Dark‑Fee Acceleration, Omni Layer Transactions & Miner Misbehavior

Table of Links

Abstract/Zusammenfassung

Publications

Acknowledgements

CHAPTER 1: INTRODUCTION

-

Introduction

1.1 Overview of thesis contributions

1.2 Thesis outline

CHAPTER 2: BACKGROUND

2.1 Blockchains & smart contracts

2.2 Transaction prioritization norms

2.3 Transaction prioritization and contention transparency

2.4 Decentralized governance

2.5 Blockchain Scalability with Layer 2.0 Solutions

CHAPTER 3. TRANSACTION PRIORITIZATION NORMS

-

Transaction Prioritization Norms

3.1 Methodology

3.2 Analyzing norm adherence

3.3 Investigating norm violations

3.4 Dark-fee transactions

3.5 Concluding remarks

CHAPTER 4. TRANSACTION PRIORITIZATION AND CONTENTION TRANSPARENCY

-

Transaction Prioritization and Contention Transparency

4.1 Methodology

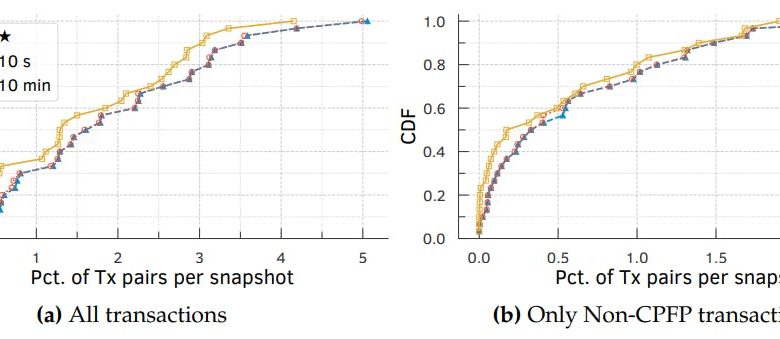

4.2 On contention transparency

4.3 On prioritization transparency

4.4 Concluding remarks

CHAPTER 5. DECENTRALIZED GOVERNANCE

-

Decentralized Governance

5.1 Methodology

5.2 Attacks on governance

5.3 Compound’s governance

5.4 Concluding remarks

CHAPTER 6. RELATED WORK

6.1 Transaction prioritization norms

6.2 Transaction prioritization and contention transparency

6.3 Decentralized governance

CHAPTER 7. DISCUSSION, LIMITATIONS & FUTURE WORK

7.1 Transaction ordering

7.2 Transaction transparency

7.3 Voting power distribution to amend smart contracts

Conclusion

Appendices

APPENDIX A: Additional Analysis of Transactions Prioritization Norms

APPENDIX B: Additional analysis of transactions prioritization and contention transparency

APPENDIX C: Additional Analysis of Distribution of Voting Power

Bibliography

3.4 Dark-fee transactions

We refer to transactions that offer additional fees to specific mining pools through an opaque and non-public side-channel payment as dark-fee transactions. Many large mining pool operators allow such side-channel payments on their websites for users wanting to “accelerate” the confirmation of their transactions, especially during periods of congestion. Such private side-channel payments that hide the fees a user pays to miners from others have other benefits for the users (AntPool, 2022; BTC.com, 2022; F2Pool, 2022; Poolin, 2022; SparkPool, 2021). One well-known advantage is, for instance, avoiding the fee rate competition in transaction inclusion, particularly during periods of high Mempool congestion; private side-channel payments would reduce a user’s transaction cost volatility and curb front-running risks (Daian et al., 2020; Eskandari et al., 2020; Strehle and Ante, 2020). We use the data set C to first investigate how such transaction acceleration services work and later propose a simple test for detecting accelerated transactions in the Bitcoin blockchain.

Investigating transaction acceleration services

We examined transaction acceleration services offered by 5 large Bitcoin mining pools namely, BTC.com (BTC.com, 2022), AntPool (AntPool, 2022), ViaBTC (ViaBTC, 2022), F2Pool (F2Pool, 2022), and Poolin (Poolin, 2022). Specifically, we queried BTC.com for the prices of accelerating all transactions in a real-time snapshot of the Mempool in data set C (see §A.7). We found that the dark fee requested by BTC.com to accelerate each transaction is so high that if it was added to the publicly offered transaction fee, the resulting total fee rate would be higher than the fee rate offered by any other transaction in the Mempool snapshot. Put differently, had users included the requested acceleration fees in the publicly offered fee when issuing the transaction, every miner would have included the transaction with the highest priority.

