ETH Bulls Eye $2,000 Rally Amid Rising Demand

The top ETH of Altcoin has covered the broader market collapse over the past 24 hours, posting moderate acquisitions by almost 1%. At the time of press, the coin traded for $ 1,842.

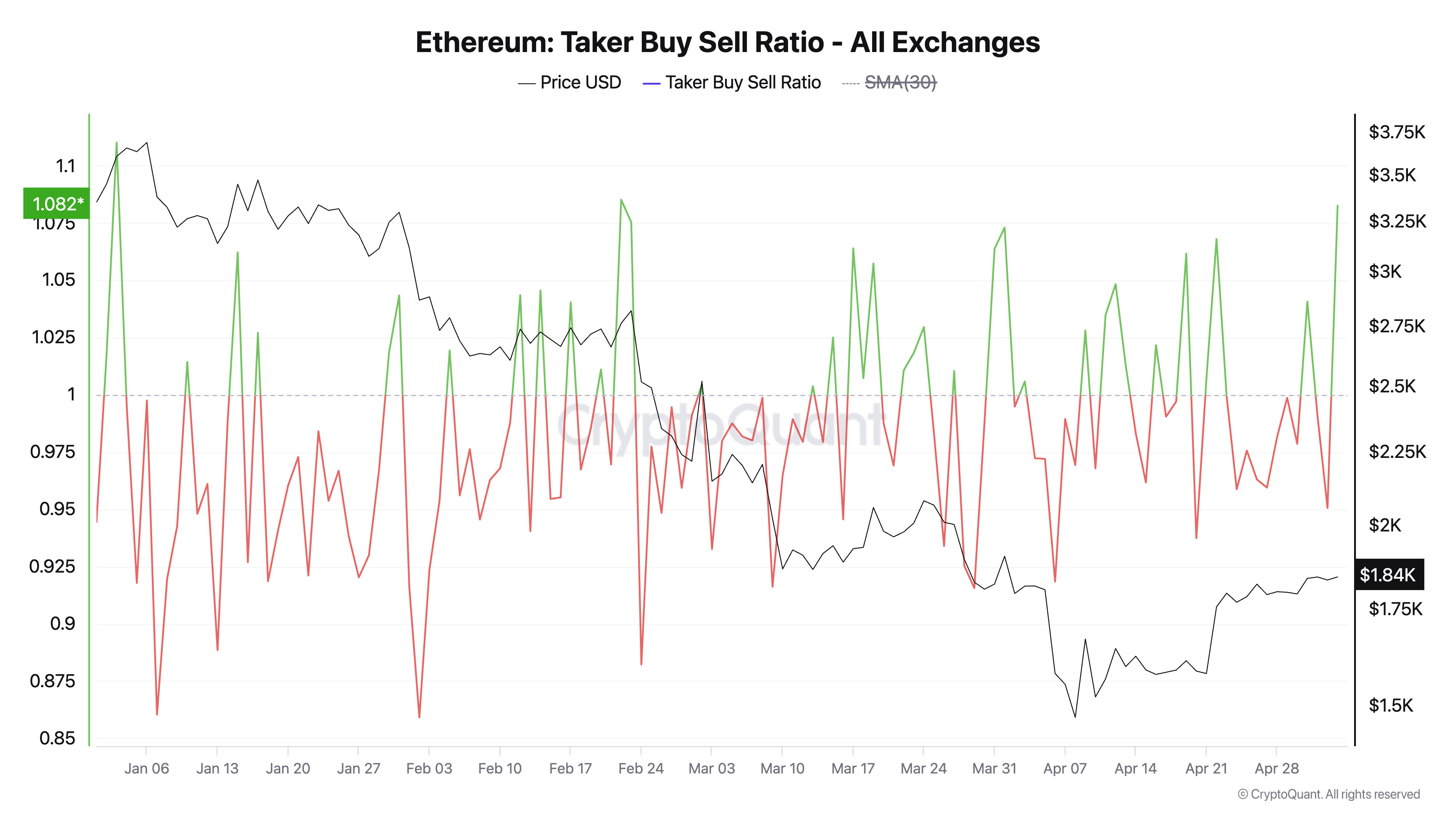

It came as a major measure of the momentum-the ratio of the taker's purchase-has fallen to its highest level in 30 days, signing the modified bullish pressure in the asset futures market.

Eye traders are upside down as buying pressure and developing

According to the Cryptoquant, the ETH taker-bell ratio is currently at 1.08, which has marked the highest value since early April.

This measure measures the ratio between buying and selling volumes in the ETH futures market. A value above 1 suggests that more traders aggressively buy ETH contracts than sale, while the values below 1 indicate dominant sales pressure.

At 1.08, the ETH buy-sell ratio clearly tilted the consumers' favor, reflecting the increase in confidence among entrepreneurs whose prices could continue to rise.

