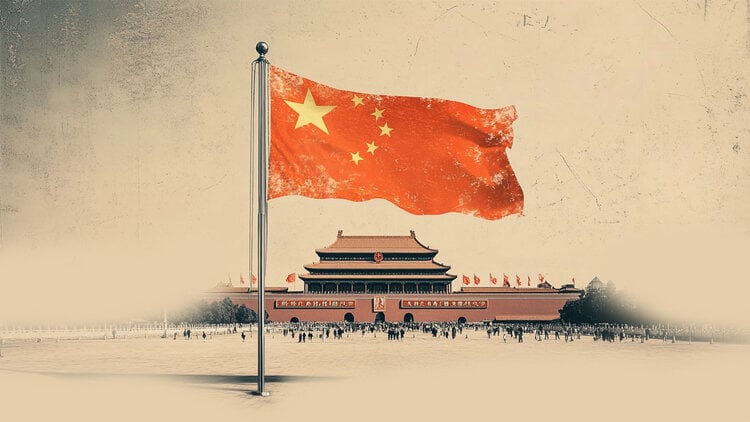

Current world economic growth momentum is insufficient

The Chinese Finance Ministry said on Friday that the current dynamic of global economic growth was insufficient, the tariff and commercial wars having an impact on economic and financial stability, by Reuters. He called on all parties to further improve the international economic and financial system by strengthening multilateral cooperation.

Key quotes

Tariff wars and commercial wars have still affected economic and financial stability.

All parties should still improve the international economic and financial system by strengthening multilateral cooperation.

All parties should pool more resources for Africa's development.

Market reaction

At the time of writing the editorial staff, Aud / USD holds higher land almost 0.6400, losing 0.14% per day.

Australian dollar faq

One of the most important factors for the Australian dollar (AUD) is the level of interest rate set by the Bank of Australia (RBA) reserve. Because Australia is a country rich in resources, another key engine is the price of its greatest export, iron ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and its commercial balance. The feeling of the market – that investors have more risky assets (risk) or are looking for safety havens (risk) – is also a factor, with a positive risk for AUD.

The reserve bank of Australia (RBA) influences the Australian dollar (AUD) by fixing the level of interest rate that Australian banks can lend each other. This influences the level of interest rate in the economy as a whole. The main objective of the RBA is to maintain a stable inflation rate of 2 to 3% by adjusting increased or down interest rates. Relatively high interest rates compared to other large central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative softening and tightening to influence credit conditions, with the old Aud-Negative and the second positive audience.

China is the largest trading partner in Australia, the health of the Chinese economy therefore has a major influence on the value of the Australian dollar (AUD). When the Chinese economy is doing well, it buys more raw materials, Australian goods and services, to lift demand for the AUD and to raise its value. The reverse is the case when the Chinese economy does not develop as quickly as expected. Positive or negative surprises in Chinese growth data therefore often have a direct impact on the Australian dollar and its pairs.

The iron ore is the largest export in Australia, representing $ 118 billion per year according to 2021 data, China as the main destination. The price of the iron ore can therefore be an engine of the Australian dollar. Generally, if the price of the iron ore increases, the AUD also increases, as the overall demand for the currency increases. The opposite is the case if the price of the iron ore falls. Higher prices of iron ore also tend to lead to a greater probability of a positive commercial balance for Australia, which is also positive of the AUD.

The commercial balance, which is the difference between what a country earns its exports in relation to what it pays for its imports, is another factor that can influence the value of the Australian dollar. If Australia produces highly sought -after exports, its currency will gain only from the excess demand created from foreign buyers seeking to buy its exports in relation to what it spends to buy imports. Consequently, a positive net trade balance strengthens the AUD, with the opposite effect if the trade balance is negative.