Blackrock will investigate DLT shares for $ 150 billion in the Treasury Fund when submitting SEC

Blackrock, the world's largest asset manager, wants to launch the digital ledger technology (DLT) shares for his money market fund. On April 29, the company submitted an initial prospectus to the Securities and Exchange Committee (SEC).

According to submissionThe BLACKROCK BLF Treasury Trust Fund (TTTXX) is monitored by the $ 150 billion fund, which mainly invests in the US Treasury bills, bonds, cash and other liabilities issued and guaranteed.

The company announced that the shares would be sold through the New York Bank (BNY) Mellon, with the Bank holding the mirror register and ownership of the shares in the chain chain. However, added that the fund is currently not using chip circuit technology.

The initial prospectus is as follows:

“Although the Foundation does not currently use chip circuit technology and does not invest in cryptocurrencies, the financial intermediary, through whom shareholders buy and redeem DLT shares, intends to use blockchain technology to maintain a mirror of ownership of their customers' shares.”

Not surprisingly, the product is only available for institutional investors, which have a minimum investment of $ 3 million. The company still has a bird for DLT shares, but stated that the management fee is 0.18%.

Marked Treasury already over $ 6 billion

Moving Blackrock highlights the continuous exploration of traditional financial institutions to launch new products. Blackrock is already a key participant in this sector, whose Tocenized US Treasury Product BUIDL is the largest tokenized Treasury product.

The company is with Bullish Chairman Larry Fink in the chart technology and labeling, finding out the importance of making financial products more accessible to investors.

According to the data rwa.xyzThe BUIDL, which is a product of Securitize and Blackrock, is currently asset (AUM) assets of $ 2,556 billion, and in the last 30 days, the net inflow is more than $ 600 million. With only 70 owners, its performance reflects a definite interest in tokenized products, especially the institutional investors of the decentralized financial sector.

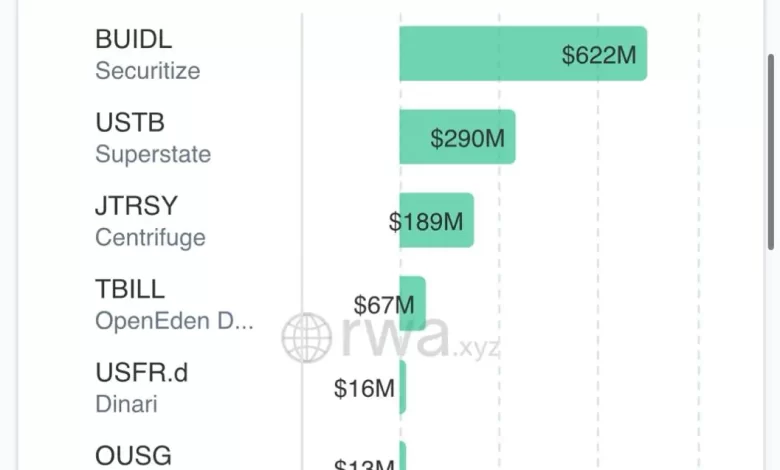

However, other marked treasury products also attract a lot of interest, even if they do not grow at a similar level than the BUIDL. In general, the sector has $ 6.16 billion of AUM in the sector.

The next product with Buidl's highest AUM is Franklin Temple Bengee, $ 706.77 million. Others, such as Superstate Ustb, Ondo Usdy and OUSG and Circle Usyc, also have over $ 400 million in AUM.

Despite the growth of these products, many industry experts believe that it is only at an early stage and that the sector has increased for greater growth. Standard chartered experts predict that the tokenization market could be $ 30 trillion by 2030.

Blackrock Ibit sees a record inlet

In the meantime, Buidl is not the only blackRock cryptocurrency product that has been massively positive in recent times. The IBIT Foundation (ETF), a company traded in Bitcoin Exchange, has recorded its second largest day in the inflow since the coming of the market, Monday was $ 970.9 million.

The inflow of this day is contrasted with competing outflows, for example, ARK 21 shares ARKB, Fidelity's FBTC and Bitwise Bitb. However, Ibit's performance was sufficient to compensate for these outflows and for Bitcoin ETFs to ensure $ 591.2 million net flows.

A product with more than $ 50 billion in AUM has released more than $ 4.5 billion in the inflow since April 22 and is 51% of all Spot Bitcoin ETFs.

Cryptopolitan Academy: Soon – a new way to earn a passive income with a defi in 2025. For more information