Curve Finance X account hacked, posts fake airdrop link

The X account of the financing of the curve was most likely hacked. The DEFI protocol has displayed an air link that can cause personal wallet losses.

Curve Finance's X account has unexpectedly published an air link urging registration for a new award program. The unusual publication behavior was immediately recognized as a hack.

Unlike other hacks that simply published a turnover for a token, this time, the X account of the finance of the curve led to an Airdrop page. The data request page and the connection of a cryptographic portfolio, which exposes users at risk. The curve scam is on the Ethereum ecosystem, which means that users can revoke authorization.

Michael Egorov, the founder of the project, confirmed The account is always compromised, and none of the information on rewards or aerial parameters is true.

Channel investigators warned against the connection of a portfolio for the air card and the revocation of all authorizations if the users connected their cryptographic portfolio. The risk for end users lies in the signing of test transactions, which may come from a malicious intelligent contract.

The best approach is to avoid interaction with all the links published by Courbe or to responses in the same threads. Usually, hacked accounts also call for robots or additional crooks with false links to revoke portfolio authorizations.

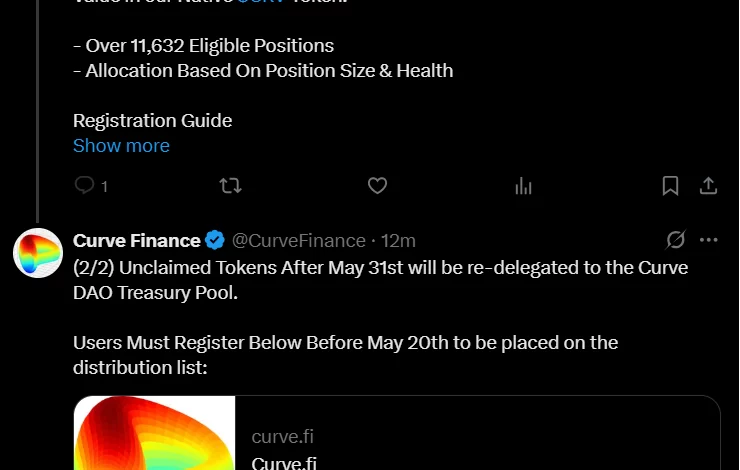

Shortly after the first message, Curve FI continued with messages from a next CRV token card, urging registration before May 20.

The messages were immediately deleted after the publication, lasting 30 minutes before withdrawal. Later, Curve Finance displayed a wire establishing the Curve Reward Foundation, describing a reward program and republishing the risky recording link.

What has raised a red flag for the curve community is that the project has already distributed all its CRV tokens, and they have a predetermined acquisition and unlocking calendar. Over 42% of CRV tokens are unlocked, with a total offer of tokens of 3.03b. No other source has announced an Airdrop CRV.

Curve Finance aims to revive the liquidity of

The finance of the curve was one of the first DEFI exchanges, passing through several liquidations and losses for its native token.

At its peak, the protocol locked more than $ 23 billion of total value. Liquidity was destroyed during the UST release event and the Terra (Luna) crash. The bankruptcy of the FTX has further demonstrated the curves.

Currently, the protocol carries around $ 2 billion in locked value. However, Curve hopes to revive its loan activity.

CURVE LLAMA Lend recently revived its locked value after a liquidity replenishment event. Llama Lend sets up expectations for a new summer defined after years of low -level activity.

The curve ecosystem is limited, according to the stablecoin crvusd. The token has only $ 158 million, which makes a small DEFI sector.

After the news of the Pirate X account, the CRV token remained relatively unchanged. The asset is negotiated almost a three -month summit in expectations. The curve can recover. The protocol has lagged behind Aave and other DEFI applications after the Haussier 2022-2023 market.

Cryptopolitan Academy: Do you want to develop your money in 2025? Learn to do it with DEFI in our next webclass. Record your place