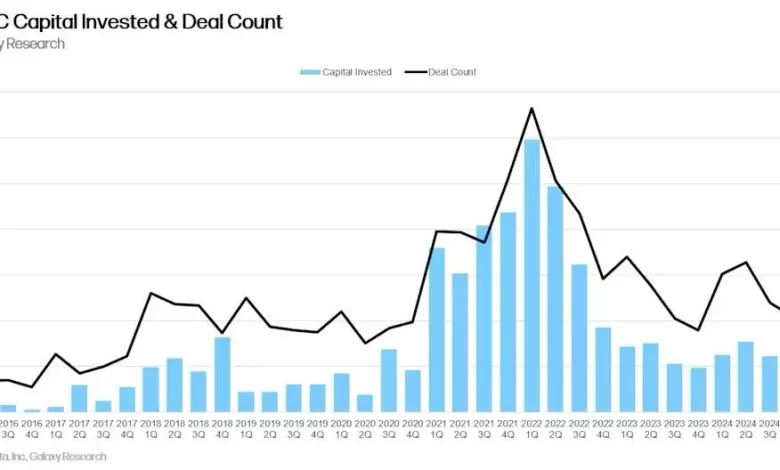

Crypto VC funding surges to $4.8B in Q1 as Binance deal drives strongest quarter since 2022

Venture Capital (VC) companies invested $ 4.8 billion in crypto startups in the first quarter of 2025, indicating the resurgence of crypto deals. Digital assets firm Galaxy, reported on the summary of its deal, noted that it represents a 40% increase compared to the Q4 of 2024.

According to ReportNot the only amount that VCs poured into crypto companies to rise. The number of deals also increased, with a 446 deals in the quarter, representing a 7.5% quarter-on-quarter (QOQ) increase.

Noteworthy, the $ 2 billion of United Arab Emirates' MGX investment in Binance is worth about half of total investment and enough to make Q1 the best quarter for crypto and blockchain startup investment since 2022 Q3.

However, things can be significantly different without MGX investment in Binance. When that deal was removed, the crypto sector was recorded only $ 2.8 billion in investment, which was 20% lower than the previous quarter.

The Binance Deal also sets the tone for the types of investors favored in the quarter. Investments in the next phase, such as those in the established companies, cost 65%, while early stages deals consist of only 35%. This is the first time the next stages of companies have seen a higher investment percentage since Q1 2021.

However, pre-seed deals have fallen slightly, and there are more stages of the deal in general, showing that the market is growing even though the crypto change continues at a healthy pace.

Trading/Exchange and Defi have seen the most investment

The Binance deal also influenced which subsector saw the most investment, including the Trading/Exchange/Investment/Lending of the Accounting Category for 47.9% of funds, worth $ 2.55 billion. Defi followed $ 763 million, showing that it remained a place of interest for VCS.

According to the report, Defi is one of the leading sectors for investment in the last two quarters, including infrastructure. It has seen more interest from investors than gaming/web3. The gaming sector has now slipped in the fifth place, which falls behind the infrastructure and payment sectors.

However, the gaming sector costs 16% of all deals, showing that companies in that sector are getting smaller investment. The trade followed the 62 deals in the quarter, while both infrastructure and AI gained more than 40 deals each. Despite receiving the defi of high capital infusion, it is less than 40 deals.

Meanwhile, US companies attract the most interesting from VC companies, with 38.6% of all quarter deals involving a company with its head office in the US. The UK followed 8.6%, while Singapore and the UAE had 6.4%and 4.4%, respectively.

Noteworthy, dealing with Binance means that the US does not lead to the amount invested, with Malta leading with 36.8%. However, the US has 24.7%of all amounts invested, while Hong Kong, UK, and Singapore have 13.4%, 6.6%, and 3.2%, respectively.

Crypto investments are still far from peak levels

Despite the significant increase in VC crypto investments on both a quarterly and annual basis, capital collapse in crypto companies remains lower than their peak during the Bull Run period of 2021.

There is also a difference -different between increasing the value of bitcoin and capital invested in crypto startups. The BTC has reached new highs, but the funds to the crypto funds remain relatively low.

Galaxy analysts recognize this in historical events such as the collapse of the Crypto market in 2022 and 2023, which continues to disturb some investors from allocating large capital to Crypto adventures. Growing up AI as an alternative investment is also a factor.

Analysts write:

“The Macro Environment and excitement in the Crypto Market from 2022 to 2023 have continued to dived several allocators from making the same level of promise to crypto adventure investors they made in early 2021 and 2022.”

Furthermore, the advent of products exchanged by crypto exchange products (ETP) means that investors who provide capital in a crypto venture or startup fund now have the successor of exposure to the sector through ETPS.

However, analysts believe that regulatory clarity can restore investors. This may be why the US is leading the crypto startup ecosystem, with the new administration deregulated the sector. The country is expected to strengthen its dominance once there are pro-crypto regulations that provide better clarity.

Cryptopolitan Academy: Tired of market swings? Learn how the Defi can help you develop a steady passive income. Register now