Bitcoin is a global reserve earlier than most expected: 'Trump advisor

In a conversation on The Scoop, Bitcoin Mapped Inc. CEO David Bailey and US President Trump Trump's trustee, in his view, leads the world's first cryptocurrency technology to the primary reserve property “much earlier than people think”. Talking to host Frank Champarro, Bailey described The merger of political opportunisms, sovereign gaming and balance sheeting, which he thinks constantly undermines the old financial order.

Bailey did not start the words about the extent of the transition. “We are becoming a world reserve on Bitcoin,” he said, adding that the schedule is accelerating. The requirement shaped a debate that extended from the personality of US President Donald Trump, from the personality of the “Bitcoin president” to Bhutan's dependence on block-supidy's revenue and Softbank entrance to the Arbitrage of the Treasury.

Bitcoin will become a reserve property than expected earlier

Bailey recalled his first meeting with Trump at Trump Tower, where he and others tried to fold the Bitcoin President's platform. According to him, the meeting revealed an instinctive political antenna. Trump has this ability to turn his personality in a way […] joking and having fun […] Business for Trump, decision time. “What began as a memory -based overture has become a reflex campaign plan in Bailey's narrative:” Six months passes and now he is the president of the crypto, he is the president of Bitcoin. “

Bailey claimed that this turning point is important because the constituency is already significant. “Crypto Americans […] There are 90 million people, 80 million people, ”he told Chaparro. Trump added, he added that Kohord is” fierce and more than we have gun owners. “

If politics offers a narrative, energy will provide cash flow. Bailey said that sovereign mining has exceeded the turning point, estimating that “about 50 countries” are now organizing public private mining activities based on excessive generation capacity. He suggested that the scale is no longer trivial: qualifying countries use “like 100-plus megawatt power”, with some “using gigavadi”.

The Kingdom of Bhutan's Himalayan is Bailey's canonical example. Bitcoin mining there now “50% of the country's GDP […] It can be even higher. “He claimed that this addiction would make the export of the Raundry a pillar of fiscal insolvency, but it is also competition for commercial miners.

Bailey claimed that the accumulation of sovereignly follows sovereign production. When the government controls the bonuses, the internal issue shifts to custody, sales and institutional mandate.

If only El Salvador and the Central African Republic have publicly accepted Bitcoin's legal offer or as a reserve property, Bailey asserted that “sovereign money flows [the] The Bitcoin market was already quite significant, ”some of it participated in the funds of sovereign people rather than central banks.

He linked this current to the framework of the national security. “Is it a matter of national security for your country [… ] The dominant reserve property? Yes, for sure. “He hinted that defense authorities have begun to consider whether Bitcoin will strengthen or lower existing security teaching – a debate he hopes to bring in US Congress certificates this year.

Strategy template

At the company level, Michael Saylor's strategy remains a reference model. Bailey said Saylor's playbook-own capital or debts, buying a bitcoin, diluting the market capitalization premiums-is already copied “widely everywhere”. According to his number, “We are likely to push 200” companies that lead the strategy variations; He projects “hundreds” by the end of the year. The consequences of demand demand are transparent: “There is simply not enough bitcoin to satisfy this price. The price must go up.”

The mechanism is not a systemic risk. Bailey compared corporate bitcoin trade with a closed confidence structure that once regulated GBTC, while emphasizing the crucial distinction: operating companies can buy back their shares by slipping. Even in this way, he warned that a widespread borrowing of shares could distribute leverage in stock markets, making a serious bitcoin a potential trigger for global decay. “The Bitcoin Bear Market can cause financial infection […] And in fact, no one to stop it to stop it. ”

Throughout the interview, Bailey returned to institutional fragility. “These institutions are much weaker and much more fragile than people appreciate,” he said of the traditional money order. But fragility cuts both ways: the same amplification that accelerates the rise of bitcoin, multiplying the dangers of turning. However, Bailey remained unequivocal. “We [ultimately] dictate the federal reserve, what their future is, “he said because” war drums crossed [Bitcoin’s] Inevitability. ”

During the press, BTC traded for $ 99,550.

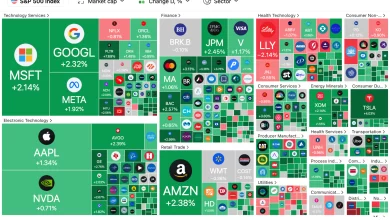

A highlighted image created with Dall.E, graph from site TradingView.com

Editorial For bitcoinists, the focus of the provision of precise and impartial content has been focused. We support strict procurement standards and each page passes a careful overview of our top technology experts and experienced editors. This process ensures the integrity, relevance and value of the content of our readers.