Bitcoin ETFs Record $3 billion Inflow as Institutional Demand Rises

Funds exchanged by the Bitcoin (ETF) exchange in the US recorded a massive flow of more than $ 3 billion last week.

This performance marks one of the strongest weeks for the Bitcoin ETFs in 2025, driven by BTC price recovery and changed interest from institutional investors.

Bitcoin ETFS posted the strongest six-day flow of flow

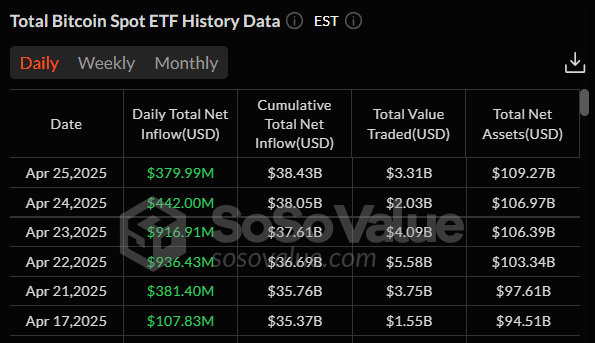

According to Sosovalue, the 11 spots Bitcoin ETF recorded a combined flow of approximately $ 3.06 billion in six consecutive trading sessions.

This investment wave rank as the second largest net inflow in the record for Bitcoin ETFs, featuring an increase in demand for crypto -focused financial products.

The largest flow was seen on April 22 and April 23, up to $ 936 million and $ 916 million, respectively. Analysts mentioned that these are among the best single-day performances since Donald Trump returned to the White House earlier this year.

The investment wave raised total properties under Management (AUM) for Bitcoin ETFs to $ 109 billion. Blackrock's Ishhares Bitcoin Trust (IBIT) continues to lead the market, now managing more than $ 56 billion. This account is approximately 3% of the circulating -transferous Bitcoin supply.

Michael Saylor, chairman of Strategy (formerly microstrategy), reported predicted That Ibit can be the world's largest ETF in the next decade.

Meanwhile, analysts are linked to the flow of ETF's flow to Bitcoin's recent degeneration from traditional risk ownership such as US and gold stocks. Raising geopolitical tensions, especially global tariff against, have strengthened Bitcoin's status as a safe investment.

Moreover, analysts from the Kobeissi letter suggest that bitcoin degeneration from MacRO assets has supported its price reversing. From the sinking under $ 75,000 on April 7, the BTC price has risen more than 25% and now trades more than $ 94,000.

“As the global currency continues to print so the price of bitcoin prices. The amount of paper money is supported more than the debt, and that debt runs out of control within a little time. Says.

Hopefully, David Puell, an analyst in Ark Invest, remains highly optimistic about the top crypto.

Puell predicts that Bitcoin can reach up to $ 2.4 million by 2030, driven by the growing institutional adoption and its increase as a strategic wealth owned for corporations and even state-states.

With more conservative scenarios, he estimates Bitcoin reaching between $ 500,000 and $ 1.2 million within the same time.

Refusal

In compliance with the guidelines of the trust project, the beincrypto focuses on unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult a professional before making any decisions based on this content. Please note that our terms and conditions, privacy policy, and disclaimers are updated.