The above observation raises the following question: why would rational users offer a dark fee to incentivize a subset of miners to prioritize their transaction rather than publicly announce the fee to incentivize all miners to prioritize their transaction? One potential explanation could be that as payment senders determine the publicly offered transaction fees, payment receivers might wish to accelerate the transaction confirmation by offering an

acceleration fee. Another explanation could be that the user issuing the transaction might want to avoid revealing the true fees they are willing to offer publicly, to avoid a fee rate battle with transactions competing for inclusion in the chain during congestion. Opaque transaction fees can reduce transaction cost volatility, but they may also unfairly bias the level playing field amongst user transactions attempting to front-run one another (Daian et al., 2020; Strehle and Ante, 2020).

On the other hand, every rational mining pool has clear incentives to offer such acceleration services. They receive a very high fee by mining the accelerated transaction. Better still, they keep the offered fee, even if the accelerated transaction were mined by some other miners.

Detecting accelerated transactions

Given the high fees demanded by acceleration services, we anticipate that accelerated transactions would be included in the blockchain with the highest priority, i.e., in the first few blocks mined by the accelerating miner and amongst the first few positions within the block. We would also anticipate that without the acceleration fee, the transaction would not stand a chance of being included in the block based on its publicly offered transaction fee. The above two observations suggest a potential method for detecting accelerated transactions in the Bitcoin blockchain: An accelerated transaction would have a very high signed position prediction error (SPPE), as its predicted position based on its public fee would be towards the bottom of the block it is included in, while its actual position would be towards the very top of the block.

To test the effectiveness of our method, we analyzed all 6381 blocks and 13,395,079 transactions mined by BTC.com mining pool in data set C. We then extracted all transactions with SPPE greater or equal than 100%, 99%, 90%, 50%, 1% and checked what fraction of such transactions were accelerated. Given a transaction identifier, BTC.com’s

acceleration service (BTC.com, 2022) allows anyone to verify whether the transaction has been accelerated. Our results are shown in Table 3.6. We find that more than 64% of the 1108 transactions with SPPE greater or equal than 99% were accelerated, while only 1.06% of transactions with SPPE greater or equal than 50% were accelerated. In comparison, we found no accelerated transactions in a random sample of 1000 transactions drawn from the 13,395,079 transactions mined by BTC.com. Our results show that large values of SPPE for confirmed transactions indicate the potential use of transaction acceleration services. In particular, a transaction with SPPE ≥ 99% (i.e., a transaction that is included in the top 1% of the block positions, when it should have been included in the bottom 1% of the block positions based on their public fee rate) has a high chance of being accelerated.

3.4.1 Layer 2.0 transactions

Bitcoin offers a unique operation code, or simply opcode (Bitcoin Wiki, 2023b), known as OP_Return, which allows anyone to write arbitrary data to the Bitcoin blockchain. This opcode was introduced with the release of Bitcoin Core v0.9.0 in 2014. The primary purpose of OP_Return is to enable participants to mark a transaction output as invalid or to store additional data on the blockchain. By using OP_Return, the Bitcoin blockchain can also serve as a Layer 1.0 solution for Layer 2.0 applications like the Omni Layer Protocol (Omni Layer, 2023). However, this usage can lead to a situation where the true value of a transaction transfer (in the case of Bitcoin) might not be directly visible on the blockchain. Instead, the actual value of a transaction can be determined by interpreting the arbitrary data stored within it. To better understand these transactions and their purposes, we aim to parse the data written to the blockchain, using the data specification from (Omni Layer, 2020), and investigate whether transactions with arbitrary data have been accelerated or utilized for specific reasons.

To this end, we considered a 3-year Bitcoin data set named data set D (refer §4.1), consisting of a total of 313,737,341 transactions (313,575,387 issued transactions and 161,954 coinbase transactions), we observed that 42,994,249 transactions (13.70%) contained at least one OP_RETURN opcode in their list of transaction output. Focusing solely on the issued transactions, 42,832,713 transactions (13.66%) included at least one OP_RETURN opcode. Regarding the coinbase transactions, from the total of 161,954 blocks, a majority of 161,536 coinbase transactions (99.74%) contained at least one OP_RETURN opcode. This indicates that miners have also been actively including arbitrary data in the Bitcoin blockchain.

Moreover, we identified 17,993,300 transactions associated with the Omni Layer Protocol (Omni Layer, 2023), averaging 111 transactions per block. These Omni transactions accounted for 5.74% of all Bitcoin issued transactions and 42% of all transactions involving OP_RETURN opcodes. Notably, a significant portion (97.27%) of these Omni transactions were related to the Tether USDT token (Tether, 2023), a stablecoin pegged to the US dollar.

