Ethereum Whale Activity and ETF Inflows Drive Bullish Sentiment

The major Ethereum holders return to the market. In the midst of market integration last week, major players got the opportunity to accumulate aggressively with ETH.

On-chain data shows an uprising on whale handling, while ETH-based funds (ETF) funds have recorded their first weekly net flow in eight weeks, signing a significant emotional shift.

The accumulation of whale whale and ETF Inflows hint at the close -off price

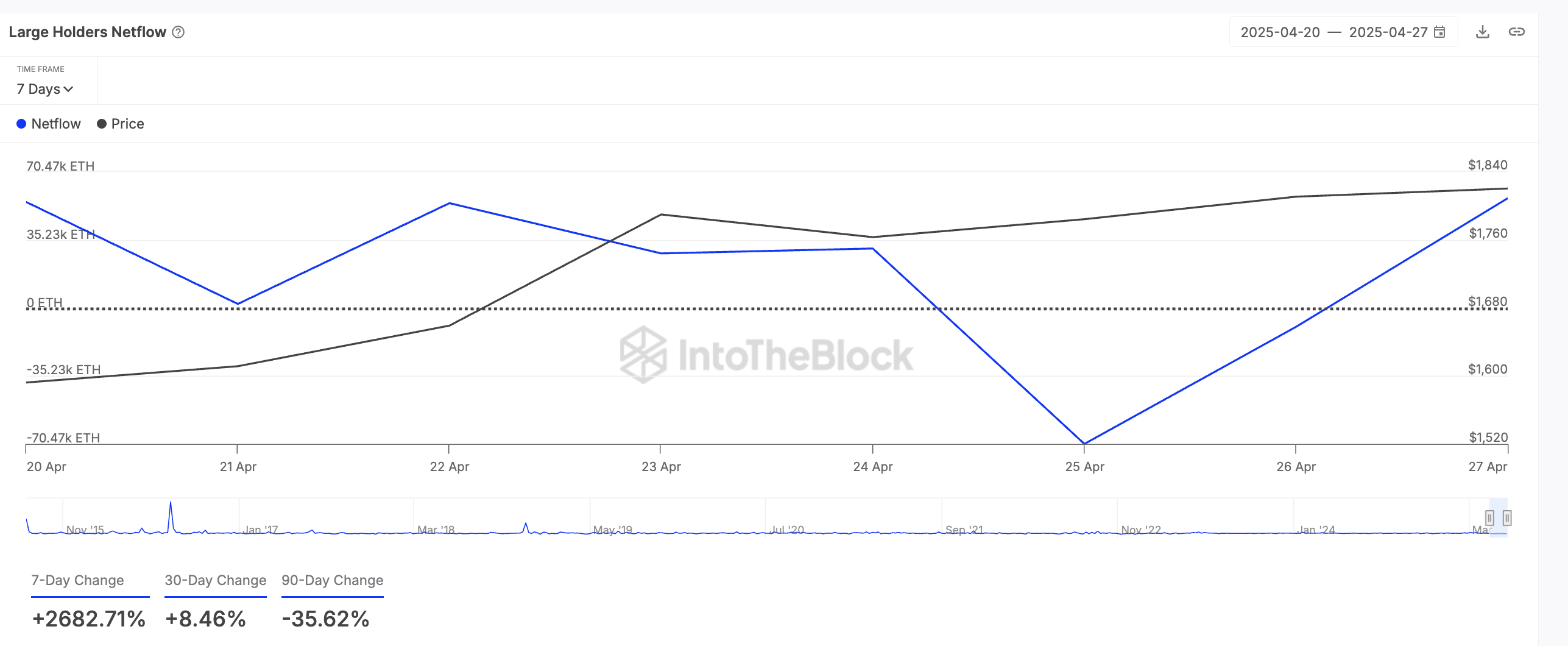

According to On-chain data, the leading Altcoin ETH has mentioned a significant spike in large Nets holders over the last week. According to the On-chain data provider, it has been rocket 2682% over the past seven days.

