EUR/JPY edges lower as markets weigh ECB–BoJ policy divergence and soft Japanese data

- EUR/JPY trading close to 163.45, which slipped after a refusal from the resistance of 163.94.

- Caring ahead of the ECB's Schnabel Speech speech limits Euro support, despite the ECB-BOJ policy interval.

- The soft Japanese data emphasizes the weakness of the yen, but the safe demand keeps the checks on the check.

- The US -China Revive's Speech Risk in appetite, even the Tariff of Tariff of Trump's Tariff

The EUR/JPY pair was less than a trading on Friday, weighted by US -China trade tensions, mixed economic data outside of Japan, and careful investors positioning ahead of a scheduled European Central Bank (ECB) Executive Board member Isabel Schnabel.

At the time of writing, EUR/JPY dropped 0.20% to 163.45, as markets recalibrated expectations around safely demanding for Japanese Yen (JPY) and continued Euro (EUR) elastic from the ECB-Bank of Japan (BOJ) policy variation.

The US -China Trade Talks Lift Mood is revive

A major market driver this week is the prospect of resurrected high-level conversations between the United States and China. The preliminary optimization was supported by confirmation that high-level talks between the United States and China would continue on Saturday in Switzerland, along with Treasury Secretary Scott Bescent and trade representative Jamieson Greer were expected to meet Chinese older officials.

However, the regional sentiment was released after US President Donald Trump suggested an 80% tariff in China, which signed a potential softening from the current rate of 145% but still creates uncertainty. This ambiguity is capped those acquired at risk-sensitive risks while supporting safe shelters such as JPY.

ECB's schnabel is committed as a difference -different policy with the BOJ remains the main driver

ECB executive board member Isabel Schnabel is speaking at the Monetary Conference of the Hoover Institution in the US. Known in his Hawkish Stance, Schnabel's statements will be strictly watched for insights on inflation and a reduction in the rate of future, as the ECB indicates a careful move towards the prevention.

Markets look forward to a 25 basis cut cut in June, but policy manufacturers remain data relying. Meanwhile, the Bank of Japan maintains an ultra-loose finances, which contrasts to ECB trajectory and supporting EUR/JPY strength. Any indication of prolonged ECB restrictions can boost the euro.

Poor data Japanese Highlight Boj's Dovish Path, limiting Yen support

Earlier on Friday, Japan released key economic indicators for March that offered a mix of snapshot of domestic conditions. The initial coincident index fell to 116.0 from a modified 117.3, suggesting a slowdown in the current economic momentum. Meanwhile.

These figures reinforce the view that the BOJ will maintain accommodative financial policy policy, especially in the absence of inflationary or pressure growth.

