Is a Major Rally Brewing?

The ETHEREUM (ETH) shows signs of modified strength, gaining 14% in the past seven days. Despite the recent rally, Ethereum has been trading below the $ 1,900 mark since April 2, featuring the importance of key levels of resistance ahead.

If Ethereum can recover higher soil or face -to -date sales pressure are likely to depend on the next moves around the basic supports and resistance to the zones.

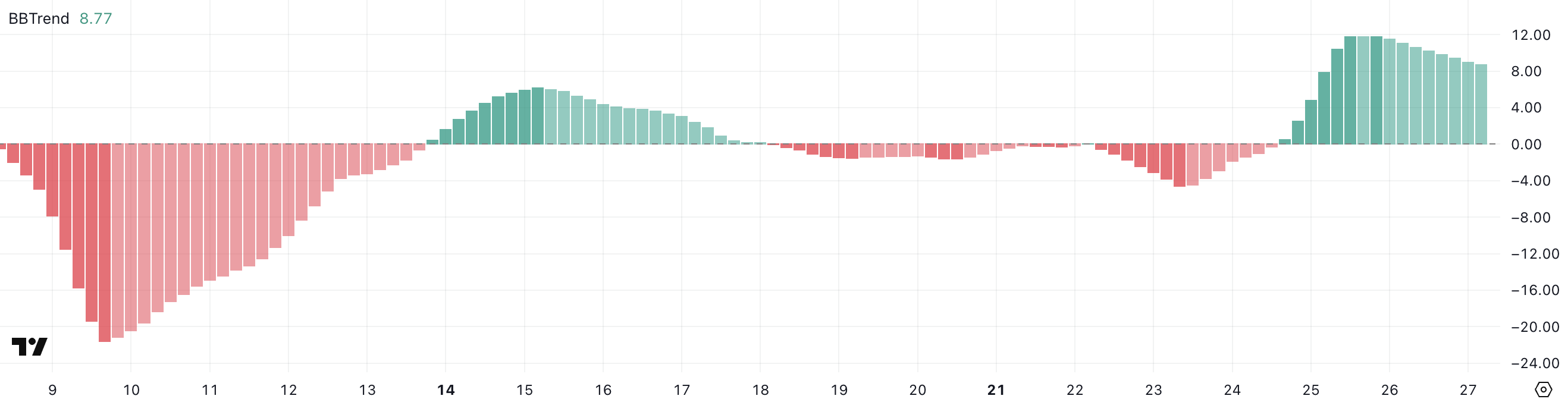

Ethereum's Bbtrend is refrigerant: what is the next signal

Ethereum's BBtrend is currently sitting at 8.77, marked a noticeable decline from 11.83 two days ago.

Despite the collapse, the indicator has remained positive for the past three days, suggesting that the Ethereum has maintained an underlying bullish structure even when the momentum cools down.

This shift can signal the early stages of a potential phase of integration -together, where the market breathes before deciding on its next major move.

The BBTrend, or Bollinger Band Trend, is a technical indicator that measures the strength of a trend by evaluating how the price relates to bollinger bands.

When the BBTrend values are high and positive, they generally signal a strong uprising; When they are negative, they point to a downtrend. Ethereum's BBtrend, now at 8.77, suggests that while the uprising is still present, its strength is fading.

Consumers who do not overcome control may lead to increased volatility, potential pullbacks, or sideways movements.

Ethereum whales last: what the price means

The number of Ethereum Whales – purses holding between 1,000 and 10,000 ETHs – currently standing at 5,458.

This figure rose slightly from 5,442 from April 21 to 5,457 on April 23, and remained stable around this level for the past four days.

The recent stabilization suggests a pause in the accumulation or distribution activity to large holders, which offers a potential signal that the market can wait for a catalyst before making the next significant move.

Monitoring Ethereum Whales is critical because large holders can have an outsized effect on price movements. When whale numbers rise, it often indicates confidence and potential accumulation, which can be bullish for the price.

On the contrary, a lowering whale may suggest sale of pressure ahead.

With the number of Ethereum whales that hold around 5,458, it can indicate a neutral stance to major players-either aggressive purchase or sale-potential leading to reduced volatility and action-bound price until a clearer trend has emerged.

Ethereum's battle around $ 1,828: breakout or breakdown?

EMA (exponential moves) lines are currently aligned with a bullish formation, with short-term ema positioned above the long-standing classic sign of upward momentum.

Over the past few days, ETH has attempted to break the resist zone around $ 1,828 but unsuccessful. If Ethereum tested this level and successfully break above it, the next reversal targets were the $ 1,954 resistance, followed by a potential transfer to $ 2,104.

A break above $ 2,000 will be significant, marked the first time ETH trade above this psychological level since March 27.

However, the Ethereum price may return to test the support at $ 1,749 if the bullish momentum is fading and the trend returns. Loss of this level can expose ETH to further refuse to $ 1,689.

Should the sale of pressure increase, deeper support levels at $ 1,537 and even $ 1,385 can play.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.