Coinbase suspends Movement (MOVE) from May 15 after evidence of insider profit-taking

Coinbase plans to suspend the movement (move) only months after the list. The move is the token of an ambitious project, which is crashed after evidence of insider sale.

Coinbase announced the suspension of motion (transfer) from May 15, while transferring the asset to limit order mode effectively. Only the suspension of the months came after the listing and promoting the transfer, following improper price movement and evidence of the insider sale.

We regularly monitor the properties in our exchange to ensure that they meet our listing standards. Based on recent reviews, we suspend trading for movement (move) on May 15, 2025, at or 2 pm et.

– Coinbase assets 🛡️ (@coinbasessesets) May 1, 2025

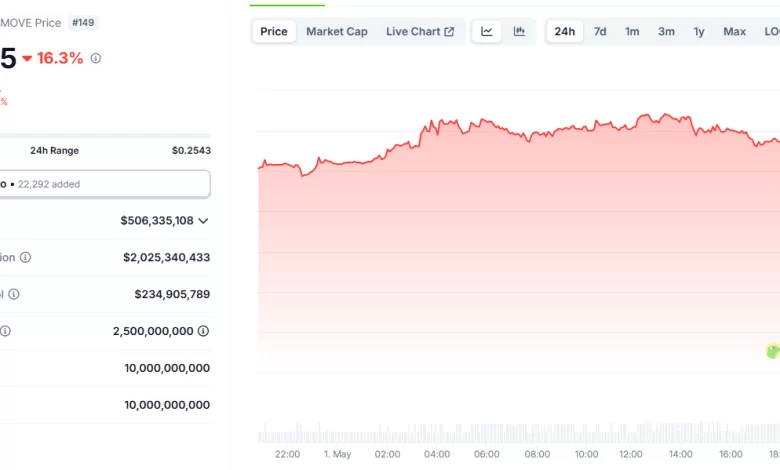

Coinbase decided while the move was still active in other exchanges. After the announcement, the move fell to another time of less than $ 0.20, while maintaining a relatively high trading volume above $ 234m in 24 hours.

The move continued its rapid denial, removing another 16% of its price after removal of the announcement.

The token will continue to trade in Binance, one of its largest markets. In the past, Binance tried to repair the insider seller's damage, which repaired a $ 38M buyback. The intervention did not prevent the transition from further crashing, as well as loss of reputation.

The motion delayed the airdrop again

The long -awaited transfer transfer campaign will be delayed again, due to aggravated market conditions for the project.

The event of Mortemprop is still expected to happen at the end of April. However, the foundation movement announced the delay in the very day, all farmers failed.

Guys, the move is delayed. We know you're waiting for it. We know this is futile.

Here's what you need to know 👇

– Movement (@movementlabsxyz) April 30, 2025

Just a day before the delay, the transition prepared 740m Tokens for further distribution. Another one 5% of the token supply is sitting in Binance, which is also marked for the final airdrop. Binance has not yet been removed, and has not given a hint to do so. The movement project was also supported by YZI LABS, which raised an unspecified twist a year ago.

Binance, along with upbit, carries around 45% of all trading transfer volumes. Traders expect to keep moving until June, when to unlock another 5% of token supply through launchpool.

The move showed all the signs of a legitimate project, including $ 40.4m Raised to many funding. The project recommends an ecosystem for developers with Defi components. The motion is already working, along with the surroundings $ 122m to the amount that is locked.

The motion platform has alerted yield protocols, lending and Dex apps, which draw more than $ 23m in Stablecoin's liquidity. The team has intended to grow the ecosystem, but blame the selected market makers for aggressive sale.

Reported, the movement used web3port services, an investment and acceleration platform. Web3port is the Rogue Market manufacturer who sells 66m transfer to Binance and is banned from exchange. The market manufacturer has access to about 50% of the circulating -switching transfer supply.

Later, the Web3port and Movement struck a rentach deal for market -making services, leading to unlimited sale shortly after the Binance list. Web3port and Rentach then used their access to the token to pump the price and sell at higher appreciation, without explicit movement agreement.

The move has also been heavily promoted on social media, and even the Trump Family Fund World Liberty Fi has gained transition tokens in many deals. After a short handling period, the World Liberty FI avoided all the moves.

Cryptopolitan Academy: Tired of market swings? Learn how the Defi can help you develop a steady passive income. Register now