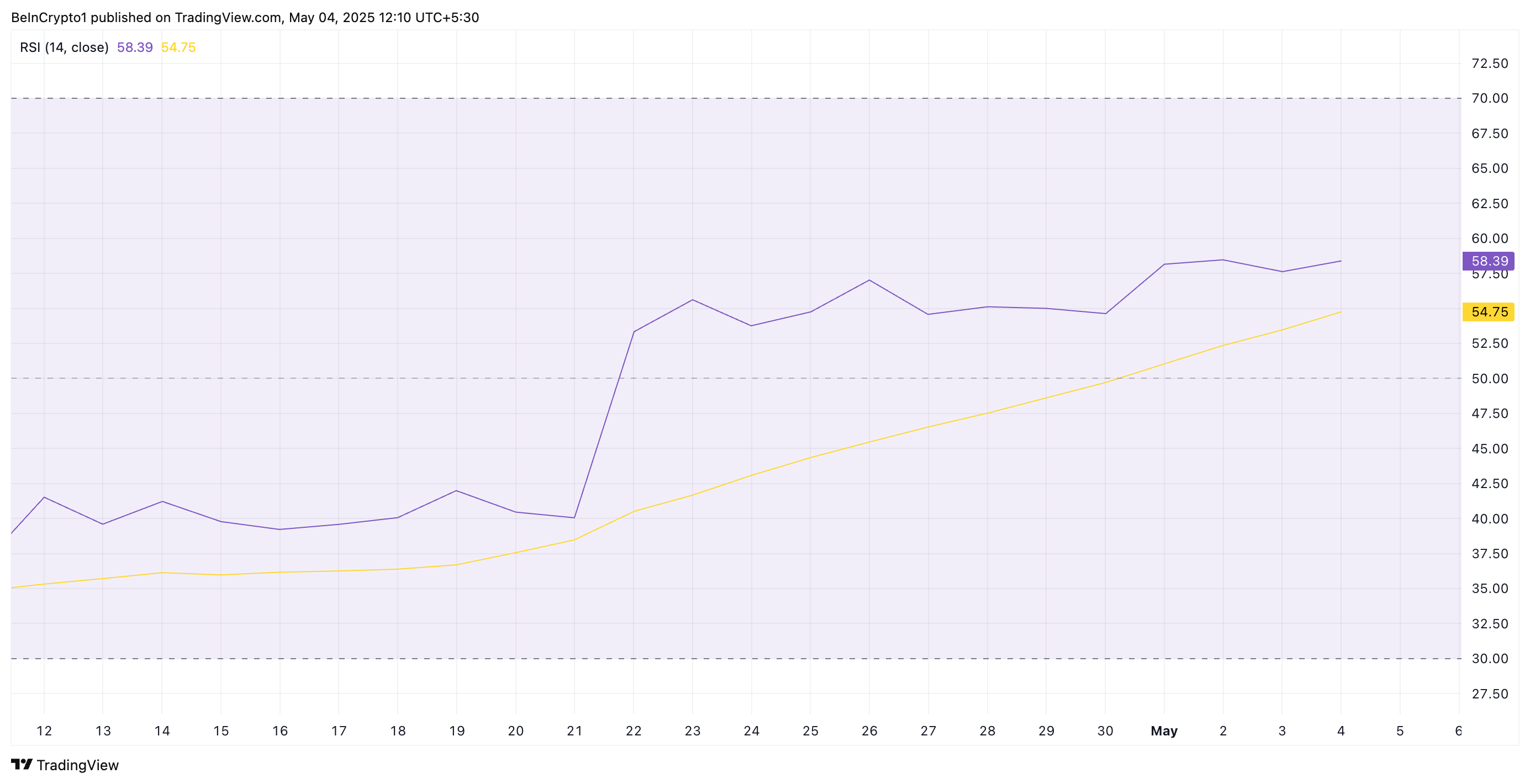

Moreover, the Kaba -Son of Altcoin's (RSI) strength continues to climb upward, supporting this narrative. At the time of press, it is at 58.39 and climbing.

The RSI indicator measures excessive and excessive market conditions. It covers between 0 and 100, with values above 70 indicating that the owner is excessive and due to a decline. Conversely, the values are under 30 signals that the owner is oversold and can witness a rebound.

The RSI reading of ETH confirms the boosting of bullish bias toward Altcoin, strengthening the view that it can be protected for further upside down.

ETH builds upstairs above short -term support

At its current price, the ETH depends on the top of the 20-day exponential transfer of the average (EMA), which generates dynamic support below its price at $ 1,770.

The 20-day EMA measures the average price of an asset over the past 20 days of trading, which provides weight at recent prices. When an asset is trading above the key transfer of this average, it indicates short -term bullish momentum. This indicates that recent prices are higher than the average in the past 20 days. Entrepreneurs often view it as a sign of underlying strength or an early revolt.

Therefore, ETH can maintain its rally towards $ 2,027 if the purchase of pressure gets momentum.

On the other hand, if the purchase of the activity is missing, the coin may lose recent gains, break below the 20-day EMA, and fall to $ 1,385.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.