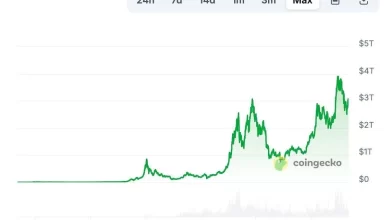

Ethereum posts biggest weekly gain in 4 years as Bitcoin, XRP, and SOL surge

Ethereum only removed the wildest comeback it had for four years. This week, the second largest crypto has jumped 25%, the biggest weekly benefit posted since May 2021.

The rally did not occur in separation. The entire crypto market was heated, and Bitcoin led the charge – leading the land of over $ 100,000.

At the time of the press, Bitcoin stood at $ 103,249, up to 2% for the day, with previous high hitting of $ 104,324, the strongest since late January, according to Data from coingecko.

Bitcoin closed the week of more than 6% higher and logged in the fourth straight win Sunday, for the first time that happened since November. All of this came as the whales continued to buy, the ETFs broke the notes, and the Macro news eased.

According to In CNBCInvestors began to relax after the US-UK trade mini-deal and signs of potential tariff relief in China, which helped riskier assets get a lip-including crypto.

Bitcoin leads while Ether, Solana, and XRP claw back ground

Extensive rebounds in the market do not skip Altcoins, even though they are far away. Ether, after dragging most of the year, saw a two-day increase by 29%, driven by a strong 10% gain this Thursday.

Meanwhile, Solana's token went up 6% and posted a 16% two-day jump. For the whole week, Solana added 14.3%, the best weekly move since January. The XRP, riding high at the end of the deadly SEC-Ripple case, has risen 5.1% over the past twenty-four hours.

Part of Ether's climb came up the Pectra upgrading of Ether's Pectra. The updates of that network, staking made it easier, and introduced support for smart wallets. That provided traders for jumping to jump, especially to those who avoided the token due to network congestion and high gas costs.

However, Ether and Solana have not recovered from previous losses. Year-to-date, Ether dropped 31%, and Solana dropped 12%, even after the rebound. Bitcoin, on the other hand, has reached 10% for the year. XRP is the only major altcoin that has not lost its ground along that way.

ETF is flowing to Bitcoin while Altcoins lack real buyers

The Bitcoin structure changed rapidly after the ETF spots launched in 2024. The money now came from retirement portfolios, Macro hedge funds, and even corporate bond techniques. This type of consumer base is sticky because it is not panic, so Bitcoin is given a clear edge.

Altcoins are still relying on traditional crypto-porridge-pores that quickly retaliate to rate walks, sector sectors, and social media trends. Eric Chen, co-founder of Injective, said Altcoins did not see the same level of demand because the current interest rate setup did not allow the tech or imaginary capital sector to grow significantly.

Eric also warned that unless the new demand shows, the ether and other altcoins may decrease before rising. He pointed to their stable supply and the absence of any structure that buys the base as the main risk.

Over Wolfe Research, the analyst went up to Harvey. “There remains a singular approach for crypto investors: Stay at BTC until the headwinds are at risk of disappearing,” Read said on a note. He added that Bitcoin is just one of two owners in their basket in green this year. The question now, according to him, is that if Bitcoin could maintain more than other properties such as stocks-or if it was gold, not crypto, ending in becoming a safer long-term play.

Cryptopolitan Academy: Wanna grow your money in 2025? Learn how to do this with Defi on our upcoming webclass. I -save your place