ETH Upside Struggles Near $1,800 Support

The Ether price continues to struggle to reclaim $ 1,800 support despite having 13.4% last week. The coin has risen 0.7% on the sunny charts such as this writing, a small but significant step to maintain the living hope of returning to $ 2K.

Blackrock $ 54 million ETH purchase adds to reversed traction

Last week was a fruitful for Ethereum, since its ETF spot performance significantly. Notingly, the Friday trading session saw the nine Ethereum Spot ETFS which recorded more than $ 100 million worth of net inflows for the first time in 56 days. At $ 104.1 million, Friday's ETF net is the highest in seven weeks. In addition, giant asset management Blackrock bought $ 54 million worth of ETH coins last week, their largest purchase in two months.

These developments emphasize the possibility that Ethereum has restored a significant portion of the investor's investor confidence that lost in the last two months. Also, the Defi TVL of the Ethereum chain rose 1.5% in the last 24 hours, pointing to the increase of utility for ETH.

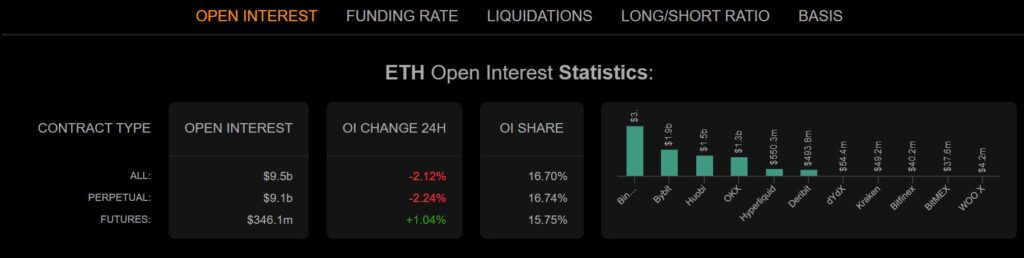

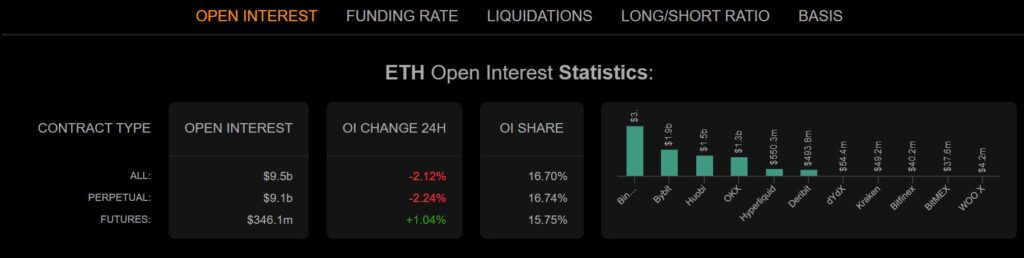

On the downside, however, the Ethereum trading volume was declined by 2.4% in the last 24 hours amidst prices. In addition, the open interest value of the ETH Coin has declined by 2.07% in the last 24 hours to $ 9.5 billion. These trends release the purchase of appetite, which will reduce reversible coin acquisitions in the near season.

Eth open interest performance. Source: Coinanalyze

Ethereum price prediction

As seen in the chart below, the momentum in Ethereum prices favors bulls to remain control over the above $ 1,794. The main resistance is likely to be at $ 1,820. However, a stronger momentum will remove the barrier and try $ 1,844.

On the other hand, sellers will control if the price breaks below $ 1,794. In that case, the coin will likely find the first support of $ 1,765. The reversed thesis is not valid below that level. In addition, such a momentum may result in an extended decline to find a second support level at $ 1,743.