We found 1805 OP_RETURN transactions among a set of 14,104 accelerated transactions in data set D, using the methodology discussed in the previous section. Out of these accelerated transactions, 1740 belong to the Omni Layer Protocol, with 1739 of them being related to the Tether token, and the remaining one to the Omni token. These Omni accelerated transactions were consistently placed right at the top of each block, on average within the top 3.4%, with a std. of 13.89% and a median of 0%. This indicates that they were the first issued transactions in their respective blocks. In comparison, non-accelerated transactions were usually placed within the top 36.97% of the block, with a std. of 28.64% and a median of 30%. Overall, we observed that 84.30% of all Omni transactions were included at the top of their respective blocks, being the first transactions to be included (refer Figure 3.10a).

Due to the opacity of the true value of Omni transactions, as it requires interpreting the arbitrary data stored in each transaction, we parsed the data using the protocol transaction specification from (Omni Layer, 2020). Then, we compared the values transferred in Bitcoin transactions based on the transaction output value with the values stored in the arbitrary data belonging to Omni. The Bitcoin prices were converted to

US dollars, considering the exchange rate at the time the transactions were included in the block, obtained from the Yahoo Finance BTC-USD feed (Yahoo Finance, 2023a). As shown in Figure 3.10b, Omni transactions tend to transfer much higher values among users compared to the values seen in the Bitcoin transaction outputs. For instance, on average, the values transferred in Tether on the Omni layer were 501,600.69 USD with a median of 1053 USD, while the values seen in the Bitcoin blockchain averaged 167,518.43 USD with a median of 84.81 USD. This means that the values transferred in Omni were almost 3 times higher on average and 12.42 times higher in the median compared to Bitcoin transactions.

We also analyzed the results based on acceleration. For half of the evaluated transactions, the accelerated Omni transaction transferred at least 15,274.34 USD, while the value reported in Bitcoin was only 58.76 USD. This indicates that the value transferred through Omni was at least 259.97 times higher for half of the transactions evaluated. In Figure 3.11, we showcase all accelerated transactions included in block 550,912, totaling 15 transactions, which belong to Omni. We also highlight the senders and receivers involved in these transactions. Comparing the value transferred in Bitcoin, we found that the average value was 313.22 USD with a std. of 1185.35 USD and a median of 5.68, ranging from 0.03 to 4597.91 USD. In contrast, on the Omni network, the average value transferred was 188,736.17 USD with a std. of 366,405.31 USD and a median of 82,256.39 USD, ranging from 22,315.00 USD to 1,491,193.52 USD.

In this chapter, we conducted an extensive empirical audit of the miners’ behavior to check whether they adhere to the established norms. At a high level, our findings reveal that transactions are primarily prioritized based on assumed norms. However, our analysis also uncovers evidence of a significant number of confirmed transactions that violate these priority norms. An in-depth investigation of these norm violations uncovered many highly troubling misbehavior by miners. Our results demonstrate that large values of SPPE for confirmed transactions indicate the potential use of transaction acceleration services. In particular, a transaction with SPPE ≥ 99% has a high chance of being accelerated.

Strikingly, we show that 4 out of the top-10 mining pools namely, F2Pool, ViaBTC, 1THash & 58Coin, and SlushPool selfishly accelerated their own transactions. Furthermore, we uncover instances of collusive behavior between mining pools. Our results are supported by the SPPE metric, which indicates that self-interest transactions were also being included in the blocks ahead of other higher fee rate transactions.

In summary, our findings strongly suggest that several large mining pools tend to give special treatment to transactions that benefit them directly. This included transactions involving payments to or from wallets owned by the mining pool. Some even collude with other large mining pools to prioritize their transactions. Additionally, a number of significant large mining pools accept additional dark (opaque) fees to accelerate transactions via non-public side-channels (e.g., their websites). This practice of darkfee transactions contradicts a fundamental, albeit unstated, assumption in blockchain systems: that the confirmation fees offered by transactions are transparent and equal to all miners.

In the following chapter, we will explore the implications of the lack of transparency into both the prioritization of transactions and the content of transactions.

Author:

(1) Johnnatan Messias Peixoto Afonso

![Table 3.6: [Data set C] For an SPPE ≥ 99%, we observe that 64.98% of BTC.com transactions were accelerated; the fourth column values are derived by dividing the values in the second with those in the third. The number of accelerated transactions decreases to 18.12% for an SPPE ≥ 90% and to 1.06% for an SPPE ≥ 50%.](https://hackernoon.imgix.net/images/fWZa4tUiBGemnqQfBGgCPf9594N2-ur933a5.png?auto=format&fit=max&w=1200)