Coinbase's Q1 2025 income statement is inadequate expectations

Coinbase's long -awaited Q1 2025 income statement came out today, disappointing Bullish expectations in several key areas. However, users' operations are still strong, with the entire USDC balance increasing by 49% QOQ.

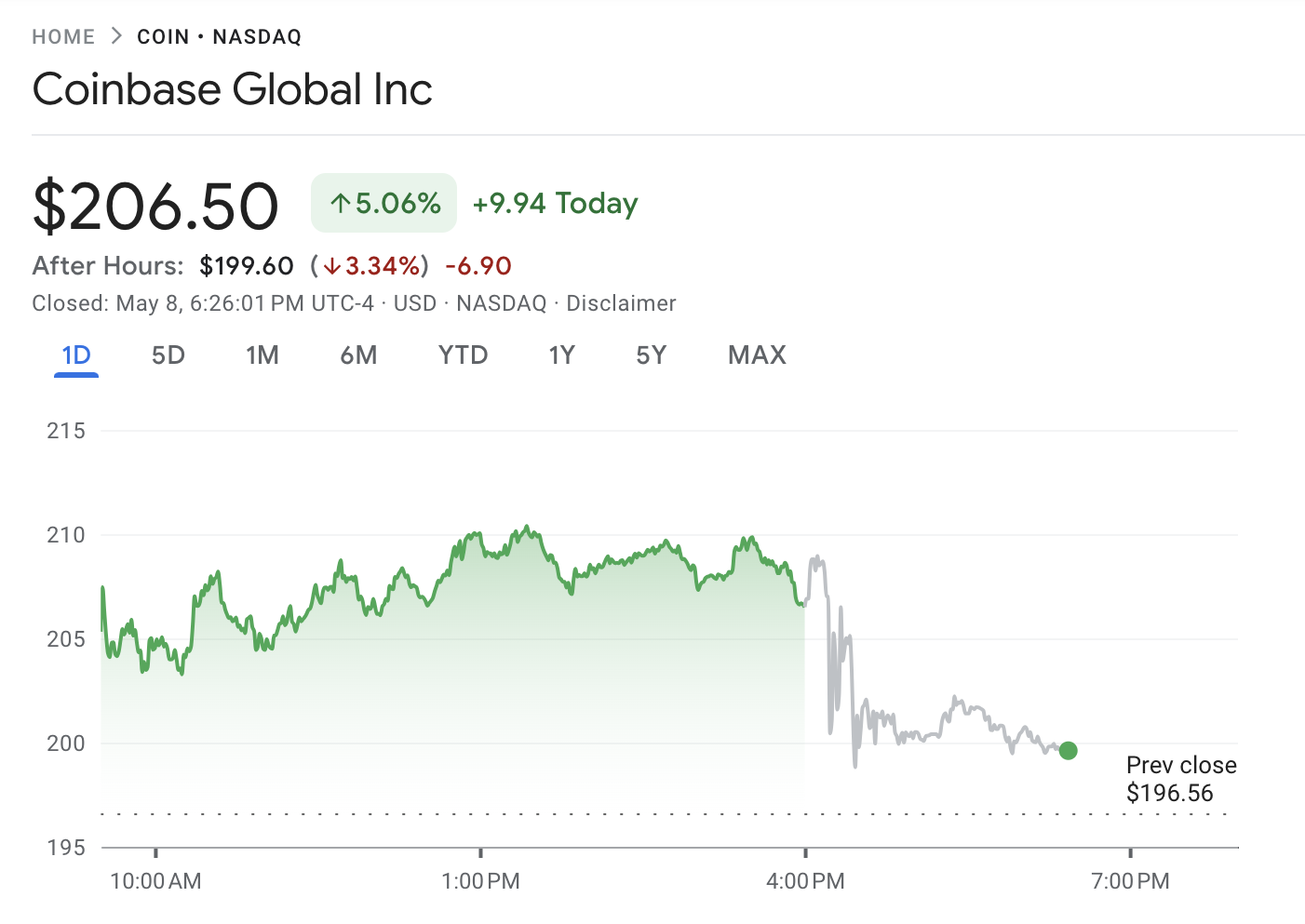

Despite the positive day, the company's shares fell by more than 3%after working hours.

Coinbase Bearish profits report

Coinbase, one of the world's largest cryptocurrencies, can indicate some growth trends to be optimistic. For example, SEC fell against its case Certain and it acquired the world's largest crypto derivatives exchange.

The industry had the expectations of Coinbase's Q1 2025 profits ReportBut the actual results were disappointed.

In general, the income of Coinbase Quarter was almost $ 200 million from the expected $ 2.2 billion and its transaction revenue was $ 70 million compared to the expected amount.

The profit per share was $ 0.24 instead of $ 2.09, and the revenue of orders and services was also $ 4.5 million.

Even before today's income report, Coinbase showed a couple of thoughtful signals. For example, fraud is aimed at its users, causing mass theft.

The stock price also fell in the Q1 by 30%, which is the worst performance after the FTX collapse. Earlier today, its shares traded well with the expectations of bullish notifications, but dripped Significantly after hours.

Nevertheless, Coinbase still highlighted some positive results to the externally hardened report. Trading volume exceeded expectations, albeit a bit; Exchange announced $ 393 billion instead of the expected $ 392.7 billion.

In addition, the company's long -term participation in Circles is pays off, with USDC balances in Coinbase products grow to $ 12.3 billion. This is an impressive 49% benefit quarter (QOQ).

Coinbase retains its optimism between these factors, the acquisition of derbit and regulatory breakthroughs:

“As we look at the future, we focus on expanding real -time cryptosuming, strengthening and expanding our trading platform, and scaling the infrastructure, which gives the future financial system. With more accurate regulatory clarity, we accelerate our vision with economic freedom,” company, ” requiredTo.

Ultimately, it is difficult to predict where the company will go from here. Although this income statement is inadequate expectations, Coinbas still has many resources.

In addition, Q1 showed a positive development on the expansion of the market. Coinbase reached regulatory licenses in both Argentina and India, further expanding its user base worldwide.

Giving up

When following the guidelines of the trust project, Beincrypto is dedicated to an impartial, transparent reporting. The purpose of this news article is to provide accurate and timely information. However, before making this content, readers are advised to independently check and consult with a professional. Note that our conditions, privacy rules and dislike have been updated.