8500 zone after having slipped modestly during Thursday's session.

- The upward trend remains intact despite the signs of mixed Momentum.

- The long -term medium of support contrasts with short -term resistance capped upwards.

The EUR / GBP pair experienced a slight weakness Thursday, trading near the 0.8500 area after the European session. Despite today's marginal drop, the overall structure remains favorable to a bias bias, supported by a firm base of mobile medium in the longer term. The short -term indicators, however, show contradictory signals, with the discoloration of the momentum, even if the wider trend is stable.

From a technical point of view, EUR / GBP looks overall optimistic. The relative resistance index remains neutral near the median point, not suggesting any extreme condition. The MacD currently provides a sales signal, indicating the slowdown in the momentum, while stochastic% K fell on the occurrence territory, displaying a potential purchase configuration. The freight channel index is also neutral, adding to the mixed short -term image.

The structural force comes from mobile averages. The 50 -day simple exponential and mobile averages are much lower than current prices and continue to point up upwards, strengthening the wider bullish configuration. On the other hand, the 20 -day SMA – positioned slightly above the spot – can act as a short -term ceiling. Meanwhile, SMAS of 100 days and 200 days remain firmly optimistic, continuing to provide a solid base to buyers.

The support is observed at 0.8478, followed by 0.8462 and 0.8434. The resistance amounts to 0.8492, 0.8497 and 0.8516.

Daily graphic