EUR/USD Phipsaws After Feeding Interest Rates Warned Powell Tar any targets inaccessible

- EUR/USD bounced from 1,1335 to 1.1365 after Fed tariffs remain permanently 4.5%.

- Market tensions are still elevated, but investors noted a small shift in Fed's policy tone.

- Fed Chairman Powell warned that the tariffs would make FED goals inaccessible if they remain.

EUR/USD cooled after intraka Federal Reserve (Fed) acquired interest prices Wednesday 4.5%. The markets had widely predicted FED for a definite attitude towards that it may -that, but the key to investors is how much Fed shifts its attitude towards cutting on future interest rates.

According to the Fed Interest Interest Notification, policy makers have noted that while US employment and economic activities are generally steady, the risks of both labor and production have increased, largely in the hands of tariffs and US trade. The anxiety of Fed officials surrounding the economic risks helped to bring the hopes to the market to cut up the upcoming interest rates by putting the EUR/USD on a high side.

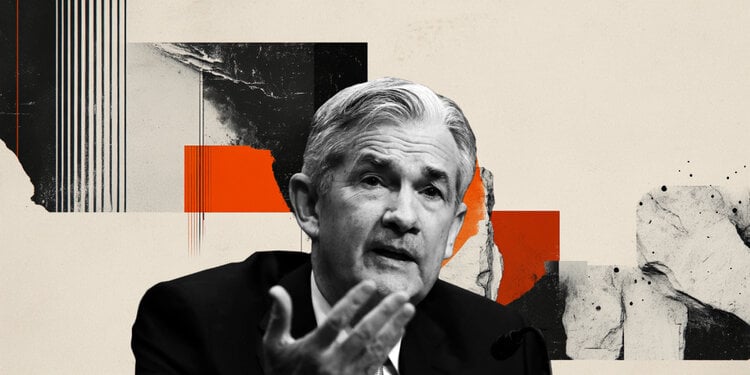

The market sentiment fell back after the press conference of Fed Director Jerome Powell. Fed Chairman Powell noted that US trade tariffs set Fed goals for both inflation and employment for the rest of the year, if they remain.

Read on Fed News here: We don't have to be fast

Fed manager Powell also warned that continuing politics continues to make it more likely that FED will continue to wait and view interest rates. Despite its devastating hits, consumer and business-based moods in the Trump administration's tariff policy, very little setbacks have given severe economic data, making it difficult for FED to justify all the immediate changes in interest rates.

According to the CME Fedwatch tool, the price markets are still hoping for a reduction in the interest rate of quarterly points in July. However, the probabilities related to the second interest rate in July have risen to 30%, and in the hope of criminal proceedings, the second speed cutting cycle.

EUR/5-minute chart

Fed -to -feds

US monetary policy is shaped by the Federal Reserve (Fed). Fed has two mandates: achieving price stability and promoting full employment. Its main tool to achieve these goals is to adjust interest rates. If prices rise too fast and inflation exceeds the average 2% goal, it increases interest rates, increasing the cost of the loan in the entire economy. This results in a stronger US dollar (USD) because it makes US international investors a more attractive place to park their money. If inflation drops below 2% or the unemployment rate is too high, interest rates that outweigh the green setback may reduce the Fed charge.

The Federal Reserve (FED) organizes eight political meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes money policy decisions. The FOMC will participate in the seven members of the twelve central bank official-curatorio, the Governor of the Bank of the New York Federal Reserve and four of the other eleven regional reserve banks, serving one-year-old conditions on a rotating basis.

In extreme situations, the Federal Reserve may turn to a quantitative relief (QE) policy. QE is a process in which FED significantly increases the credit flow of a clever in the financial system. This is a non -standard political measure used during crises or when inflation is extremely low. It was a fed -selected weapon during the 2008 great financial crisis. This includes Fed printing more dollars and their use from financial institutions to buy high quality bonds. QE usually weakens US dollars.

Quantitative effort (QT) is a QE opposite process whereby the Federal Reserve stops buying bonds from financial institutions or investing the majority of the bonds he / she has possessed to buy new bonds. Usually it is positive about the US dollar value.