Diamondback Q1 earnings beat estimates on higher production

US Energy Operator Diamondback energy It was reported that first-quarter 2025 revenue performed each part of $ 4.54, defeating the Zacks-agreed estimate of $ 4.09 and earlier last year under $ 4.50.

Outperformance reflects strong production and lower costs, which is more than the offset of a fall in the carrying of oil.

Meanwhile.

Fang again purchased $ 575 million of shares in the first quarter and an additional $ 255 million shares of shares in the current quarter. The Company's Directors Board also announced a quarterly cash dividend of $ 1 per portion of the standard shareholders of the record on May 15. Payout will be held on May 22.

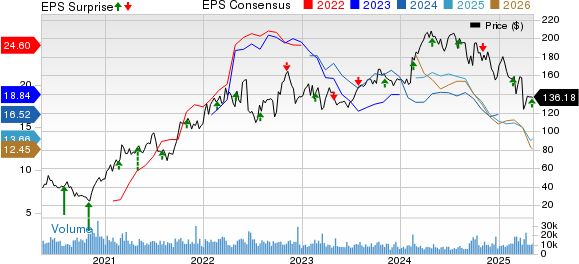

Diamondback Energy, Inc. price, agreed and surprise of EPS

Diamondback Energy, Inc. Price-Consensus-Eps-Surprise-Chart | Quote of Diamondback Energy, Inc.

Doing and realized prices

The production of oil and natural gas produces 850,656 barrels of oil equivalent per day (Boe/D), consisting of 56% oil. The figure reached 84.5% from last year but marginally missed our estimate of 850,688.7 Boe/D. While crude and natural gas output increased by 72% and 99% years over the years, respectively, natural gas fluid volume moved 96%.

The average realized oil price in the latest quarter was $ 70.95 per barrel, 5.5% less than the past carrying out $ 75.06, but in accordance with our projection. Meanwhile, the average realized natural gas price moved to $ 2.11 per thousand cubic feet (MCF) from 99 cents last year and only reached our $ 2.10 estimate. Generally, the flowing company and gas took $ 47.77 per barrel compared to $ 50.07 a year ago.

Costs and financial positions

Diamondback's first-quarter cash operating cost is $ 10.48 per barrel of oil equivalent (BOE) compared to $ 11.52 in the previous year quarter and our projection of $ 12.21. Falling costs compared to the time of last year reflects a reduction in the cost of running for $ 5.33 per BOE from $ 6.08 in the first quarter of 2024. In addition, Fang gathering, processing and transportation costs fell 21.2% year for year to $ 1.45 per BOE, while cash G&A costs fell in the first quarter of 2025 to 72 cents each cents Boe from 76 cents to the equivalent period of 2024. And Ad Valorem taxes rose 4.9% year in the year to $ 2.98 per Boe.

Diamondback has swept $ 942 million in capital spending – spending $ 864 million in drilling and completion, $ 57 million in infrastructure and environment, and $ 21 million in working capital. The company booked $ 1.6 billion in a free cash flow in the first quarter.

On March 31, the Permian-focused operator had about $ 1.8 billion equivalent to cash and cash and $ 13 billion in long-term debt, representing a ut-to-capitalization of 23.7%.

Guide

The latest Diamondback Energy guide is considered Endeavor's efforts, completed on September 10. Last year and the acquisition of Double Eagle from April 1, 2025 forward. Fang looked to pump around 857,000-900,000 BOE/D of hydrocarbon in 2025 compared to the 883,000-909,000 expected previously. Here, oil volumes are likely to be between 480,000 and 495,000 barrels per day (485,000-498,000 before). The Zacks Rank #3 (HOLD) Company also estimates a capital spending budget between $ 3.4 billion and $ 3.8 billion compared to $ 3.8 billion to $ 4.2 billion before.

Some major revenues of E&P

As we discussed the results of the first-quarter of Diamondback Energy, let's see how some other upstream companies have taken away this income period.

CONOCOPHILLIPS, One of the largest independent oil and gas producers in the world, reported a fourth quarter of 2025 that suits each of the $ 2.09, defeating the estimate of the agreed Zacks of $ 2.06. Outperformance can be attributed to the higher volume of the oil equivalent, which is partially -ofset by reduced realized oil prices.

On March 31, Conocophillips had $ 6.3 billion equivalent to cash and cash. The company had a total long -term debt of $ 23.2 billion and a short -term debt of $ 608 million on the same date. The spending and investment of Conocophillips costs $ 3.4 billion. The net cash provided by operating activities is $ 6.1 billion.

Natural gas manufacturer EQT Corporation It has reported income from the ongoing operation of $ 1.18 per part, defeating the Zacks estimate of $ 1.02. Better than-expect quarterly income is driven by higher sales volume and increased average realized prices.

EQT sales volume increased to 571 billion cubic feet equivalent (BCFE) from the quarter level of 534 BCFE. The reported figure also defeated our estimate of 543 BCFE. The natural amount of EQT gas sales volume is 536.3 BCF, from 499.3 BCF last year. The figure also defeated our estimation of 509.8 BCF.

Magnolia Oil & Gas, Another US energy operator, reported a first-quarter 2025 net profit of 55 cents per part, defeating the estimate of the agreed Zacks of 53 cents. This outperformance can be attributed to a healthy increase in production volumes driven by strong productivity in the ownership of company giddings. In the quarter of the review, Magnolia recorded $ 224.5 million in net cash from operating activities and achieved a free cash flow of $ 110.5 million.

The average daily total output of 96,549 BOE/D increased from the year last year 84,784 BOE/d. The figure also exceeded our estimate of 93,975 Boe/D. Oil and gas production increased by 13.9% years over the years. On March 31, Magnolia had a cash and cash equivalent of $ 247.6 million. The company has a long-term debt of $ 392.7 million, reflecting a capitalization of 16.5%.

Do you want the latest recommendations from Zacks Investment Research? Download 7 best stocks for the next 30 days. Click to get this free report