ETH liquidates over $430M short positions after the biggest daily rally since 2021

The ETHEREUM (ETH) exploded early throughout the crypto market, after months of sideways trading under $ 2,000. The current ETH rally has led to more than $ 430m in fluids in the past 24 hours.

ETHEREUM (ETH) has shown the ability to rally, adding more than 20% to a single day. ETH recovered at $ 2,445.37, which gains 0.023 BTC. The strong sun -shift price movement, however, raided the short positions directly. The ETH was recovered as the BTC exchanged for $ 103,419.00, strengthening all other coins and tokens with an increase in optimism.

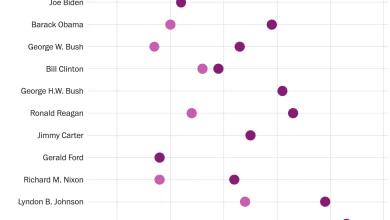

As a result, the ETH was the leader in short prevention, with over $ 430m over the past 24 hours. Short fluids affect both centralized markets and high risk single-trader position To hyperliquid that is eternal dex.

At the same time, whales continue their purchase, including from a Wallet Probably belonging to World Liberty Fi.

ETH OPEN Interest recovers, while wiping short positions

Liquids follow a spike in open interest, back above $ 12B. The recent ETH rally is seen as a potential emotion transfer and the general direction of the market. In the short time, alphanomics data shows ETH is the most successful trading day since the 2021 Bull Market.

$ Eth There has been only the biggest bomb of the day since 2021 yesterday … and the Ripple effect is real. ⚡️

Ethereum ecosystem tokens see a flow of activity, with rising DEX volume over the past 24h:

And $ Pepe

And $ Aave

And $ Link

And $ Mog

Two memes, $ Pepe and $ Mogare looking … pic.twitter.com/ca0rdvppre

– Alphanomics 💧 (@alphanomics_io) May 9, 2025

The recent price move is also a rare spike in unity at BTC, as the leading coin exploded at $ 103,000. Even after the price recovery, the BTC leads 60.4% of the market, while Ethereum's dominance drops to 8.4%.

ETH has not yet proven whether its rally is preserved and reflects improvements from Pectra upgrading. During the recent market recovery, most of the leading crypto assets moved to Overbought Category, potential signing an upside down from the local price peak.

The eth ecosystem is still recovering after a period of low price

As a result of the ETH rally, the entire Ethereum ecosystem was recovered. Defi tokens and memes also gained outflows, with signs of whales that re-enter Ethereum meme positions. The amount of eth locked back to $ 59b, with significant expansion for Lido and Aave.

Ethereum on-chain activity has also been selected for more than 450K daily active purses. During the rally, the largest gas burners were general transfer of ETH and USDT, which burned around 25 ETH in the past 24 hours.

Ethereum staking still holds more than 34M coins, even if there is a move to the owner. Lido saw the flow of 191,872 ETH last month, while Binance's validators saw a flow of 174,976 ETH.

The Eth Ecosystem has yet to recover its lending of liquidity after a recent price sink at $ 1,400. Defi Lending has nearly $ 902m in liquid loans, even on a range under $ 1,400 and the largest number of price -level loans of $ 853 per ETH. There are almost no loans located above $ 1,500, following the previous quick correction for ETH.

The low price reflects the fears that ETH can sink even lower, despite the current breakout. On the positive side, ETH is expected to return to $ 3,000 and potentially continue its rally as high as $ 10,000.

Key wire difference Crypto brands help break down and dominate the headlines quickly