Large holders of an asset refer to whale addresses holding more than 0.1% of the transfer supply. Large Netflow holders monitor the difference between coins purchased by investors and the amount they sell at a certain time.

When large holders hold an asset, its whale investors destroy their coin accumulation. The trend of this accumulation suggests a belief in the future of the ETH, as the major holders tend to act when they see the value at the current price levels.

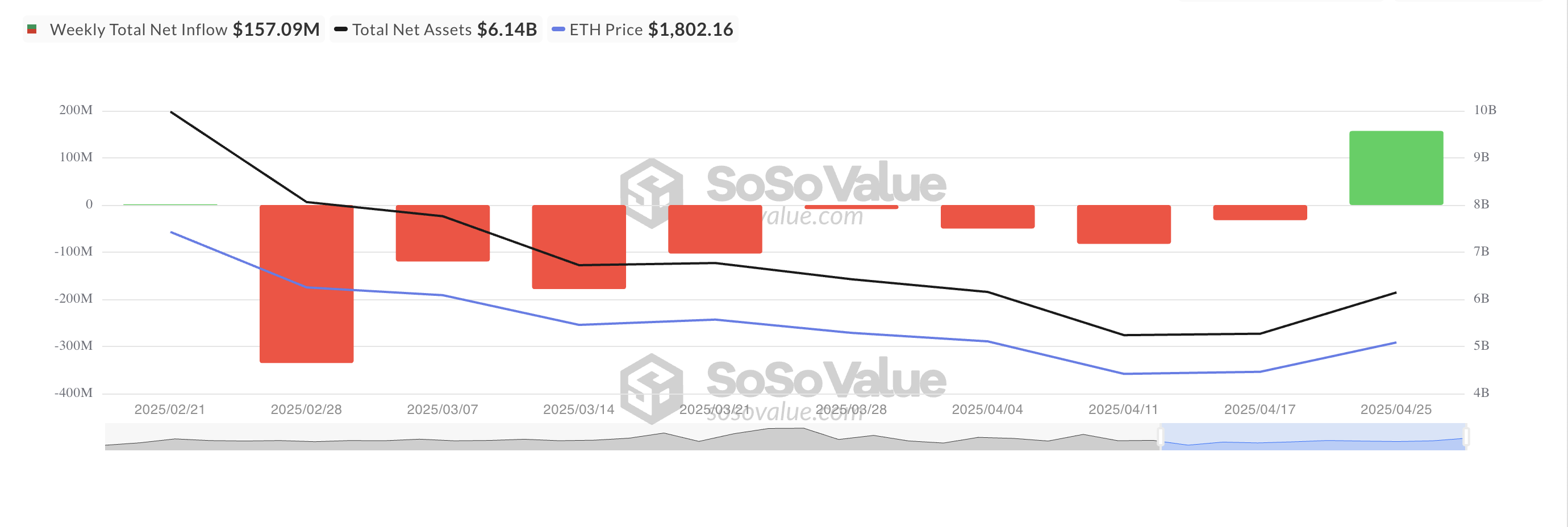

Adding to the bullish narrative, the ETHs recorded ETFs their first weekly net flow in eight weeks. According to Sosovalue, the Net Inflows in the Eth-backed ETF reached $ 157.09 million between April 21 and April 25, reversing an eight-week flow of flows worth more than $ 700 million.

In the major players who re-enter the market, the ETH can be poised for further upside down in the near term.

Ethereum sees bullish momentum

On the technical side, the positive balance of ETH (BOP) power features a resurrection in demand for the leading altcoin. It is currently at 0.31.

This indicator measures the purchase and sale of pressure a possession. When it costs positively, the pressure is more than the pressure seller. This indicates strength in the movement of the ETH price and signs of additional potential upward momentum. If this happens, ETH can rally above $ 2,000 to exchange hands at $ 2,027.

However, if the sentiment in the market worsens, the ETH can pour recent acquisitions and plummet at $ 1,385.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.