XRP Price Signals Strong Upside But Must First Clear $2.30

- Summary:

- The XRP price has a strong foundation, which is supported by the first ETF list worldwide in Brazil and bullish-leaning technical indicators.

The XRP price expanded its upbringing on Saturday, trading at $ 2.24 after gaining 2.7% at the time of writing. The benefit came one day after the first XRP ETF worldwide began to trade in Brazil. The XRP gained 8.8% last week, and the year-to-date gains also turned green this week. Interestingly, the coin recorded two consecutive days of loss before those obtained on Saturday, which were against the broader crypto market.

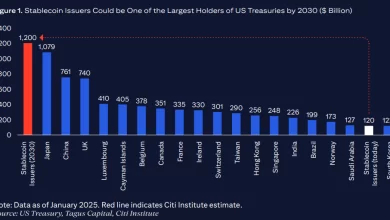

The next major resistance level for XRP prices is likely to be at $ 2.25, and breaking up the upper level can develop traction to break outside the $ 2.00- $ 2.30 range that the coin has stuck in the last two weeks. Hashdex's XRPH11 ETF was launched in Brazil on Friday that traded the B3 exchange and 95% supported coin. It supports growing coin reception in major financial markets.

Everywhere, the popular online Japan market, Mercari added support for XRP. The e-commerce platform has over 20 million active users and allows them to keep their balances from selling unused items in the form of Mercari points. From now on, users have been able to convert their Mercari points to XRP, creating significant utility for the coin.

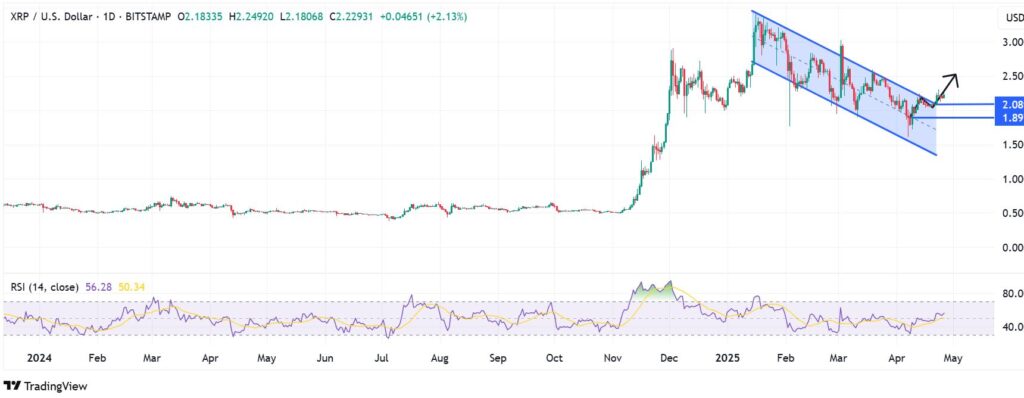

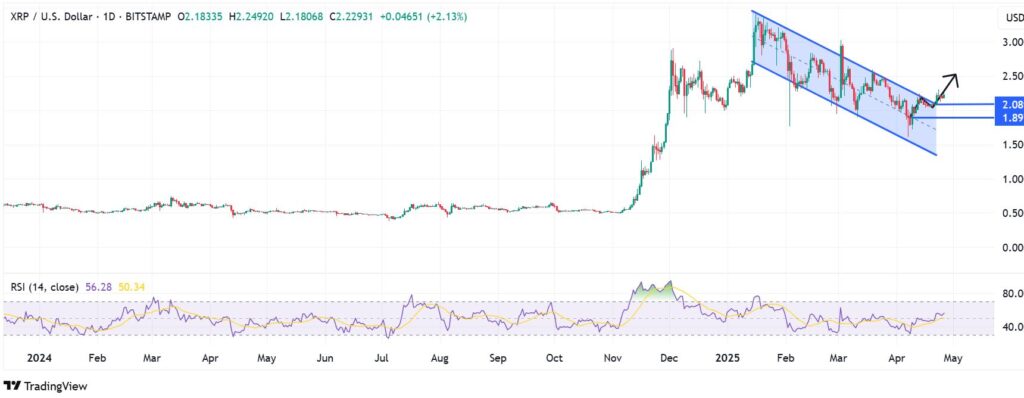

XRP price trend review

As seen in the daily chart below, the price of XRP has been in a downward channel since mid-January. It broke upward from the upper band four days ago, and has been held at the upper level since that time. RSI in the sun -day chart reads 56, which signed bullish control. The coin is likely to break above the $ 2.30 barrier if it keeps the action above the upper channel band corresponding to $ 2.08.

Conversely, the destruction below $ 1.89 will raise the expectation of a more steep decline. The close support for the reverse is likely to be in the psychological $ 2.00 mark. However, most XRP price momentum depends on the amount of trade. As of this writing, the 24-hour amount of coin trading drops by 16.4%, indicating a weakening climb.