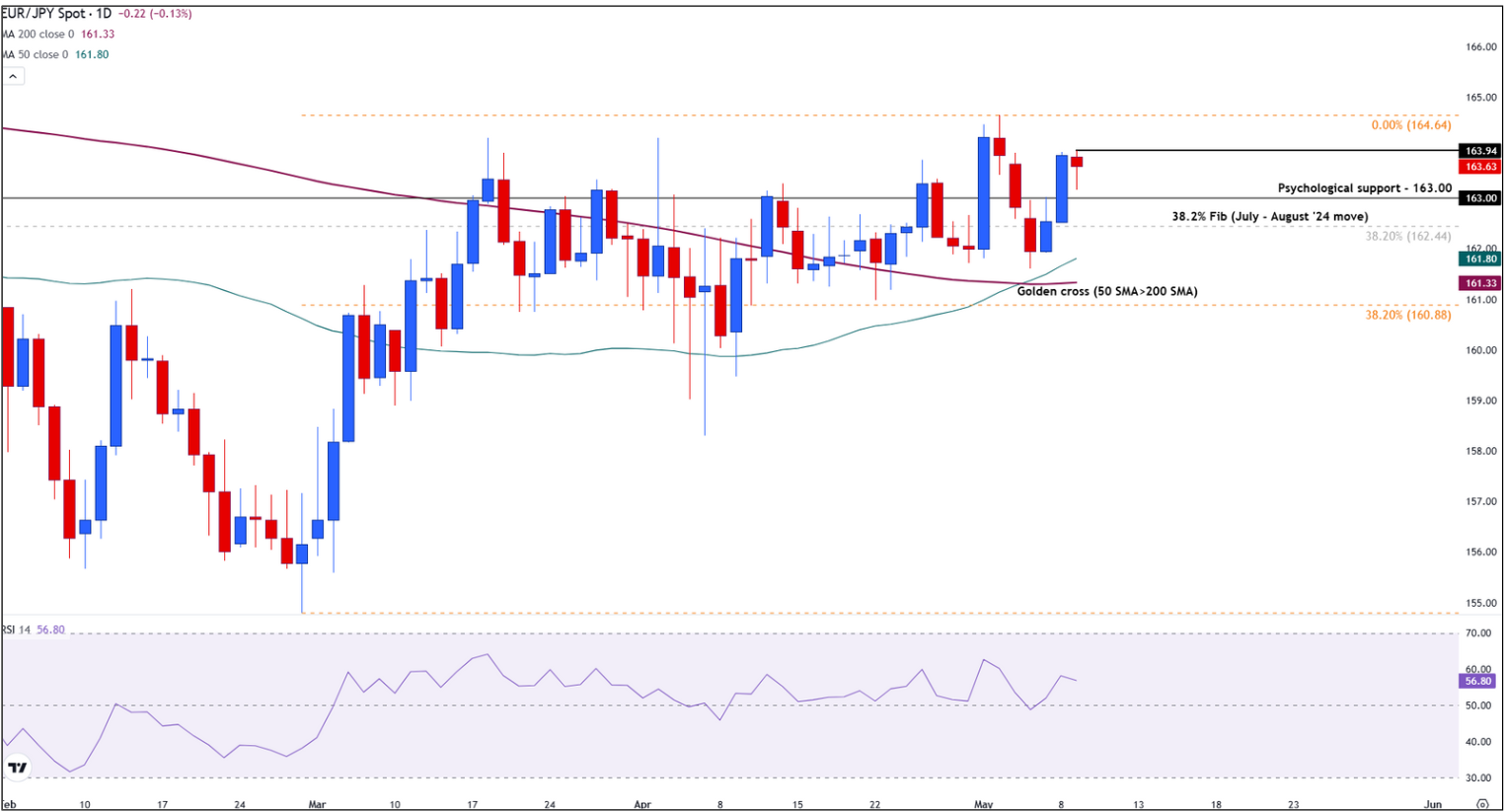

EUR/JPY stabilized after a denial from the resistance of 163.94

EUR/JPY was combined -including around 163.45, tested in the intraday resistance to 163.94 in the early Friday trading. The pair continues to trade above 50 days (161.80) and 200-day (161.32) simple moving averages, recently formed by a gold cross, which adopts a bullish medium-term perspective.

The reversed momentum remains enclosed below 163.94, with a confirmed sun -day near this level required to expose the high march to 164.64.

The support is seen at the psychological level of 163.00, followed by the July -August 2024 rally 38.2% Fibonacci Retracement at 162.44. A break below the zone will bring a move of the average cluster near 161.80–161.32 to focus.

Kamag -child Index index (RSI) is currently holding around 55.78, suggesting moderate bullish momentum without excessive conditions.

EUR/JPY DAILY CHART

Japanese yen faqs

Japanese Yen (JPY) is one of the most traded currencies in the world. Its value is widely determined by the Japanese economic performance, but more specifically in the Bank of Japan policy, the difference between Japanese and US bond yields, or at risk of entrepreneurs, among other factors.

One of the Bank of Japan's mandates is money control, so its motions are key for yen. The BOJ directly intervenes in the currency markets sometimes, generally lowering the cost of the yen, though it is not prevented from doing so often because of political concerns of major trading partners. The BoJ Ultra-Lose financial policy between 2013 and 2024 has caused the yen to remove the major currency due to an increase in policy variation between Bank of Japan and other major banks. Most recently, the gradual disobedience to this ultra-loose policy has provided some yen support.

In the past decade, the BOJ's stance that clings to ultra-loose financial policy has led to an expansion of policy variation on other central banks, especially in the US Federal Reserve. It supports an expansion of diversity between the 10-year US and Japanese bond, favored the US dollar against the Japanese Yen. The BOJ's decision in 2024 to gradually renounce the ultra-loose policy, in conjunction with reductions in interest rates on other major central banks, narrowed the diversity.

Japanese Yen is often seen as a safe investment. This means that in times of stress on the market, investors are more likely to put their money on Japanese money because of the supposed reliability and stability. The chaotic times are likely to strengthen the amount of yen against other currencies that are seen as more risk to invest.