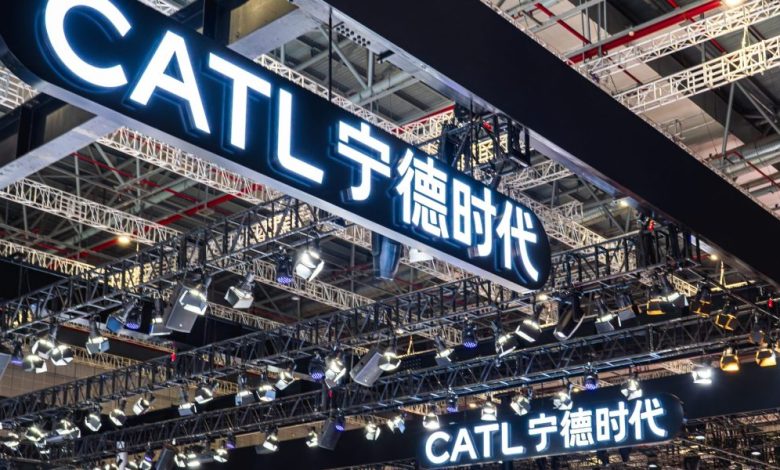

CATL gauges interest for potential $5 billion HK listing

Contemporary Amperex Technology Co. LTD., the largest manufacturer of batteries in the world for electric vehicles, began to assess the interest of investors for a sale of shares which could recover $ 5 billion and will probably be the largest list of Hong Kong in years.

CATL, like the Chinese electric-developing battery giant is known, launched its investor education meetings on Tuesday, according to the agreement seen by Bloomberg. The beginnings of Hong Kong Trading will probably perform this month, according to familiar people with the case, asking not to be identified because they were not allowed to speak publicly.

The company is ahead with the offer despite the prices of US President Donald Trump having shot the world markets. Given its scale, the success of the agreement will probably influence investors' confidence in Hong Kong and Chinese companies, the actions of which have underperformed global peers in the midst of market disorders induced by prices.

However, Chinese companies seem take the trade war in the process And on with action sales last month, while offers in the United States and Europe fell.

The CATL agreement came after a committee of the US Congress in April called For Bank of America Corp. and JPMorgan Chase & Co. to withdraw from work on the planned list. The two banks still work on the offer, according to Catl Postal list implementation documents dated Tuesday.

The Restricted Committee of the Chamber on the President of the Chinese Communist Party, John MoolenaarPentagon black listIn January, quoting his alleged ties with the Chinese army. A spokesperson for Catl said that allegations in the letters were baseless and that the company had never had any activity or activities related to the army.

At 5 billion dollars, CATL's list would be the largest in the world since the $ 5.1 billion contract in Cold-Storage Real Estate Investment Trust Lineage Inc., and the largest in Hong Kong since the $ 6.2 billion in Kuaishou Technology offer in 2021, according to data compiled by Bloomberg.

Hong Kong announcements have collected $ 2.7 billion so far this year, according to data compiled by Bloomberg. The expected product of CATL would be almost triple of this figure, and other big cases such as those of the drug Jiangsu Hengrui Pharmaceuticals Co. are also in progress. The product of registration in Hong Kong could more than double to $ 22 billion this year, according to Bloomberg Intelligence Estimates.

CATL in April said a solid set of results for the first quarter, the net income increasing at the fastest rate in almost two years. CATL leaders, a better supplier of Tesla Inc. and many other major car manufacturers, describe The impact of American prices as “little” and said that the company's United States exposure was “quite small”.

The sale of CATL shares will feed its current international expansion in Europe, where a large part of the funds collected will be channeled to finish a factory capable of producing 100 gigawattheures per year in Hungary to provide high-level customers like Mercedes-Benz. The company holds a market share of around 38%, while EV Maker byd Co., which mainly manufactures cells for its own cars, is a distant second at around 17%.

Separately, the company islooking forA loan of around 1 billion dollars to finance an investment in Indonesia, according to people familiar with the issue.

CATL shares fell 12% this year in Shenzhen, against a 3.4% drop in the CSI 300 index.

This story was initially presented on Fortune.com