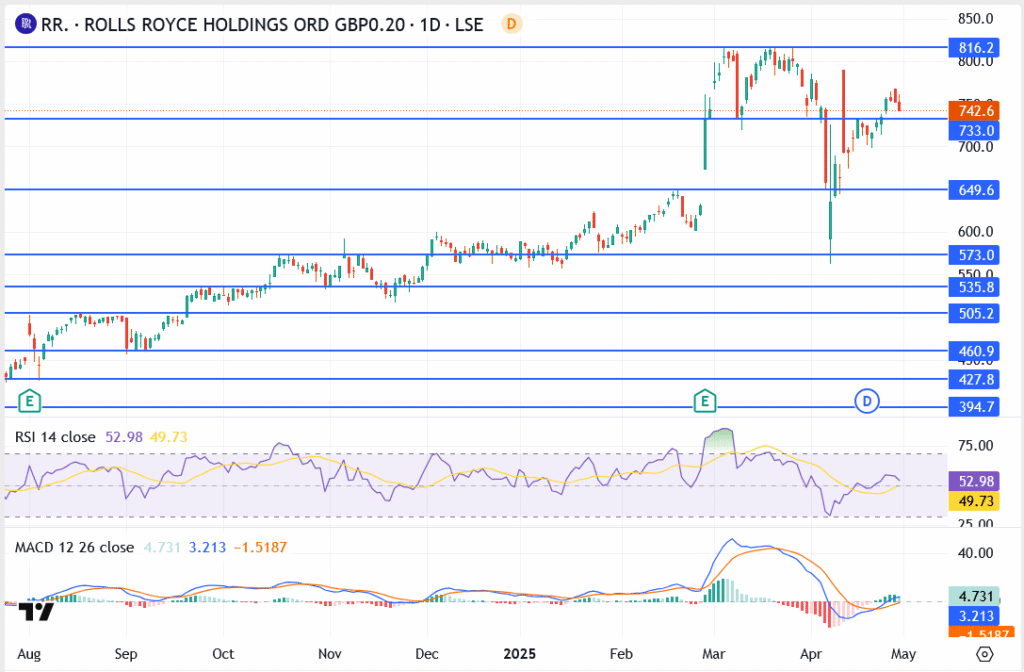

Can RR. Extend Its Rebound Toward 816p?

- Summary:

- Rolls Royce's sharing price holds above 733p as Bulls Eye 816p. Can rr. Stock expands those acquired with SMR momentum and defense deal?

Rolls-Royce (LSE: RR ..) traded just above 733p this week, finding support after a sharp pullback in early April. It was a jerk around 742p, a level that draws close attention from entrepreneurs watching a breakout or a return.

Government deals and SMR plans keep interested

The focus remains in the long-term Rolls-Royce contract secured to the UK government to provide nuclear reactor tech for submarines-a £ 9 billion, eight years of dealing with future income. The firm also positions itself in the SMR space (small modular reactor), with the regulatory movement expected in the coming months.

The global SMR market is expected to cross $ 70 billion by 2033, and RR. is hoping to carve a serious cut. The price of investors in the story begins.

On the commercial side, engine demand is taken as airline push capacity back to pre-covid levels.

Rr. Stock Technical Outlook: Basic levels in gaming

Sharing price is currently pivoting near 733p. Handling above this zone maintains an open path for a retest of 742.6p. If that breaks, the next target upside down is 816p, the high 2025.

But if consumers lose control and the stock slides under 733p, it opens the door to 649.6p support. Below, the next key floors are around 573p and 535.8p.

- Resistance: 742.6p, then 816.2p

- Support: 733p (Pivot), 649.6p, 573p, 535.8p

- RSI: neutral to 52.98, slightly upward

- MACD: POSITIVE MOMENTUM OF CROSSOVER CROSSOVER

Outlook: Can Rolls-Royce stay in rally mode?

There is still a reversal of potential – if the chart is holding. Entrepreneurs are watching if the 742-75-750P coverage will be able to conclude with convincing. SMR news or fresh aviation orders can provide the next spark.

So far, the trend remains bullish above 733p. A strong push above can revive the rally back to the highs of March.